We may earn money when you click on links to our partners. Advertiser Disclosure

Payroll is a large part of running a business. From ensuring employees receive pay on time to matching and paying the correct amount of taxes, payroll poses both administrative and financial strain.

However, with enough planning and foresight, owners and human resource teams can easily develop a strong business strategy and budget around payroll expenses. Keeping track of current and trending payroll statistics will allow you to prepare for the coming year as well as find innovative and money-saving methods.

Whether you outsource payroll or do it in-house, keeping track of payroll trends and the labor market will enhance your decision-making processes.

Key Takeaways

- Employers are budgeting for a 4% salary increase in 2024.

- Some companies are increasing merit salary budgets by 3.5% in 2024.

- The taxable maximum is increasing by about 5%.

- 95.15% of employees receive pay via direct deposit.

- The U.S. has around 5,700 payroll service industry establishments.

Payroll Trends for 2024

Employee salaries greatly impact company budgets. Not only do companies have to pay the salaries, but they need to pay FICA and Social Security taxes on top of that. When salaries increase, so do taxes. As Americans move on from the pandemic, we’ve seen wage growth slow, but employers are still preparing for pay increases this year.

- Many employers are budgeting for an average salary increase of 4% in 2024.

- This projection is 0.4% less than the 2023 pay increase but higher than the 3.1% increase in 2021 and prior years.

- 70% of employers are budgeting for pay to remain the same or higher in 2024.

Additionally, Payscale’s Salary Budget Survey shows that 22% of organizations expect to lower their salary budgets in 2024. This is more than in the previous year when only 9% of employers reduced salary budgets.

- 45% of employers say “economic uncertainty” is the main reason for reducing annual salary increases.

- However, some companies are increasing their merit salary budgets by 3.5% in 2024.

One reason employers need to budget for salary increases is that the Social Security Administration (SSA) plans to increase the wage base for 2024 by 5.2%, leading to higher taxes for high-salaried positions. This correlates with the 3.2% cost-of-living (COLA) increase.

Additionally, the SSA is increasing the wage cap for taxable income in 2024.

- The taxable maximum is increasing by about 5% from $160,200 to $168,600.

Businesses must be aware of this change to withhold payroll taxes from their high-earning employees’ paychecks properly.

45% of employers say “economic uncertainty” is the main reason for reducing annual salary increases.

Impacts of the SECURE Act of 2022

On December 29th, 2022, President Biden signed into law the “Setting Every Community Up for Retirement Enhancement (SECURE) 2.0 Act of 2022.” The law changes rules for retirement plans, affecting payroll for years to come.

Employers that establish a 401(k) plan after the signing date must automatically enroll eligible employees, effective for the years starting after December 31st, 2024.

- Employees must be automatically enrolled at a rate between 3% and 10% (unless the employee elects to contribute more or not at all).

- The rate will increase by 1% annually until it reaches at least 10%.

- The rate cannot exceed 15%, however.

A few types of companies are not required to automatically enroll employees in a 401(k) plan:

- Employers with ten or fewer employees,

- Government plans,

- Church plans,

- And new employers who’ve been in business for less than three years are exempt.

The SECURE 2.0 Act also affects payroll for some part-time employees, effective for the tax years starting after December 31st, 2024. The act lowers the number of years a part-time employee needs to work before they’re eligible to contribute to a 401(k) plan.

- Part-time employees must work at least 500 hours per year for two years before they can contribute (previously a three-year requirement).

The act also lists a higher catch-up limit for individuals aged 60, 61, 62, and 63, effective for tax years beginning after December 31st, 2024.

- Qualified people can either contribute up to $10,000 extra,

- Or 50% more than the regular amount.

It’s important to note that the increased limit is indexed to inflation after 2025.

Similarly, as an employer, you want to know how catch-up contributions will change for your highly compensated employees. Highly compensated employees are those whose wages exceed $145,000 in the preceding calendar year (adjusted for inflation beginning in 2025).

- Starting January 1st, 2024, contributions made by high-earners must be treated as Roth contributions and not pre-tax contributions.

- Companies have until January 1st, 2026, to transition their operations to comply with this provision, as announced by the IRS on August 25th, 2023.

The act also made several changes to the RMD rules. Among those changes is the age at which Americans receive distributions.

- As of 2023, the age increased from 72 to 73 years old.

- The age is planned to rise again in 2025 to 75 years old.

It’s essential to stay up-to-date on the latest laws and regulations surrounding payroll. The SECURE 2.0 Act has the largest impact for next year, but its effect extends to years beyond.

Company Payroll Statistics

Business employers are responsible for withholding the correct amount of taxes from their employees’ paychecks every pay period. They must also calculate their own share of the taxes while depositing and filing returns with the proper government agencies on time.

