Small Business Accounting Software Reviews

To help you choose the best accounting service for your business, we started with a list of 56 accounting software vendors. After a deep dive into features, pricing, customer support, and brand reputation, we narrowed our list to the best six. You can be assured that these companies are legit, thoroughly vetted by our editorial team, and have the best features to benefit your small business. Check out our methodology section for the full scoop on how we made these picks.

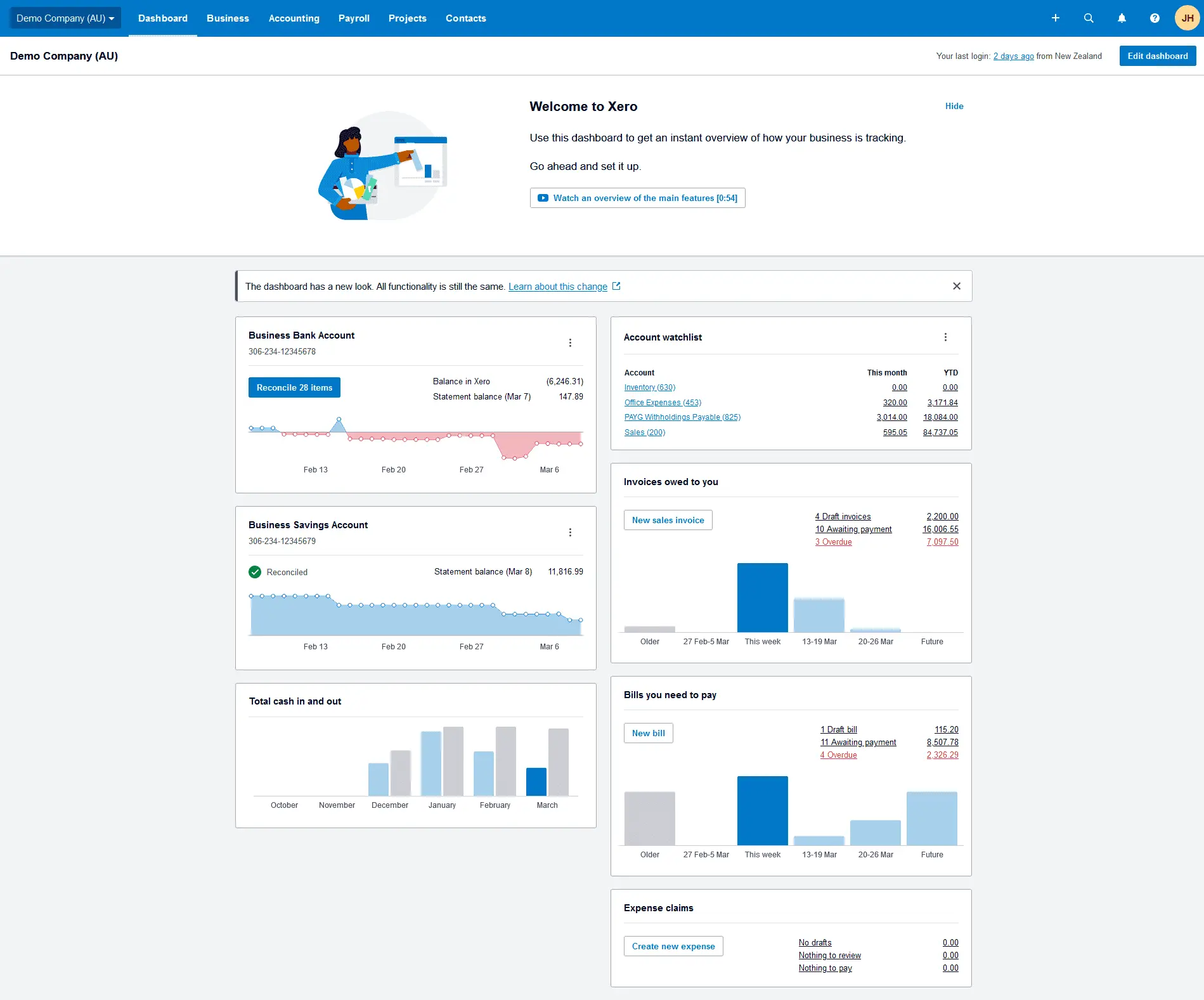

Xero – Best AI-Powered Accounting Software

By providing unlimited users, discounts for multiple businesses using the program, and AI that automates tasks like bill pay and receipt tracking, Xero supports small business accounting. It has a staff of onboarding experts to assist you in getting started and offers more than 1,000 integrations. As long as you only send 20 invoices or fewer and pay five or fewer bills each month, there is a very affordable plan for microbusinesses.

