What is QuickBridge?

QuickBridge is a business lending platform that aims to help small business owners who could not access working capital through traditional means. The biggest draw for QuickBridge is its unique approach to the approval process. Not only does it review all credit scores, but it also requires a mere six months in business to qualify for a short-term loan.

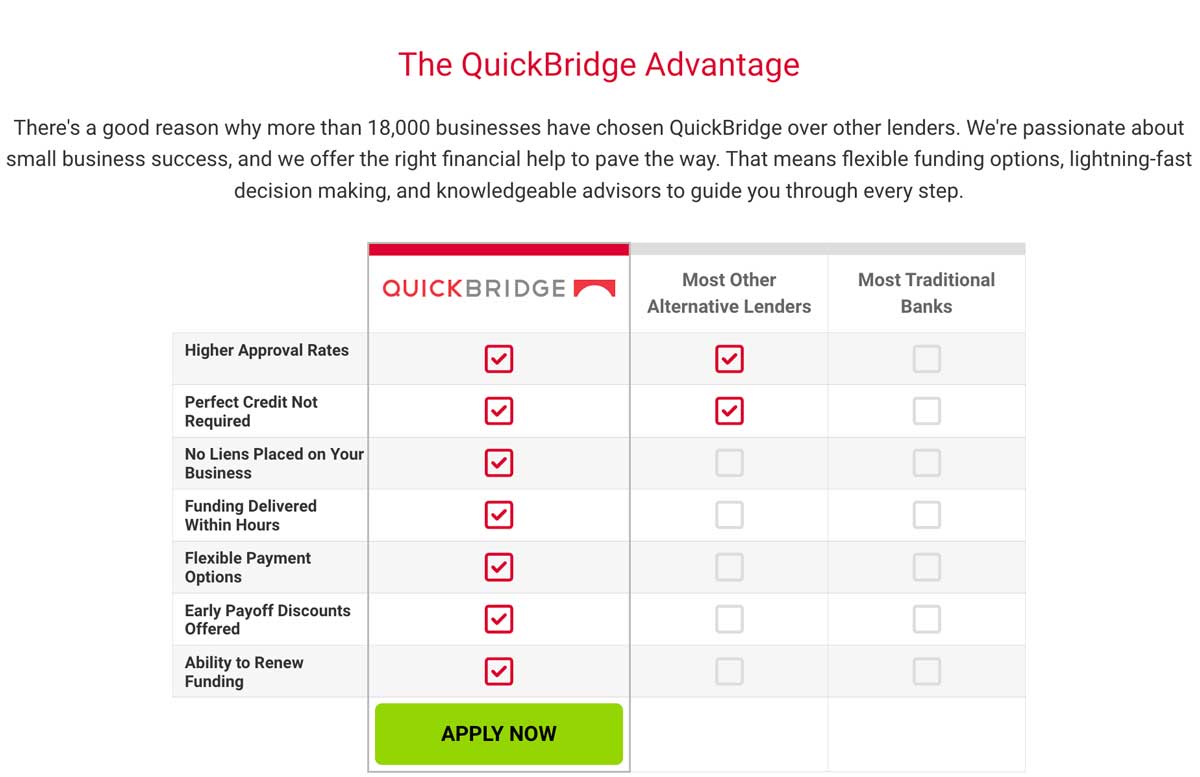

QuickBridge features. Source: QuickBridge website.

To apply for a short-term loan or QuickBridge working capital, you must complete a quick online application. The company will provide an experienced advisor to help you determine your exact funding needs and repayment terms.

The company prides itself on a unique approach to the approval process and flexible repayment terms so the businesses they serve can take out the amount they need and pay it off quickly to better benefit their business.

Best for Established Credit

SMB Compass

- Flexible repayment terms

- Large loan amounts

- Quick business loan option

Start Application Visit the SMB Compass website

QuickBridge loan requirements

QuickBridge terms loans require at least 6 months in business to qualify.

- Time in business:

- 6 months

- Annual Revenue:

- Not disclosed

- Credit Score:

- No minimum requirement

| QuickBridge Lender Details | ||

|---|---|---|

| Loan Amounts | Time to Funding | Repayment Terms |

| Up to $500k | In a matter of days | Up to 18 Months |

What does QuickBridge offer?

| Business Loan Types | |

|---|---|

| Term loan | |

| SBA loan | |

| Line of credit | |

| Invoice financing | |

| Working capital loan | |

| Merchant cash advance | |

| Equipment financing | |

Other notable QuickBridge features

- Experienced advisors to help your figure out the best funding options

- Flexible payment options

- Quick credit decisions

QuickBridge application process

You will need the following information to apply for a QuickBridge business loan:

- Drivers license

- Bank statements (how many is not disclosed)

QuickBridge Customer Support

| New Customer Phone | (888) 233-9085 | |

| Existing Customer Phone | ||

| Customer Support Email | ||

| Chat | ||

| FAQs | Available | |

| Knowledge Base | Available |

QuickBridge user review highlights

We analyzed 344 user reviews about QuickBridge to provide this summary.

Overall QuickBridge reviews are positive. We were hard-pressed to find any negative reviews. Users love the customer service with QuickBridge, saying they are professional, knowledgeable, and informative.

The most common complaint we encountered in QuickBridge funding reviews is that their QuickBridge interest rates and payment plans can be pricey. That is a common thread among all online lenders that we reviewed. We also saw a few QuickBridge complaints stating that the company is aggressive in getting new loan applicants.

- Application process – Reviewers of QuickBridge report that the application process does require some back and forth, but nothing too strenuous, and the company representatives make the process smooth and fast.

- Ease of Recieving Funds – Users have no complaints about setting up the process, accessing their QuickBridge login, or receiving funds upon approval.

- Features – The most commented-on part of QuickBridge is customer service. Users are blown away by how helpful the customer service representatives are, and many customers report they will return the next time they need funding.

- Quality of Support – One user compared QuickBridge support to other similar online lenders and said that QuickBridge won his business because they’re the only ones who took the time to get to know his business. He was impressed that the company representative personally helped him make the right funding decision for his company. Others agree that customer service is what sells the product.

- Convenience – Users report that the QuickBridge funding interest rates, fees, and payment plans are steep in price, but they also say it pays off because the process is quick, easy, and in the end, pays off.

QuickBridge Contact Information

- Parent Company:

- National Funding, Inc.

- Headquarters:

- Irvine, CA

- Year Founded:

- 2011

- Website:

- quickbridge.com

- Facebook:

- facebook.com/quickbridgefunding

- Twitter:

- twitter.com/QuickBridgeOC

- LinkedIn:

- linkedin.com/company/quick-bridge-funding

- YouTube:

- https://www.youtube.com/@quickbridgefunding1636

QuickBridge alternatives

| Lender | Loan Amounts | B2B Reviews Score |

|---|---|---|

| QuickBridge | Up to $500k | 4.5 |

| OnDeck | Up to $250k | 4.25 |

| Biz2Credit | Up to $2M | 4.75 |