These taxes are due to the Federal Insurance Contribution Act (FICA), which supports the federal Social Security and Medicare programs. In total, 15.3% of an individual’s wages are due every pay period, and the amounts are split evenly between the employer and the employee.

- Each party pays 6.2% (up to the base limit) of Social Security taxes.

- Each party pays 1.45% of Medicare taxes, which has no limit.

Employees who earn more than $200,000 may be required to pay an additional 0.9% in taxes to Medicare. However, employers are not required to match this increased percentage.

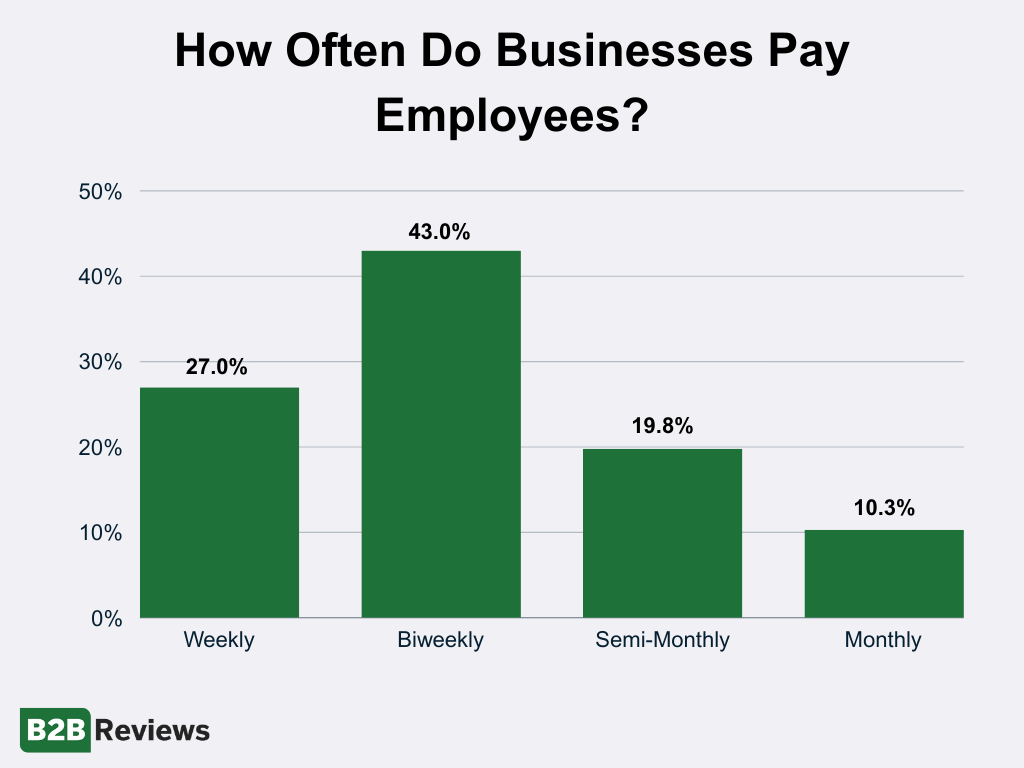

Another responsibility employers have is to ensure that they offer a good employee experience. Paying employees on time is a major way you can achieve this. Depending on local and state laws, employers generally choose one of the four below methods:

- Weekly

- Biweekly or every other week

- Semi-monthly

- Monthly

Biweekly is the most common timeframe for payroll, with nearly half of all companies utilizing this method. Weekly is the second most common, followed closely by semi-monthly. Finally, monthly is the least common, with only 10% of U.S. companies using this method.

Source: U.S. Bureau of Labor Statistics CES Survey

Interestingly, the size of a company affects how frequently each payment method is used. Yet, no matter the company’s size, biweekly payments are the most common.

| Business Size | Weekly | Biweekly | Semimonthly | Monthly |

|---|---|---|---|---|

| 1–9 | 24.1% | 39.0% | 22.5% | 14.5% |

| 10–19 | 34.0% | 46.5% | 15.9% | 3.7% |

| 20–49 | 32.8% | 51.1% | 14.7% | 1.4% |

| 50–99 | 31.6% | 54.0% | 13.4% | 1.0% |

| 100–249 | 27.3% | 59.4% | 12.5% | 0.7% |

| 250–499 | 24.7% | 63.4% | 11.4% | 0.5% |

| 500–999 | 25.4% | 63.8% | 10.1% | 0.7% |

| 1,000+ | 26.3% | 66.6% | 5.6% | 1.5% |

Source: U.S. Bureau of Labor Statistics, CES Survey

Another payroll trend is misclassifying employees as independent contractors. Some employers do this to attempt to save on taxes. This may seem like a nice trick in the short term but quickly leads to legal issues. On top of that, misclassifying workers might prevent them from receiving employee benefits and place the burden of taxes on them.