- Makes use of AI to automate processes

- Over 1,000 integrations

- Team of onboarding specialists

- No phone support

- Extra fees for ACH payments

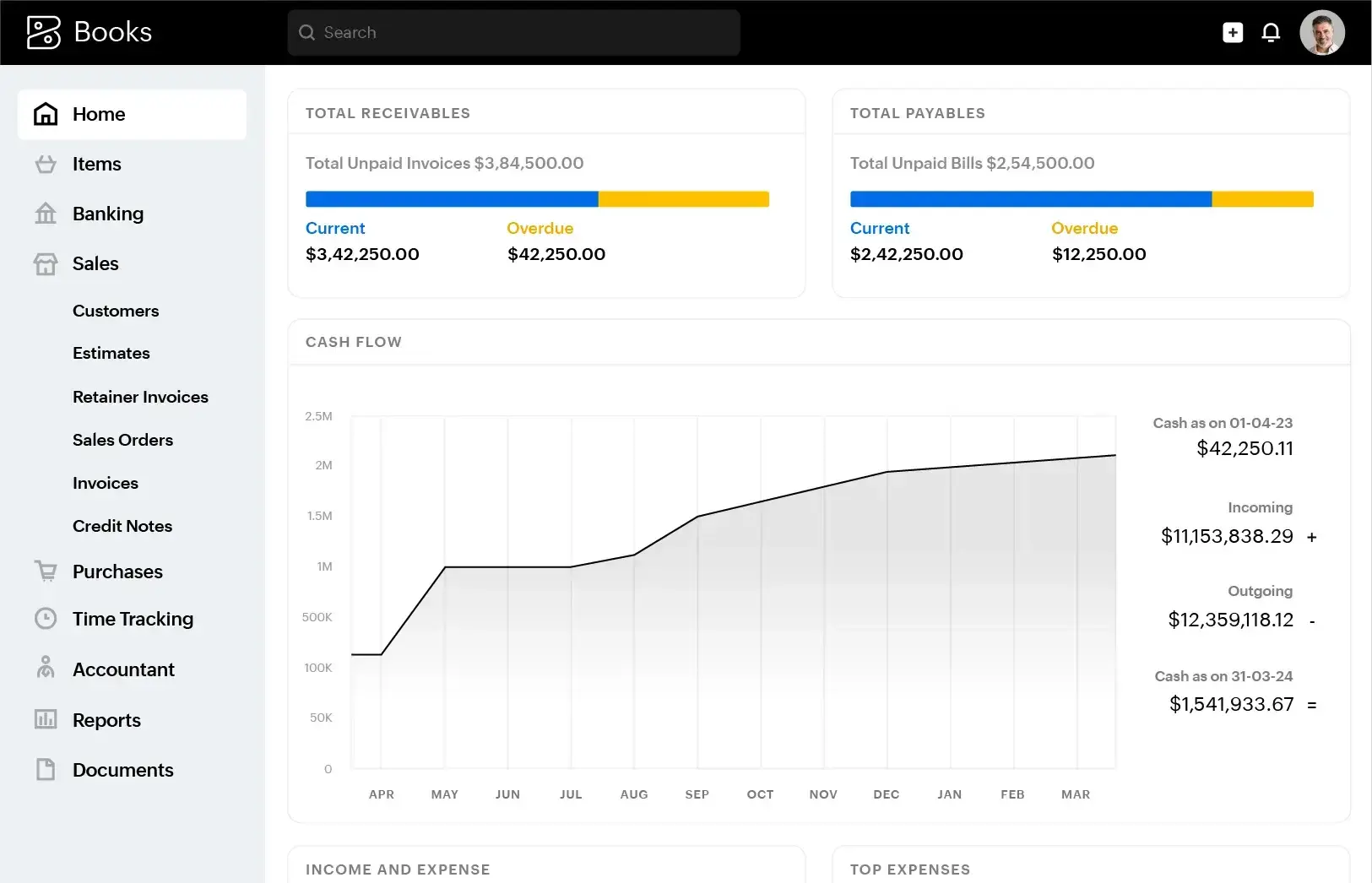

Xero dashboard.

Get Started Visit Xero’s website

Xero features

- Accounts receivable – Collect multiple types of online payments, keep your funds protected, and add click-to-pay to your online invoices.

- Accounts payable – Track, schedule, and make batch payments.

- Expense tracking – Automated expense tracking—snap a picture of your receipt with your phone, and the details are automatically tracked and loaded.

- Inventory management – Inventory software that tracks inventory, automates orders, and details demand forecasting.

- Financial reporting – Customize and run reports and collaborate with an online advisor when needed.

