We may earn money when you click on links to our partners. Advertiser Disclosure

Payroll is critical to keep employees engaged, loyal, and paid. However, many businesses view it as just another expense. As such, investment in digital payroll processes has grown slower than customer-facing functions, according to PayrollOrg. However, once the COVID-19 pandemic hit, investment in digital payroll increased.

In an attempt to handle the sudden changes in the workplace, payroll modernization projects began, and more companies began outsourcing some or all of their payroll functions. Below, we examine the most recent data to see what percentage of companies outsource payroll, break down the key drivers for outsourcing, and review the pros and cons of outsourcing.

Key Takeaways

- 61% of companies outsource some or all of their payroll operations.

- 12% of companies worldwide fully outsource payroll.

- 57% of companies say outsourcing payroll enables them to focus on the core business.

- 12% of companies could not meet payroll in 2023 due to a lack of capital.

Percentage of Companies Outsourcing Payroll

Payroll providers have grown in recent years and offer many benefits and cost savings. Usually, these providers help with various HR services like payroll and bookkeeping, making them valuable services for many American businesses.

- 61% of companies outsource some or all of their payroll operations.

In fact, when it comes to outsourcing human resources (HR), payroll is the most common worldwide.

- 12% of companies worldwide fully outsource payroll.

- 26% of companies worldwide co-outsource payroll.

In the United States, 65% of businesses that have outsourced in the past plan to increase their outsourcing. This is becoming easier for businesses with agile cloud payroll technologies improving.

- 62% of businesses use agile cloud payroll technologies.

- In 2019, only 34.8% used these technologies.

As technology continues to improve, more businesses can process payroll efficiently. Additionally, as artificial intelligence (AI) and automation are integrated into business tools, payroll services will soon become more streamlined.

Outsourcing Payroll Pre-Pandemic

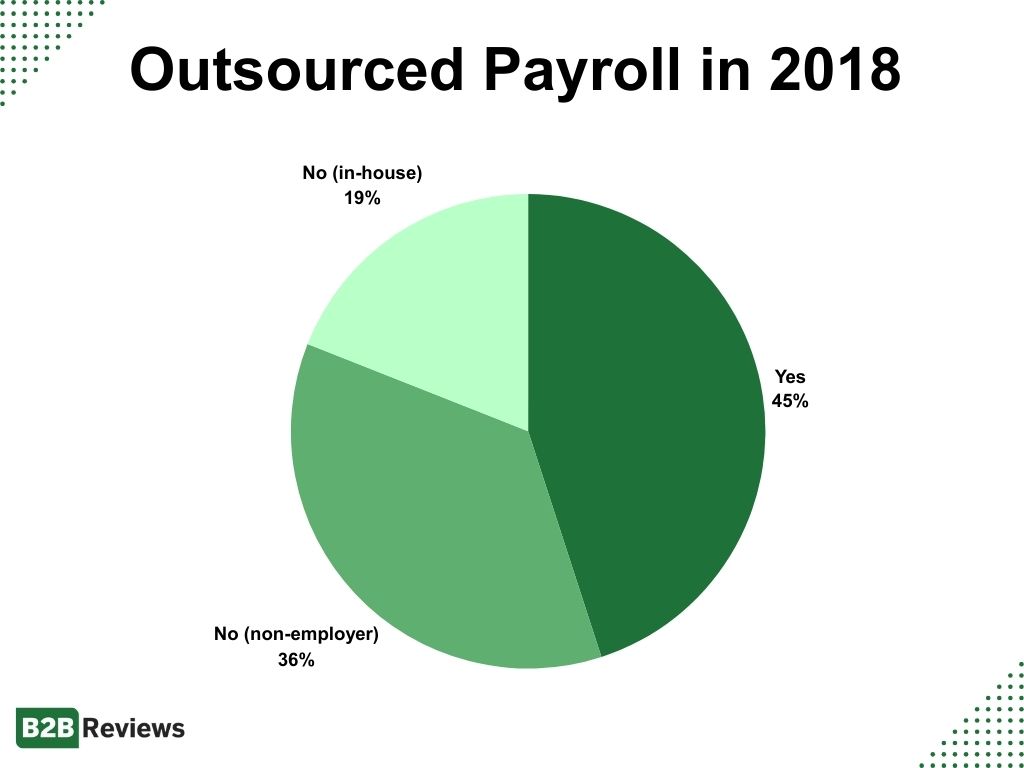

In 2018, the National Small Business Association conducted a survey and asked business owners how their companies processed payroll.

- 45% of companies in 2018 outsourced payroll.

- 36% did not outsource because they had no employees.

- 19% processed payroll in-house.

Of the companies who outsourced payroll, the majority spent between $101 – $500 at the payroll company.

- 42% of those companies spent between $101 – $500

- 35% spent $100 or less

- 22% spent more than $500

As you can see, the percentage of businesses outsourcing payroll processes has increased significantly since 2018. This percentage will likely continue to increase because the global payroll software industry is projected to grow by 5.8% from 2022 to 2027.

Other Payroll Facts

Usually, businesses can choose how frequently they pay their employees. However, some states have laws on frequency, so businesses need to be aware of the local laws. Biweekly is the most common pay period.

- 27.0% of businesses run payroll weekly

- 43.0% run payroll biweekly

- 19.8% use a semi-monthly pay schedule

- 10.3% of businesses run payroll monthly

Whatever pay period businesses choose, they are unfortunately not free from the effects of inflation and a turbulent economy.

- 46% of businesses raised employee wages due to inflation.

