What is Big Think Capital?

If you’re looking for a simplified way to find a business loan, Big Think Capital has you covered. It acts as a bridge between small businesses and lenders that can help them accomplish their goals.

Best for Established Credit

SMB Compass

- Flexible repayment terms

- Large loan amounts

- Quick business loan option

Start Application Visit the SMB Compass website

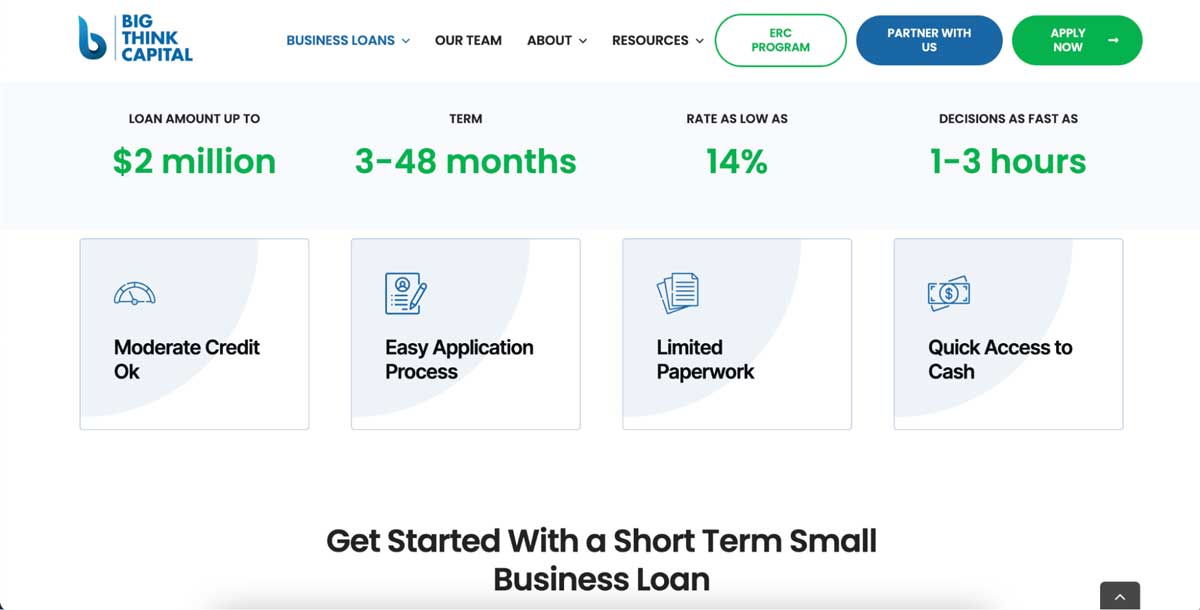

Short-term loan lender details. Source: Big Think Capital website.

There are many financing options – both traditional and alternative – to choose from. You can quickly scan their straightforward website and see that Big Think Capital offers a wide variety of loans that run the gamut from short term and SBA loans to invoice financing and merchant cash advances.

Big Think Capital prides itself on a fast and easy process. There is one quick application to fill out, and Big Think Capital then presents your application to their network of lenders. Lenders can then put together loan offers and send them back to Big Think Capital, who compiles all your loan offers and presents them to you. You then decide what best fits your needs, and you can receive funding in as little as 24 hours.

In our deep dive into Big Think Capital, we were blown away by positive reviews. The company garners a near-perfect score out of thousands of reviews – it truly stands out as the best on the market.

Big Think Capital short term loan requirements

Big Think Capital loans require at least 6 months in business to qualify.

- Time in business:

- 6 months

- Annual revenue:

- $100K

- Credit score:

- 500

| Big Think Capital Lender Details | ||

|---|---|---|

| Loan Amounts | Time to Funding | Repayment Terms |

| Up to $2M | 24 hours | Up to 48 months |

Which features does Big Think Capital offer?

| Business Loans Types | |

|---|---|

| Term loan | |

| SBA loan | |

| Line of credit | |

| Invoice financing | |

| Working capital loan | |

| Merchant cash advance | |

| Equipment financing | |

Other notable Big Think Capital features

- Small business resource center

- Employee Retention Credit (ERC)

- Commercial real estate financing

- Large community of lenders

The variety of financing offered at Big Think Captial. Source: Big Think Capital website

Big Think Capital application process

You will need the following information when applying through Big Think Capital:

- Time in business

- Annual revenue

- Three months of bank statements

- Credit score range

- Desired loan amount

Big Think Capital customer support

| New customer phone number | 844-200-7201 | |

| Existing customer phone number | Not available until you apply for funding | |

| Customer support email | info@bigthinkcapital.com | |

| Chat | Not available | |

| FAQs | Available | |

| Knowledge Base | Available |

Big Think Capital user review highlights

We analyzed 2,099 user reviews about Big Think Capital from one third-party review website to provide this summary.

A first for us, we were hard-pressed to find ANY negative reviews about a company. Big Think Capital simply enchants users. Every single review is glowing and points out how compassionate, knowledgeable, helpful, and amazing the customer service representatives are.

Users report that even those with less than stellar credit are treated with respect. The company works with each business to make sure they have options, understand all aspects of the process and funding, and are in control of the decision. The customer support representatives are there for each customer, walk them through the process step by step, and make everyone feel very taken care of every step of the way.

- Application process – very quick and easy.

- Ease of Use – users feel educated and report no problems using the system.

- Features – customer service is the standout feature, scoring Big Think Capital nearly perfect review scores.

- Quality of Support – users gush at how excellent the account managers and customer service representatives are. They are reported to be patient and helpful and seem to honestly care about every single customer. They go above and beyond to ensure everything is clear and explained so users can make the best decision.

- Convenience – filling out the application, gathering the information, and getting funding takes little time. One customer reported the whole process took less than a day and was beyond convenient to give their business a real chance.

Big Think Capital Contact Information

- Parent Company:

- Big Think Capital

- Headquarters:

- Melville, New York

- Year Founded:

- 2017

- Website:

- bigthinkcapital.com

- Facebook:

- facebook.com/bigthinkcapital

- Twitter:

- twitter.com/bigthinkcapital

- LinkedIn:

- linkedin.com/company/bigthinkcapital.com

- Instagram:

- instagram.com/big_think_capital

- YouTube:

- youtube.com/@bigthinkcapital1492

Big Think Capital alternatives

| Software | Starting Price | B2B Reviews Score |

|---|---|---|

| Big Think Capital | Up to $2M | 4.8 |

| Biz2Credit | Up to $2M | 4.8 |

| OnDeck | Up to $250k | 4.3 |