How Xero pricing works

Xero has three plans with a free 30-day trial: Early, Growing, and Established. The Early plan costs just $20 a month. This plan is limited to very small businesses, though, with only 20 monthly invoices and five bills paid monthly. The other two plans, the Growing plan, starting at $47 monthly, and the Established plan, starting at $80 monthly, give you unlimited invoices and bills. Payroll is an add-on that is made available through Gusto.

What markets does Xero serve?

Xero works for several types of businesses. First, the Early plan is at an affordable price point for small businesses as long as you keep invoices to 20 a month and bills to five monthly. We also like that Xero automates many tasks, making it great for businesses that need to save time and resources. Finally, we like Xero for users with more than one business or multiple users, as there is no limit to the number of users, unlike some competitors.

Read our full Xero review

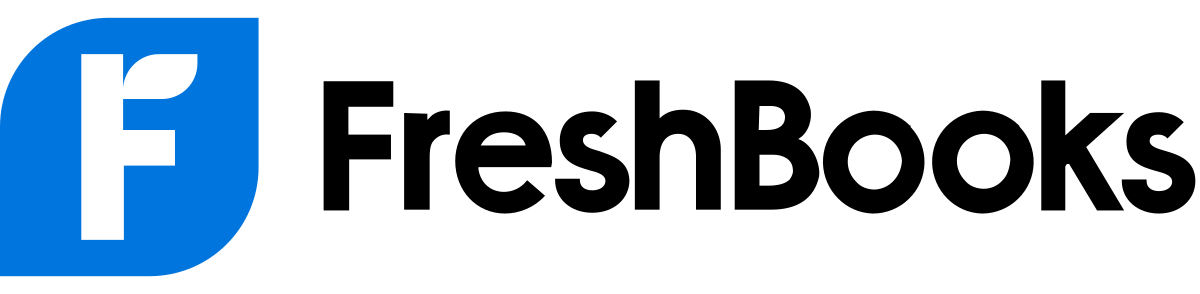

FreshBooks – Best for SMBs and Accountants

For accountants, freelancers, the self-employed, and small businesses, FreshBooks is a simple accounting program. It has functions like project management, mileage and expense tracking, billing, invoicing, and retainer management. Despite its simplicity, you can add sophisticated features like bookkeeping and payroll services to customize it to your needs. Regardless of your accounting requirements, the software is accessible and user-friendly due to its four reasonably priced plans.

- User-friendly interface

- Excellent customer service

- Feature-rich with unique offerings for freelancers and service professionals

- Does not include inventory tracking

- Limited users

FreshBooks dashboard.

Get Started Visit FreshBooks’s website

FreshBooks features

- Accounts receivable – Send professional-quality invoices and accept payments online.

- Accounts payable – Perform accounts payable basics like bill pay, general ledger, and more.

- Expense tracking – Use automatic receipt scanning to eliminate manual expense tracking.

- Inventory management – Track products and services sold, and monitor stock levels through integrations.

- Financial reporting – Access a straightforward dashboard and run detailed reports.

How FreshBooks pricing works

FreshBooks has four plans: Lite, Plus, Premium, and Select.

- Lite starts at $21/month and includes up to 5 billable clients.

- Plus starts at $38/month and supports up to 50 clients.

- Premium costs $65/month and includes unlimited clients.

- Select offers unlimited clients and two users—you’ll need to contact FreshBooks for a quote.

What markets does FreshBooks serve?

FreshBooks is designed for freelancers, solopreneurs, small businesses, and those who provide professional services. FreshBooks also offers special features and tools for accountants who offer services to small businesses. Its Accountant Hub makes it easy to manage clients and see everything in one place. Instead of inventory tracking like many competitors, it offers features like retainer client billing and mileage tracking to help smaller businesses and professional service providers.

