What is Plooto?

Plooto is an online payment processing platform that simplifies accounts payable and receivable for small and medium-sized businesses. With its focus on automating payment workflows, Plooto enables businesses to handle all their financial transactions in one secure place, eliminating the need for checks and manual data entry.

Start Free Trial Visit Plooto’s website.

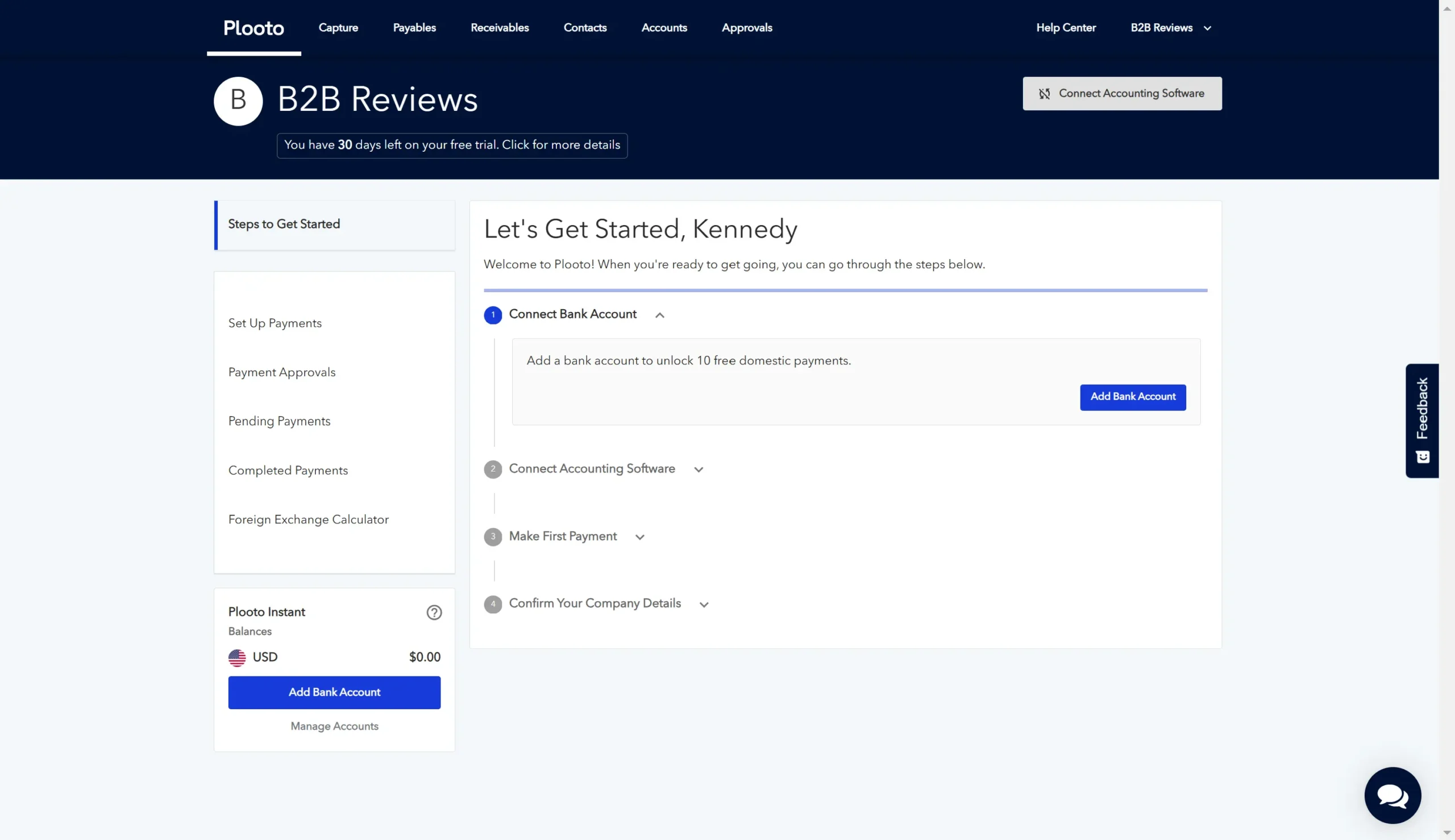

Plooto dashboard. Source: Plooto free trial

Through Plooto, businesses can pay bills, collect payments, and handle multiple clients with ease. Its integration with accounting software like QuickBooks and Xero helps ensure that records are automatically updated. Plooto’s platform includes automated payment scheduling, two-way approval workflows, detailed audit trails, and multi-currency transactions.

