What is Nav?

Nav offers various services for businesses looking to monitor and improve their financial health to get small business loans. Using Nav can show you the financing you will likely get based on your data before applying. It can also pinpoint issues holding you back from the funding you need.

Setting up company profile and dashboard. Source: Nav free account.

Nav shows you critical financial information on your business that saves you time, money, and resources applying for funding you aren’t likely to get. Plus, it streamlines the process of collecting credit reports and scores independently.

Utilizing their trusted partners, Nav provides the information and actionable details you need to make smart business decisions, improve your business credit score, and open the door to better lending options. Using Nav, you will receive personalized financial recommendations for your business.

Nav also offers business credit cards, a business checking account, and additional business services like payroll services and accounting solutions.

Nav Prime is a solution for small businesses to track their credit progress while helping build their business credit history at the same time. Nav Prime works with small businesses at any stage of the process to strengthen their financial healthiness without the need for credit requirements, minimum time in business, or annual revenue minimums.

Nav Prime shows you a comprehensive view of both your business and personal credit health in order to see them from an outside perspective and improve your position.

Having separate business and personal financials, Nav Prime allows for a business to bank smarter while using a platform that guides the business to new financial opportunities.

Over 250k small businesses that have used Nav Prime have built business credit and managed their credit health. Users seem satisfied overall with Nav’s various services and mostly comment about how helpful the customer service reps are. Nav reports that small businesses matched with lenders through their website are twice as likely to be approved for financing.

Get Started Visit Nav’s website.

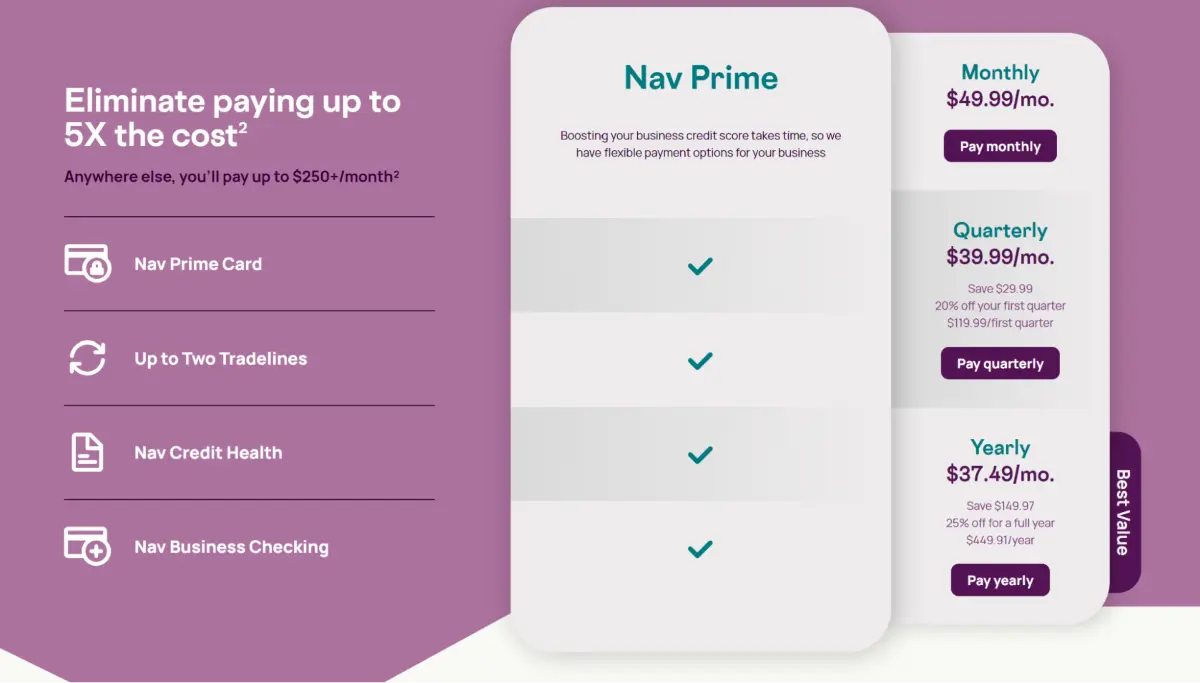

How much does Nav Prime cost?

| Nav Prime Pricing | ||

|---|---|---|

| Monthly | Quarterly | Yearly |

| Starting at $49.99/mo. | Starting at $39.99/mo. | Starting at $37.49/mo. |

| Pay Monthly | Pay Quarterly Save $29.99 20% off your first quarter $119.99/first quarter |

Pay Annually Save $149.97 25% off for a full year $449.91/year |

Nav Prime plans available. Source: Nav website.

How does Nav work?

Nav is not a direct lender. Instead, it matches you with personalized financing solutions that fit your business. Nav recommendations may include:

| Business Loans Types | |

|---|---|

| Term loan | |

| SBA loan | |

| Line of credit | |

| Invoice financing | |

| Working capital loan | |

| Merchant cash advance | |

| Equipment financing | |

Other notable Nav features

- Business credit cards

- Business checking account

- Business formation

- Business insurance

- Merchant services

- Payroll services

- Business taxes

- Accounting solutions

- Business grants

Nav application process

You will need the following information to apply for Nav marketplace lending:

- Time in business

- Annual revenue

- Three months of bank statements

- Credit score range

- How quickly you need financing

- Desired loan amount

- Purpose of the funds

Nav Prime card application process

Nav Prime requires an individual or a business to be an active Nav Prime member, have an approved Nav banking application, and have a successfully linked bank account to obtain a Nav Prime card. Unlike big banks, Nav Prime is available with:

- No revenue minimums

- No time in business requirement

- No personal credit check

- No security deposit

- No personal guarantee

Get Started Visit Nav’s website.

Nav customer support

| New customer phone number | ||

| Existing customer phone number | ||

| Customer support email | Online form | |

| Chat | Not available | |

| FAQs | Available | |

| Knowledge base | Available |

Nav user review highlights

We analyzed 233 user reviews about Nav from two third-party review websites to provide this summary.

In our research into Nav, we found limited user reviews. However, the reviews we did find gave us good insight into customers’ thoughts on the online vendor. First, for the negative – we found complaints regarding promises of quick funding made with no follow through, business checking with little to no additional benefits, and requests for repeat information that had already been submitted which delayed the application process.

On the other hand, most Nav reviews are very positive, and users especially find customer service to be above and beyond. Users report that the customer service representatives are knowledgeable, responsive, pleasant, patient, and truly go above and beyond to help.

- Application process – the application process gets mixed reviews where some users say they were asked to submit the same information more than once.

- Ease of Use – ease of use gets mixed reviews. Some users say it’s easy to navigate, and others gripe that crucial pages wouldn’t load.

- Features – Nav customer service is the most commented on and valued feature.

- Quality of Support – users say the customer support representatives are simply the best and most helpful around.

- Convenience – reviewers of Nav report that it’s a great value and something that all small businesses should use.

Nav Contact Information

- Parent Company:

- Nav

- Headquarters:

- Utah

- Year Founded:

- 2012

- Website:

- nav.com

- Facebook:

- facebook.com/navsmb

- Twitter:

- twitter.com/navsmb

- LinkedIn:

- linkedin.com/navsmb

- Instagram:

- instagram.com/navsmb

- TikTok:

- tiktok.com/@navsmb

- YouTube:

- youtube.com/ @navsmb

Nav alternatives

| Software | Starting Price | B2B Reviews Score |

|---|---|---|

| Nav | $49.99 / month | 4.75 |

| OnDeck | n/a | 4.25 |

| QuickBridge | n/a | 4.5 |