Read our full Freshbooks review

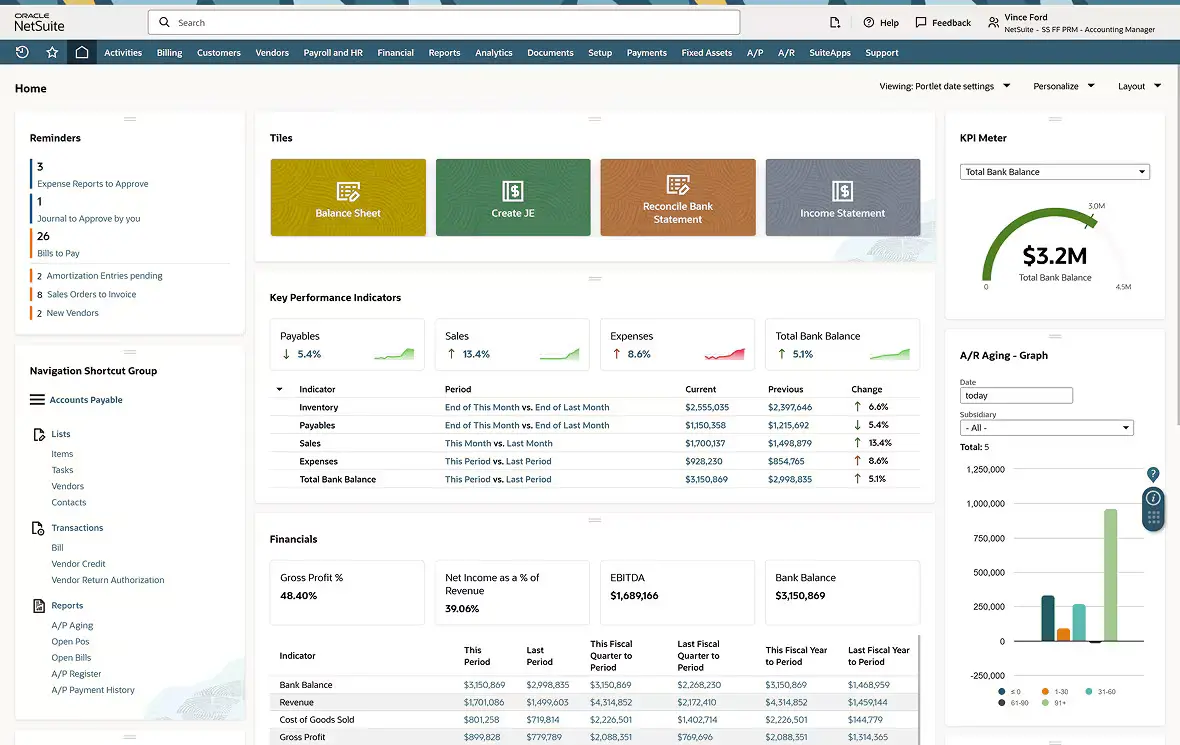

Oracle NetSuite – Best for Scalable Accounting

Oracle NetSuite, a cloud-based accounting solution, helps expanding companies manage their finances in real time with accounting apps. Businesses can manage essential operations like accounts receivable and payable, financial planning, revenue recognition, and compliance by combining accounting features with thorough resource planning.

- Strong resource planning and financial management features

- Customizable dashboards and reporting

- Cloud-based with real-time data access

- Pricing varies with customization needs

- Complex setup for smaller companies

Oracle NetSuite dashboard.

Oracle NetSuite features

- Accounts receivable – Manage customer credit, create invoices automatically, and expedite payment collection.

- Accounts payable – Utilize integrated workflow tools to manage vendor invoices, approvals, and payments.

- Expense tracking – Use advanced controls to record and classify business expenses in real time.

- Inventory management – Get complete insight into inventory locations, levels, and demand projections.

- Financial reporting – Use robust analytics tools to generate role-based, real-time financial reports.

How Oracle NetSuite pricing works

Oracle NetSuite offers four plans to choose from:

- Starter Edition: Starting at $99/month/user + $999 monthly licensing fee

- Emerging Edition: $100/month/user (exact cost based on business needs)

- Mid-Market Edition: Starting at $2,500/month (exact cost based on business needs)

- Enterprise Edition: Starting at $999/month + $200/user

What markets does Oracle NetSuite serve?

Oracle NetSuite is ideal for small to mid-sized businesses needing an extensive financial management solution that integrates seamlessly with other business functions.

Read our full Oracle NetSuite review

Zoho Books – Best Cheap Accounting Software for Small Business

Zoho Books is part of a full suite of Zoho business products, including Zoho CRM. Zoho Books offers a feature-rich program that includes core accounting, compliance, document management, access to other Zoho business tools, collaboration, smart automation, and mobile access. It’s the perfect balance of features and affordability, with free accounting software for small businesses with an annual revenue of less than $50K.

- Robust free plan

- Rich feature set

- Easy UI

- Might be too complex for your needs

- Plans are limited to 15 or fewer users

Zoho Books dashboard.

Zoho Books features

- Accounts receivable – Send customizable invoices and statements and receive payments in multiple currencies.

- Accounts payable – Generate and track vendor bills, set them up as recurring payments, and send them off for approval.

- Expense tracking – Upload receipts and your credit card to easily track where your money is spent.

- Inventory management – Capture complete product details and monitor how fast they’re moving.

- Financial reporting – View financials in charts, dashboards, and reports.

How Zoho Books pricing works

Zoho Books has six plans:

- Free: $0 – for solopreneurs and micro businesses

- Standard: $20/month/organization – organize transactions, accounts, reports, and books

- Professional: $50/month/organization – take on projects, track inventory, and handle purchases

- Premium: $70/month/organization – enhanced customization and automation

- Elite: $150/month/organization – advanced accounting bundled with inventory management

- Ultimate: $275/month/organization – gain insights with business intelligence capabilities

What markets does Zoho Books serve?