- However, employers are planning for a 4% wage increase in 2024, which is less than in previous years.

Increased wages and inflation can limit a business’s access to capital, making it difficult to meet payroll.

- 12% of businesses could not meet payroll in 2023 due to a lack of capital.

Why Businesses Outsource Payroll

A recent study from PayrollOrg asked respondents to identify the key drivers that led them to find an external way to process payroll.

| Key Drivers | Percentage |

|---|---|

| Regulatory Environment | 42% |

| Corporate Strategy Outsourcing | 39% |

| Cost Reduction | 27% |

| M & A Activities | 15% |

Business leaders also say outsourcing payroll helps in other areas of the company.

- 57% find that outsourcing payroll enables them to focus on the core business more.

- 47% think that it helps solve capacity issues.

- 31% say that it improves service quality.

- 28% say it helps them meet business needs.

Additionally, 77% of HR leaders who outsource HR functions say that payroll is more accurate and efficient. They also found that the likelihood of getting a payroll tax penalty was reduced by 4.3% when outsourcing.

Pros and Cons of Outsourcing

Outsourcing payroll services has many benefits. In addition to payroll being more efficient and accurate, it can cut costs significantly, yet those are not the only advantages.

Businesses found that outsourcing payroll:

- Saves time

- Payroll management is time-consuming. By letting payroll experts keep track of all the aspects of payroll, small business owners can focus on the core of their business.

- Gives access to trade and system expertise

- Payroll professionals can ensure that businesses remain compliant with state and federal laws while keeping track of benefit deductions, wage garnishments, paid time off, withholdings, and more. Essentially, these service providers can ensure there are no payroll errors.

- Reduces costs

- Professionals can help businesses avoid fines or penalties associated with payroll mistakes.

- Eliminates security risks

- The off-site nature of outsourcing helps prevent employees from tampering with records.

- Eliminates software concerns

- Businesses don’t need to be concerned with operating or maintaining the software required to run payroll onsite.

- Extends support

- When payroll is run in-house, it often falls onto one person’s shoulders. If they get sick or cannot run payroll for some reason, it can cause problems. But, a payroll company has many trained and knowledgeable people providing support, so issues like that can be avoided.

- Offers direct deposit

- Third-party payroll companies have resources in place that make direct deposits much easier. Small businesses don’t have to spend time and resources on navigating direct deposit concerns.

While payroll outsourcing has many advantages, there are some drawbacks that business leaders need to be aware of.

- Errors and time

- Errors are not common, but they do happen. When payroll companies make a mistake on an employee’s paycheck, it can take longer to correct than if it was run in-house.

- Responsibility

- Businesses are responsible for any tax filing mistakes or other errors the payroll company may make. The IRS won’t care that they made the mistake since it relates to the hiring business. If a payroll provider makes a mistake, it can be costly to resolve.

- Unused benefits

- Sometimes, payroll software providers offer additional services or integrations in their pricing packages. However, if a business does not need or use them, then it may be spending more money than it needs on outsourcing payroll.

- Data protection

- Most external payroll companies have exceptional security systems, but there is always a chance of data breach.

- Missing information

- Payroll companies rely on the business to give them all the necessary information. If information is delayed or lost, it can delay payroll processing, leaving employees without pay.

Some companies work with multiple payroll vendors. PayrollOrg found that when a company works with more payroll vendors, there’s a higher chance for errors to occur.

- 62% of companies with six or more payroll vendors received payroll fines within the past five years.

- But, this only happened to 27% of companies who worked with one to five vendors.

While there are some downsides to outsourcing payroll, there are plenty of benefits businesses can take advantage of. As long as companies keep track of important information and where money is spent, payroll outsourcing can be a huge time and money saver.

The Bottom Line

Payroll outsourcing is more common now than ever before, with 61% of businesses in America outsourcing some or all of their payroll. Payroll is a vital aspect of business but is also very time-consuming. Business owners have hundreds of tasks vying for their attention. Outsourcing payroll is one way to remove the burden from the business without paying for an in-house payroll department.

However, outsourcing does cost money. In the past, 42% of businesses spent somewhere between $101 – $500 on payroll providers. Payroll costs largely depend on the number of employees, full-time or otherwise, and any additional services. Luckily, many providers offer multiple packages. It’s good for business owners to review a few payroll software providers to find the best fit for their business needs.

Fair Use Statement

If you find this article helpful, you can share this article for noncommercial purposes. But please provide a link back to this page so that people can appreciate our full findings.

- Indeed. “Outsourcing Payroll: Pros and Cons for Businesses.” Accessed December 8, 2023.

- National Small Business Association. “2023 Economic Report.” Accessed December 7, 2023.

- National Small Business Association. “NSBA 2018 Small Business Taxation Survey.” Accessed December 8, 2023.

- Outsource Asia. “Everything You Need to Know About Outsourcing Payroll Processing Services.” Accessed December 7, 2023.

- PayrollOrg. “Is Outsourcing Payroll Right for Your Company?” Accessed December 8, 2023.

- PayrollOrg. “Why Payroll Automation Is Critical to 2022 Business Growth Strategy” Accessed December 7, 2023.

- TeamStage. “Outsourcing Statistics 2023: In the US and Globally.” Accessed December 7, 2023.

- U.S. Bureau of Labor Statistics. “Current Employment Statistics – CES (National) Length of pay periods in the Current Employment Statistics survey.” Accessed December 8, 2023.

- ZipDo. “Essential HR Outsourcing Statistics In 2023.” Accessed December 8, 2023.