Despite the legal issues of misclassification, 10% – 30% of employers misclassify their employees. It is possible that some employers do this by accident. That is why using reputable payroll providers and other technological tools is important.

Business News Daily explains that advancements in technology like artificial intelligence (AI) and automation can be used to correctly classify employees, ensuring they are placed in the proper tax brackets.

Trending Employee Payroll Statistics

To fully understand why payroll trends move the way they do, you need to have a good grasp of the whole picture. That is why we need to take a look at the employee side of payroll.

It’s vital to get payroll right because recent studies find that 50% of employees will look for a new job after just two payroll errors. Little mistakes can end up costing you money and workers, so staying on top of payroll is important. One factor to keep in mind is how you pay your employees.

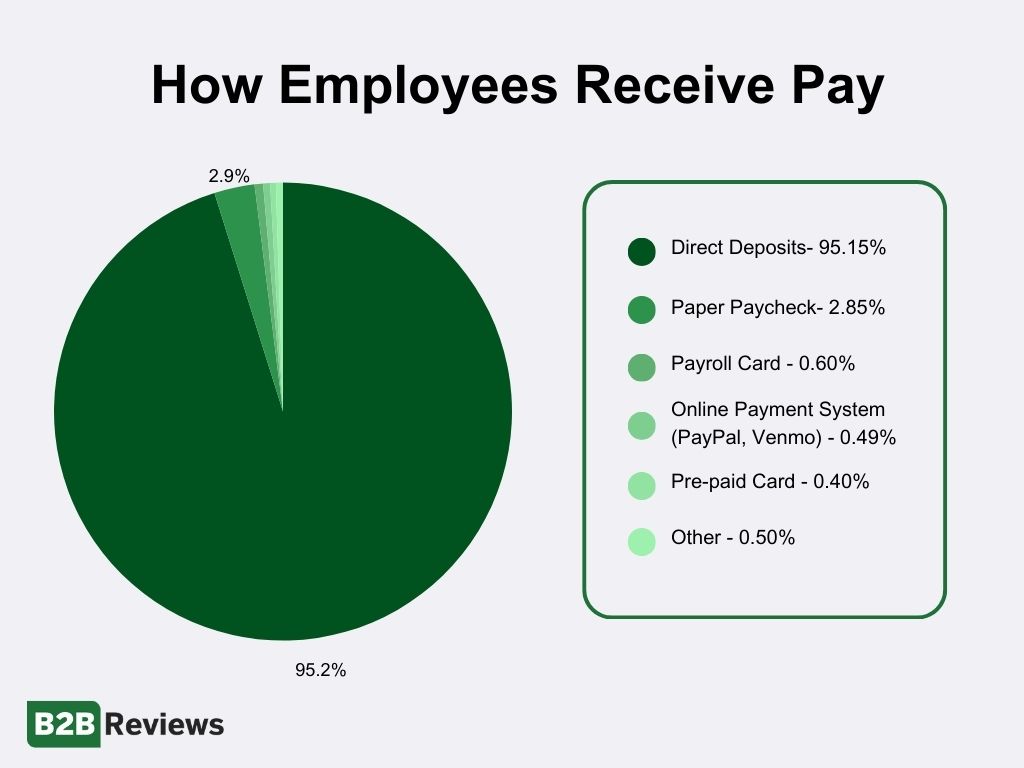

Employees can be paid in different ways, but the most common method today is direct deposit.

- 95.15% of employees receive pay via direct deposit.

- However, pay cards are also a viable option for the 10% of U.S. employees who are “unbanked” or “underbanked.”

Another aspect employers need to consider is how open they are about pay and benefits.

- 25% (one in four) of U.S. workers live in a pay transparency state.

- 87.31% of employees have access to an employee self-service portal, which allows them to access employee benefit and pay information.

Job seekers are more willing to skip the ambiguity and move on to another job opportunity than ever before. So, to improve hiring and retention, employers need to be open about payroll and salary ranges.

Interestingly, an employee’s work schedule plays a role in this discussion. While not strictly pay-related, payroll providers allow employers to pay their employees properly, no matter where they work. In recent years, remote work has become increasingly popular amongst job seekers.

- In fact, Upwork found that 65% of workers want to work remotely all the time.

Being open about payroll and scheduling is a great way to attract top talent and help them determine if your company is a good fit in their career development journey. Luckily, the U.S. Bureau of Labor Statistics (BLS) predicts that total employment will steadily increase in the coming years.

- From 2022 to 2032, total employment is expected to increase by 2.8% (or 164.5 million people to 169.1 million people in the workforce).