For small businesses with complicated needs, Zoho Books is a good choice. Super small businesses may find this feature-rich platform too complicated, but small businesses that need to compete with larger companies or are getting ready to scale are the ideal customers. Businesses that already use other Zoho products can also benefit from it. iikv

Read our full Zoho Books review

Intuit QuickBooks Online – Best Accounting and Payroll Software for Small Business

Intuit QuickBooks Online is a well-known and widely used accounting software program that offers small businesses both basic and advanced accounting features, along with a range of add-on options like time tracking and payroll. Additionally, it is highly customizable, has dependable mobile access, and is user-friendly enough for small businesses to understand. Bill pay, expense tracking, and inventory management are notable features.

- Supports many add-ons like payroll

- Well-known and easy-to-find online resources

- Highly capable mobile app

- Steep learning curve

- Limited users in some plans

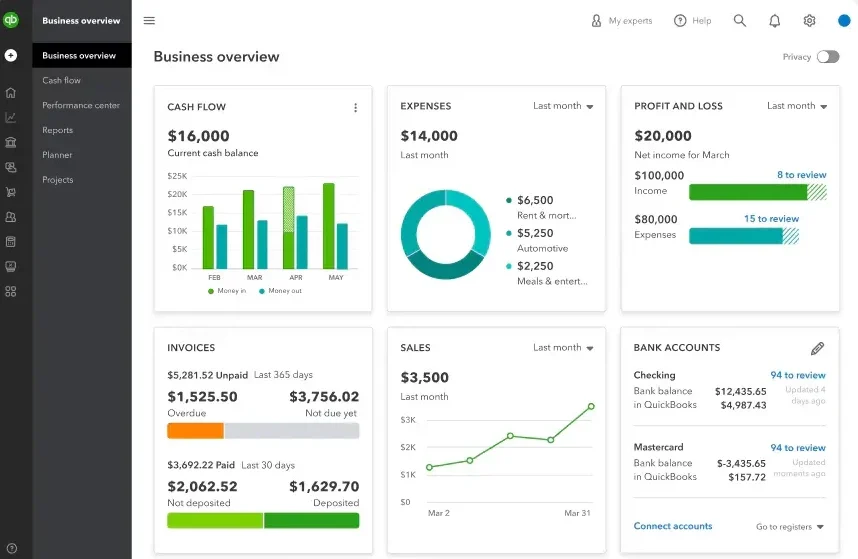

Intuit QuickBooks Online dashboard.

Intuit QuickBooks Online features

- Accounts receivable – Send professional invoices and collect online payments quickly and easily.

- Accounts payable – Organize, manage, and pay bills in one place to avoid missed payments.

- Expense tracking – Track expenses across multiple accounts and categories.

- Inventory management – Monitor what’s in stock, what’s been sold, and what’s on order.

- Financial reporting – Generate detailed, customizable financial reports and balance sheets.

How Intuit QuickBooks Online pricing works

Intuit QuickBooks Online has three plans and a 30-day free trial:

- Simple Start: Starting at $35/month

- Plus: Starting at $99/month

- Advanced: Starting at $235/month

What markets does Intuit QuickBooks Online serve?

Intuit QuickBooks Online has a wide variety of features, integrations, and a highly successful mobile app, making it appealing to a range of businesses. We like it best for SMBs, as the price can be steep, but it covers more complex features that midsize businesses with a tech budget will find useful.

Read our full Intuit QuickBooks Online review

Sage 50 Accounting – Best Desktop Accounting Software for Small Business

Sage 50 Accounting combines powerful desktop accounting software with online accounting capabilities to give you a complete view of your finances and inventory. While Sage 50 is priced slightly higher than strictly cloud-based services, the desktop platform stands out for advanced inventory tracking and job costing tools. But because it has online access, you aren’t tied to your desk. You can see real-time business insights on the go while collaborating with your teams, giving you the best of both worlds.