Plooto’s security is another standout because it includes advanced encryption and fraud prevention. The platform also offers additional time-saving features, like automatic payment reminders and recurring payments.

While Plooto’s main strength lies in automating payables and receivables, its customization options are limited, which might be a consideration for businesses needing more tailored features. Additionally, customer support options are limited, meaning users may experience slower response times. However, Plooto is an efficient, user-friendly solution that saves businesses time and helps maintain accurate, up-to-date records, making it ideal for companies looking to automate their payment workflows.

How much does Plooto cost?

Plooto plans start at $9/month for accounting firms and $32/month for businesses.

- Starting price:

- $9/month or $32/month

- Free trial:

- 30 Days

- Free version:

- Not Available

| Plooto Pricing & Plans (Accounting Firms) | ||

|---|---|---|

| Go | Grow | Pro |

| Starting at $9/month | Starting at $32/month | Available by quote |

| 1 accountant user | Unlimited accountant users | Unlimited accountant users |

| Plooto Pricing & Plans (Businesses) | ||

|---|---|---|

| Grow | Pro | |

| Starting at $32/month | Available by quote | |

| Unlimited accountant users | Unlimited accountant users | |

Start Free Trial Visit Plooto’s website.

What’s included in every Plooto plan?

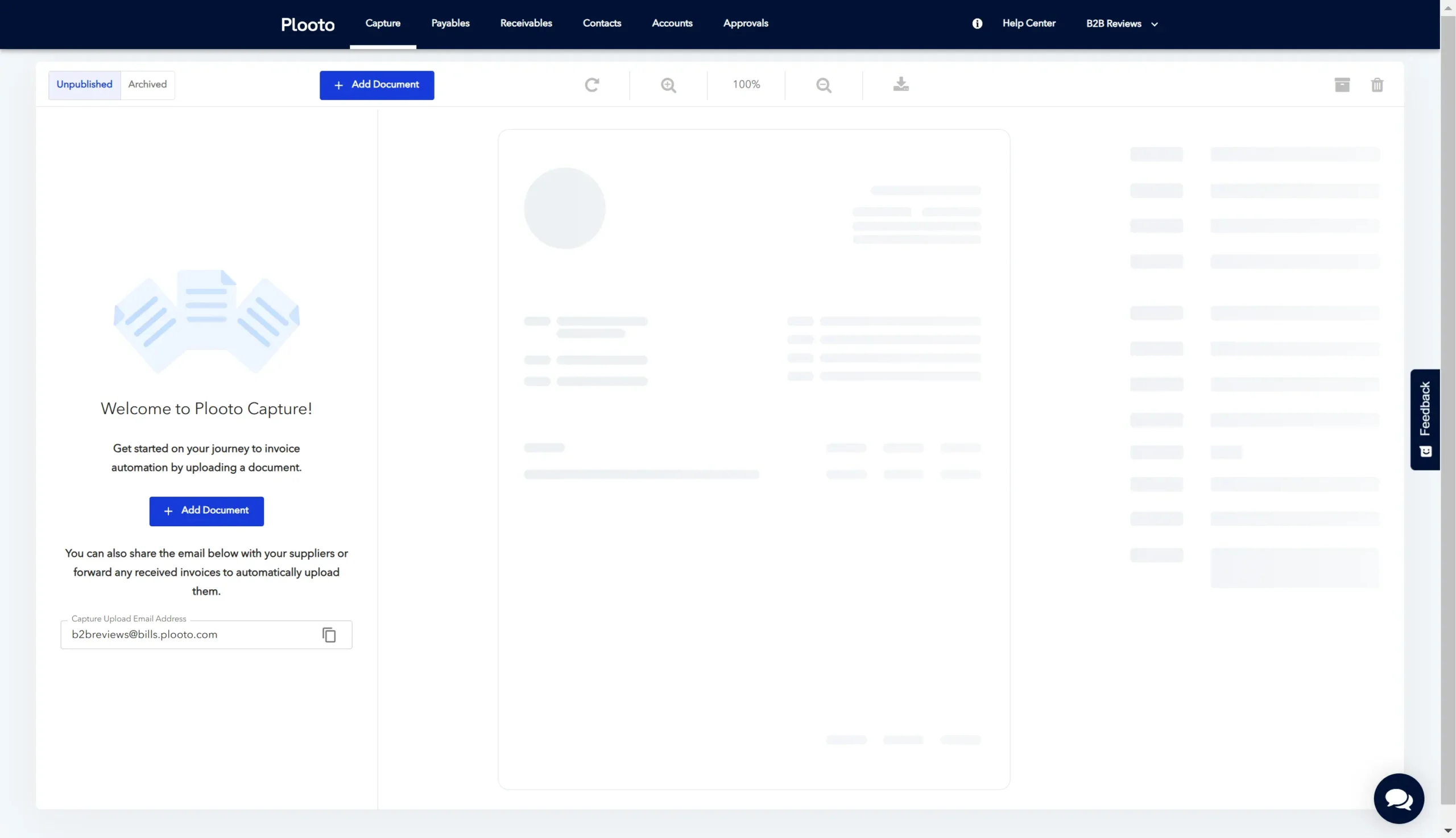

Plooto offers three plans, each designed to streamline invoice processing with Plooto Capture. All plans allow for approval workflows, with the Go plan supported by one approver and the Grow and Pro plans offering unlimited approvers. Users can collaborate with accountants, manage up to five ACH transactions per month on the Go plan, or enjoy unlimited ACH transactions on the Grow and Pro plans. Additionally, all plans enable payments with Pre-Authorized Debits (PAD) and credit cards.

Plooto Capture. Source: Plooto free trial

Which features does Plooto offer?