- Similarly, wage and salary employment is expected to increase by 3% over the coming decade.

- Self-employed workers are expected to grow by 0.6% over the projected decade.

With this increased employment, increased salaries and taxes will follow. However, not all industries will see an increase. Those expected to grow need to be aware of the change to budget and create job openings properly. The following data points are based on metrics for the years 2022 to 2032.

- The healthcare and social assistance sector is expected to account for 45% of all new jobs.

- The professional, scientific, and technical services sector is projected to account for 21% of all new jobs.

Below is a list of the top five occupations and the expected growth (in thousands):

- Home health and personal care aides – 804.6

- Software developers – 410.4

- Cooks, restaurant – 277.6

- Stockers and order fillers – 178.6

- Registered nurses – 177.4

Some industries are expected to decrease over the projected decade, however. With the increasing popularity and convenience of e-commerce, retail trade employment is expected to lose the most jobs.

Future of Payroll Software Providers

Payroll and Bookkeeping services have steadily grown in the U.S. from 2017 to 2022, an average of 1.7% per year. Currently, there are around 5,700 payroll service industry establishments in the United States, single and multi-location companies.

These establishments generate an annual revenue of about $22 billion. However, when you consider companies that offer payroll and bookkeeping services, the number of establishments increases to 311,903.

- Globally, payroll providers are expected to grow 5.8% from 2022 to 2027. More than half of the industry growth is expected to come from North America.

- Payroll outsourcing is expected to grow by 6% in the next four years.

- This growth through 2027 is expected to create a $7 billion market.

However, according to the U.S. Chamber of Commerce, one study predicts that the HR payroll software market will grow at a compound annual growth rate of 9.2% between 2022 and 2030. Similarly, the cloud-based payroll software market is expected to grow 10% from 2023 to 2033, reaching $15.73 billion by 2033.

This growth is no surprise. One study also found that over half of enterprise IT budgets for key market segments will be dedicated to cloud-based applications by 2025, including the payroll sector.

The Bottom Line

As long as people work for money, payroll will be intricately tied with business. Keeping an eye on trends and market data will enable you to increase the well-being of your company, manage hikes in expenses, and reduce the effects of labor shortages.

Though the future is filled with uncertainty, following trends and predictions will help business owners clear a path forward. Many companies are budgeting for an average of 4% salary increases in 2024. This increase is less than last year but is still more than in prior years. Luckily, the majority of taxes are expected to remain the same, and those that are shifting will affect a small percentage of workers.

Plus, with nearly 5,700 payroll providers available in the U.S. alone (with a projected growth rate of 5.8%), employers have plenty of options for assistance. If you want to take the initiative and stay on top of the trends, you can look at some of the most reputable payroll providers to help you manage payroll and bookkeeping.

Fair Use Statement

If you find this article helpful, feel free to share it for noncommercial purposes only. When doing so, we ask that you link back to this page so readers can see our full research and findings.

- ADP. “What are Employer Payroll Taxes?” Accessed November 13, 2023.

- American Payroll Association. “2023 ‘Getting Paid In America’ Survey.” Accessed December 13, 2023.

- Business News Daily. “The Future of Payroll: 4 Trends to Watch.” Accessed November 14, 2023.

- CPA Practice Advisor. “Social Security Tax Wage Base is Going Up 5.2% for 2024.” Accessed November 14, 2023.

- First Research. “Payroll Services Industry Profile.” Accessed November 14, 2023.

- FitSmallBusiness. “12 Payroll Statistics You Need to Know in 2023 (+ FAQs).” Accessed November 14, 2023.

- IBISWorld. “Payroll & Bookkeeping Services in the US – Number of Businesses.” Accessed November 13, 2023.

- Monthly Labor Review. “Industry and occupational employment projections overview and highlights, 2022–32.” Accessed November 13, 2023.

- PayrollOrg. “Compliance — Secure 2.0 Act.” Accessed November 13, 2023.

- PayrollOrg. “Compliance — Paycards.” Accessed November 13, 2023.

- SHRM. “Employers Eyeing More-Modest Pay Increases Next Year.” Accessed November 13, 2023.

- SHRM. “Smaller Rise in Social Security Benefits on Tap for 2024.” Accessed November 13, 2023.

- Upwork. “Upwork Study Finds 22% of American Workforce Will Be Remote by 2025.” Accessed November 15, 2023.

- U.S. Chamber. “7 Payroll Trends to Watch In 2023.” Accessed November 14, 2023.

- WorldAtWork. “Pay Increases Budgeted for 4% in 2024, Survey Finds.” Accessed November 14, 2023.

- ZoomShift. “38 Interesting Payroll Facts and Statistics You Should Know.” Accessed November 14, 2023.