- Powerful inventory and job costing features

- Microsoft 365 integration

- Industry-specific features

- No mobile app

- High price point

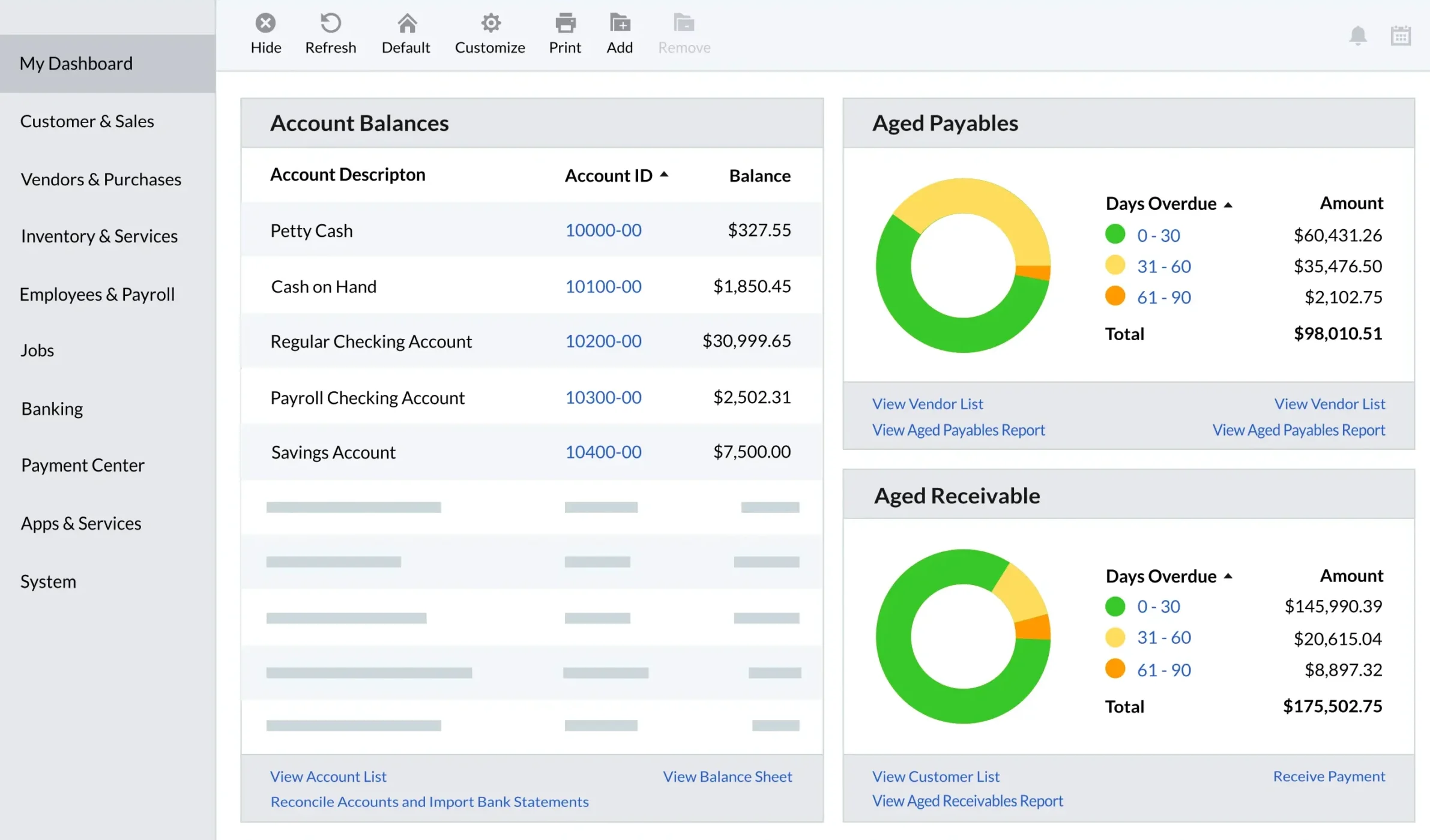

Sage 50 Accounting dashboard.

Sage 50 Accounting features

- Accounts receivable – Cash flow manager that gives you custom views of your quotes and invoices.

- Accounts payable – Automate bill payments, purchase orders, and bank reconciliations.

- Expense tracking – Utilize live bank feeds to automatically track expenses.

- Inventory management – Track inventory daily in custom units and monitor quantities, transactions, item classes, and purchase order status.

- Financial reporting – Over 150 reports, including specialized reports per industry.

How Sage 50 Accounting pricing works

Sage 50 has three plans:

- Pro Accounting: Starting at $61.92/month for one user

- Premium Accounting: Starting at $103.92/month for one user (pricing changes depending on how many users)

- Quantum Accounting: Starting at $177.17/month for one user (pricing changes depending on how many users)

What markets does Sage 50 Accounting serve?

Sage 50 Accounting is an excellent tool for businesses that need to keep close tabs on inventory and job costs. It tracks inventory in custom units daily, allowing you to view your purchase orders and inventory status. It also gives you insight into each job and project, estimating job costs, tracking inventory for each job, and estimating your revenue. Furthermore, you can use Sage 50 Accounting for a specific industry with industry-specific functions, inventory management, and reporting.

Wave – Best Free Accounting Software

Wave offers a suite of money management tools, including invoicing, online payment acceptance, and accounting basics. While pretty lean in features, it has one of the best free accounting software for small business plans that we reviewed. Small businesses needing a simple accounting solution will benefit from the free plan, which allows you to send unlimited invoices and perform basic accounting.