| AR Automation Features | |

|---|---|

| Plooto Capture | |

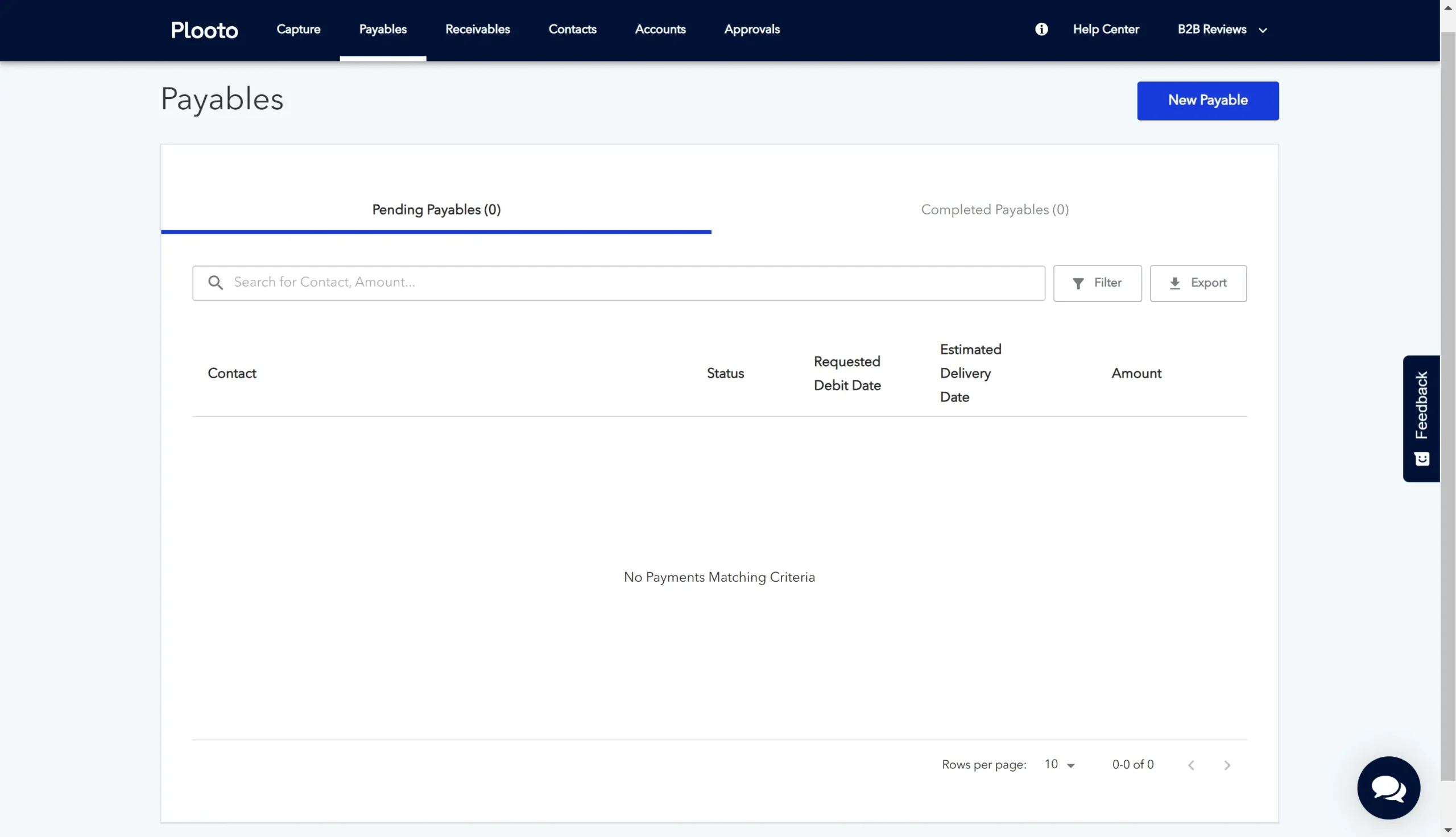

| Payables & Receivables | |

| Contacts Management | |

| Bank Integration | |

| Approvals Management | |

Other notable Plooto features

- Multi-currency support

- Payment tracking

- Audit trail

Plooto payables dashboard. Source: Plooto free trial

Start Free Trial Visit Plooto’s website.