- Basic free plan with accounting and invoicing

- Unlimited users and transactions

- Excellent transaction management tools

- Limited features

- Lacking human support

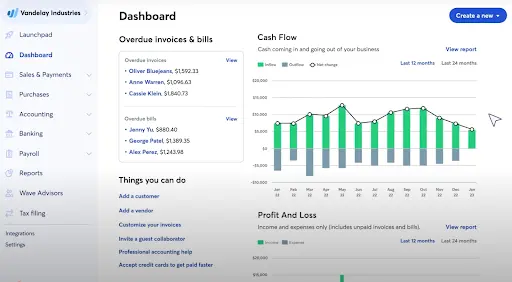

Wave dashboard.

Wave features

- Accounts receivable – Create and send professional invoices that sync with Wave’s accounting to easily keep track of your outstanding invoices.

- Accounts payable – Track money going out versus money coming in with basic accounting features.

- Expense tracking – Scan and track spending straight from your mobile device.

- Inventory management – Track inventory manually using workarounds or integrate with third-party apps for more advanced features.

- Financial reporting – Monitor the health of your business through a variety of reports, including profit and loss statements.

How Wave pricing works

Wave offers just two plans: Starter and Pro. The Starter plan is free and includes unlimited invoices, a mobile app for tracking invoices, and basic accounting. If you want anything beyond that, there will be an added fee. The Pro plan starts at $16 a month and includes expense tracking and the ability to make and accept online payments. Payroll, bookkeeping, and the ability to scan receipts digitally are add-ons.

What markets does Wave serve?

For very small businesses that don’t require an all-in-one platform, Wave is perfect. Wave is a straightforward and cost-free option if all you need is a way to create invoices and monitor basic income versus expenses. The Pro plan is an option for those with more complicated needs.

Compare the Best Accounting Software for Small Businesses Side-by-Side

| Software Name | Why we picked it | Starting price for the cheapest plan | Highlights |

|---|---|---|---|

| Xero | Best AI-Powered Accounting Software | $20 / month | Many automated features like receipt tracking and integrations |

| FreshBooks | Best for SMBs and Accountants | $21 / month | Unique features like retainer tools and mileage tracking for solopreneurs | Oracle NetSuite | Best for Comprehensive Financial Management | $99 / month | Strong resource planning and financial management |

| Zoho Books | Best Cheap Accounting Software for Small Business | Free | Free version available, plus it’s good for those already using Zoho tools |

| Intuit QuickBooks Online | Best Accounting and Payroll Software for Small Business | $35 / month | Well-known and easy to get support |

| Sage 50 Accounting | Best Accounting and Inventory Software for Small Business | $61.92 / month | Desktop tool for advanced inventory and job cost management |

| Wave | Best Free Accounting Software | Free | Free plan with unlimited invoicing and basic accounting |

What is Accounting Software?

All businesses need accounting software to manage their financial transactions, track income and expenses, reconcile accounts, create reports, and keep track of their debts. Typical accounting system features include, but are not restricted to, bill payments, invoices, and income and expenses. Small businesses frequently use simplified programs that automate and do away with the need for manual data entry, saving the company time and money while lowering errors. Larger businesses, on the other hand, use more feature-rich, complex software designed to handle higher transaction volumes and provide advanced reporting, payroll, and inventory management. Accounting software for small businesses helps you easily connect your bank account to automatically track income and expenses, saving time and reducing errors. By integrating with your bank account and other financial tools, these programs offer real-time insights into your cash flow and financial health, making it easier to stay organized and make informed business decisions.

Why Should I Use Accounting Software For My Business?

By automating the categorization of processes like invoicing, expense tracking, bill payment, and financial reporting, accounting software helps you manage your company’s finances more effectively and efficiently. It provides real-time insights into your cash flow, helping you understand where your money is coming from and where it’s going. This not only saves time but also significantly reduces the risk of human error that comes with manual bookkeeping. With organized, up-to-date financial records, it becomes easier to prepare for tax time, file sales tax accurately to maintain regulatory compliance, and present accurate reports to stakeholders. Additionally, accounting software supports smarter decision-making by offering customizable reports and forecasts that can guide budgeting and growth strategies. Ultimately, it gives you the confidence and clarity needed to focus on growing your business.

What Are the Advantages of Using Free Accounting Software for Small Businesses?

Small businesses can manage their finances more affordably without compromising on necessary features by using free accounting software. These tools often include essential functions like invoicing, expense tracking, and basic financial reporting, helping business owners stay organized and maintain control over their cash flow. Many free platforms also offer user-friendly interfaces, making them accessible even to those with little or no accounting experience. For startups or small businesses with tight budgets, free accounting software provides a practical starting point, offering the flexibility to upgrade or integrate with more advanced tools as the business grows. This allows owners to scale their financial management systems alongside their company without incurring upfront software costs.