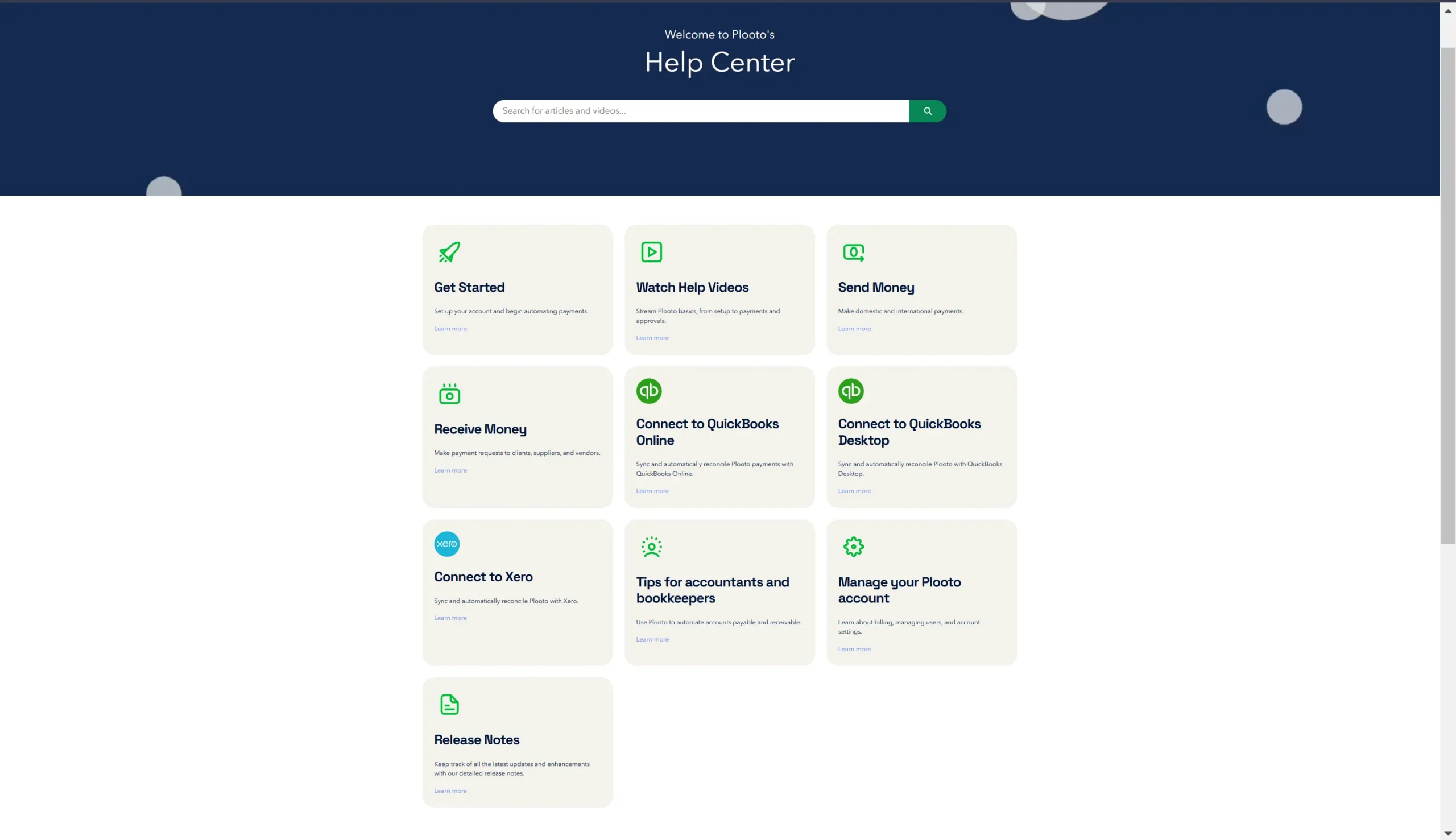

What types of support does Plooto offer?

| Data Migration | |

| 1-on-1 Live Training | |

| Self-Guided Online Training | |

| Knowledge Base | |

| FAQs/Forum | |

| Email Support | |

| Live Chat | |

| Phone Support |

Plooto help center. Source: Plooto free trial

Plooto user review highlights

We analyzed 341 user reviews about Plooto from four third-party review websites to provide this summary.

User reviews of Plooto reveal a platform that is highly appreciated for its affordability, ease of use, and streamlined payment processes, especially for small to medium-sized businesses. Customers love the software’s user-friendly interface, seamless integrations with QuickBooks and Xero, and the ability to automate and simplify accounts payable and receivable workflows. Many users highlighted the cost-effective flat-rate pricing, which makes Plooto an attractive alternative to more expensive platforms.

However, Plooto has drawbacks, particularly regarding support quality and transaction speeds. A recurring complaint we found is the delay in fund transfers, with reviewers noting that payments can take 3-7 days to process. The lack of instant payout options is a downside compared to competitors like Stripe.

Many customers are also frustrated by the customer service experience, reporting slow response times and unhelpful support interactions. Some users also encounter challenges with setup and automation, finding the platform’s interface confusing and lacking proper onboarding guidance.

- Ease of Setup – Many users find Plooto’s initial setup straightforward, especially while integrating with QuickBooks and Xero. However, some report a tedious setup process when managing multiple clients or adding complex payment structures.