What Accounting Software Do Small Businesses Use?

Depending on their size, financial constraints, and unique requirements, small businesses employ a range of accounting software. Common choices include FreshBooks, which is best suited for service-based businesses with basic accounting requirements; Xero, which provides robust invoicing and inventory tools; and QuickBooks Online, which is renowned for its comprehensive features and user-friendly interface. Wave’s free core features make it a popular option for freelancers and startups, while Zoho Books is a favorite among users of other Zoho apps. More sophisticated or expanding companies that require sophisticated tools like payroll, inventory control, or comprehensive reporting are served by Sage 50 and Oracle NetSuite. Since different business types and experience levels are catered to by each software solution, it’s critical to select one that complements your workflow and long-term objectives.

“Accounting software has been essential every time our small business has hit a growth stage.”

How Much Does Accounting Software Cost?

The features, number of users, and size of your company all affect how much accounting software costs. For small businesses with basic requirements, basic plans can start as low as free or about $10 to $20 per month. The monthly cost of more sophisticated plans with extra features like payroll, inventory management, and multiple user access usually ranges from $40 to $100 or more. Several hundred dollars a month or a custom quote may be needed for enterprise-level solutions with extensive customization and support. To make it simpler to test the software before committing, many providers also provide free trials or discounts for the first few months. In the end, the appropriate price is determined by the particular requirements and size of your company.

| Accounting Software for Small Businesses Pricing Comparison | ||

|---|---|---|

| Vendor | Monthly Fee | Free Trial |

| Xero | $20 | 30 days |

| Sage 50 Accounting | $61.92 | 30 days |

| FreshBooks | $21 | 30 days |

Accounting Software for Small Business FAQ

What is the easiest accounting software for a small business?

Small business accounting software that has a straightforward, user-friendly interface and basic features like expense tracking, invoicing, and reporting is usually the easiest to use. Popular options that require little to no accounting experience to get started are FreshBooks and Wave, which are renowned for being user-friendly. These platforms help busy small business owners manage their finances by streamlining routine tasks, providing clear dashboards, and offering helpful customer support.

Is QuickBooks worth it for a small business?

Due to its extensive feature set that makes bookkeeping, invoicing, tracking expenses, and tax preparation easier, QuickBooks is frequently worth the investment for small businesses. It is appropriate for a broad spectrum of industries and company sizes due to its scalable plans, robust integration options, and user-friendly interface. Even though it might cost more than some alternatives, many small business owners find that the accuracy and time savings make the difference, keeping them organized and enabling them to make wise financial decisions.

What is the easiest bookkeeping software?

The simplest bookkeeping software is one that automates routine tasks like bank reconciliation, expense tracking, and invoicing, and offers excellent ease of use. Wave and FreshBooks are frequently commended for their intuitive designs, which make them perfect for freelancers or small business owners with limited accounting knowledge. These platforms keep financial management simple and stress-free by concentrating on the most important features without overburdening users.

Is Xero worth it for small business owners?

For small business owners looking for a robust yet user-friendly accounting solution, Xero is worth the investment. Through a clear, user-friendly interface, it provides robust features like inventory management, bank reconciliation, invoicing, and real-time financial reporting. Workflows are streamlined by Xero’s strong integrations with numerous other business apps. Many small business owners find its flexibility and powerful tools useful for expanding their company and maintaining organization, even though it might be a little more expensive than some basic options.

How We Chose the Best Accounting Software For Small Businesses

We started with a well-rounded list of 56 accounting software companies on the market. We narrowed it down to 12 well-known brands with significant market share to test and compare each platform. From there, we choose seven vendors that stand out for their features, the markets they serve, and their brand reputation.

Our research is collected and vetted from vendor websites, interviews, video and live demos, user reviews, and free trials. We focus on a scoring system for each company that weighs the following four parts as 25 percent of the total score.

- Features: In accounting software, we looked for vendors that offer accounts payable, accounts receivable, expense tracking, inventory management, and financial reporting features. Companies that offer all these features score higher as they provide a more streamlined and complete experience for small businesses and their accountants.

- Price: When we looked at pricing, we looked for price and fee transparency, free trials, or demos to try before you buy. We also compared pricing among vendors. Companies with transparent pricing and fees, as well as a free trial, got a higher score.

- Customer support: We studied availability and the types of support channels offered. Companies that offer more customer support hours and channels of support rank higher.

- Brand reputation: To gauge each vendor’s reputation, we gathered and studied data from customer reviews and ratings published on third-party review sites.