- Ease of Use – Plooto’s user-friendly interface and automated payment processes make it a favorite for small to mid-sized businesses. Users appreciate how easy it is to train clients on the platform, but some find it challenging to explain the approval process to less tech-savvy clients.

- Features – Users love the features, including automated accounts payable, audit trails, approval workflows, and customizable payment schedules. The flat-rate pricing and contactless payments also stand out, though some wish for faster payment processing and additional reporting tools.

- Quality of Support – Plooto’s support team receives mixed reviews; while some customers report prompt, helpful responses, others feel the support lacks responsiveness and live chat assistance, especially during complex issues.

- Value for Money – Plooto is valued for its competitive pricing, which is particularly appealing for small businesses needing a flat-rate payment solution. Many consider it a cost-effective alternative to pricier platforms.

Plooto Contact Information

- Parent Company:

- None

- Headquarters:

- Toronto, ON, Canada

- Year Founded:

- 2015

- Website:

- plooto.com/

- Facebook:

- facebook.com/plootoinc/

- Twitter (X):

- x.com/PlootoInc

- Instagram:

- instagram.com/plooto/

- TikTok:

- tiktok.com/@plootoinc

- LinkedIn:

- linkedin.com/company/plooto/

- YouTube:

- youtube.com/c/plooto

Plooto alternatives

| Software | Starting Price | B2B Reviews Score |

|---|---|---|

| Plooto | $9/month or $32/month | 4.7 |

| Billtrust | Custom Pricing | |

| Bill.com | $45/month/user |