PEO for Small Businesses Reviews

We sifted through about a dozen of the best PEO companies for small businesses and focused on the ones that offered key HR features like payroll management, applicant tracking, employee onboarding, tax compliance, and time-off tracking. We also looked for transparent pricing, easy access to customer service, and positive online reviews. You can find out more about our selection criteria in the methodology section.

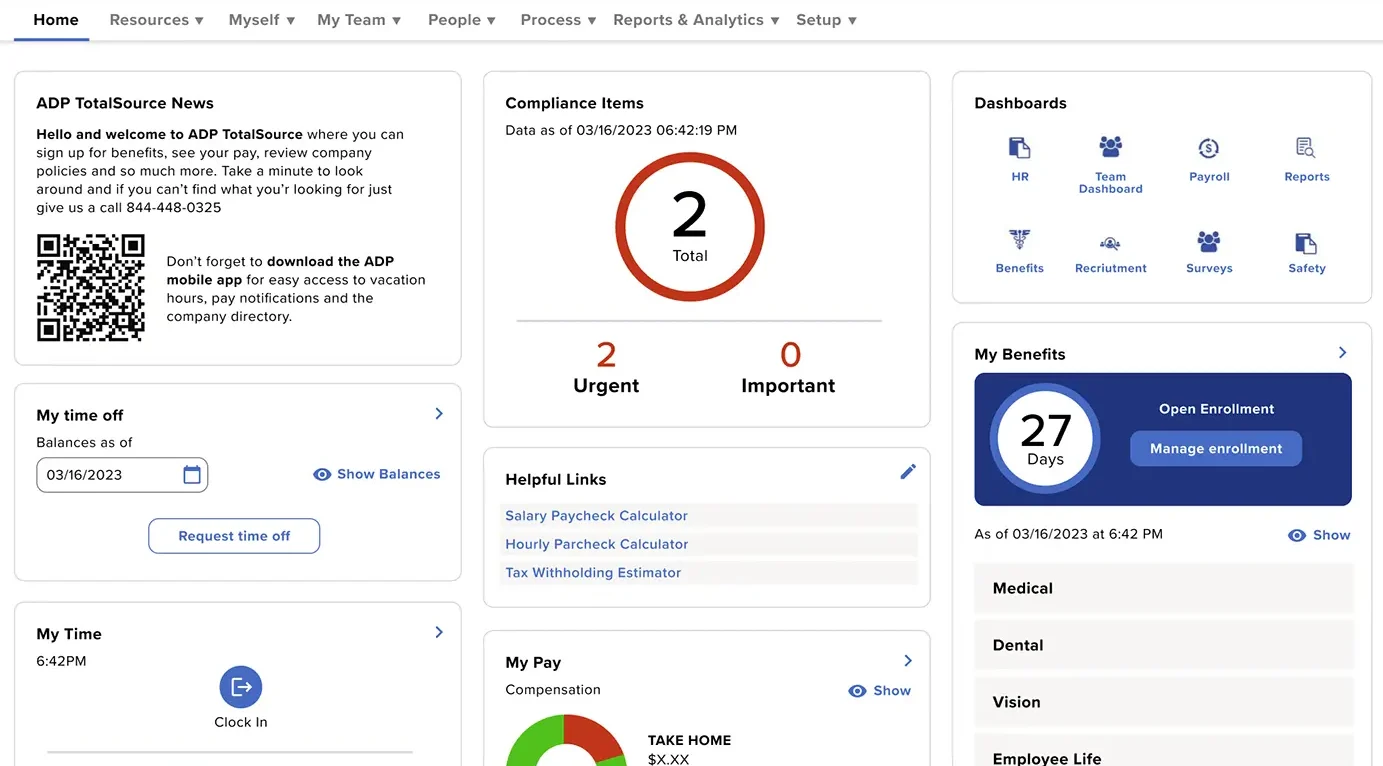

ADP TotalSource – Best for Comprehensive HR Software

ADP TotalSource offers a complete PEO solution best suited for small companies needing effective HR, payroll, benefits, and compliance assistance. It handles significant administrative tasks like payroll processing, risk control, and HR compliance, allowing companies to focus on growth. With ADP TotalSource, small companies are also offered competitive employee benefits and one-on-one service from experienced HR specialists.

- Extensive HR and compliance support

- Access to competitive employee benefits

- Dedicated HR specialists

- Pricing requires a custom quote

- Some features may require add-ons

ADP TotalSource dashboard.

Get Pricing Visit ADP TotalSource’s website

ADP TotalSource features

- Payroll Management – Streamlines payroll processing with automated software that reduces manual effort and ensures accuracy, keeping small businesses compliant and on schedule.

- Applicant Tracking – Includes robust applicant tracking capabilities that allow you to post jobs, screen applicants, set up interviews (including video), and streamline the hiring process.

- Employee Onboarding – Allows you to create formalized onboarding processes, so new employees can complete critical tasks, view necessary documents, and get up to speed quickly.

- Vacation/Leave Tracking – With an integrated time-off and scheduling system, you can easily track employee sick and vacation time off and view team availability, along with valuable reminders like birthdays or work anniversaries.

- Benefits Administration – Offers small businesses access to world-class employee benefits such as health insurance and retirement plans, and handles the complexities of benefits enrollment and compliance.

How ADP TotalSource pricing works

ADP TotalSource doesn’t publicly list its pricing because it differs according to company size, industry, and chosen services. Instead, companies must request a customized quote that best suits their requirements. It usually relies on the number of employees, the complexity of payroll, and the degree of HR support needed.

What markets does ADP TotalSource serve?

ADP TotalSource is ideal for small and mid-sized businesses searching for a full-service PEO for HR management, payroll, and compliance. It’s beneficial for companies that need to streamline operations, stay up to date on changing regulations, and offer competitive employee benefits without taking on the task of doing HR in-house. Its flexible technology also supports expanding businesses with long-term HR needs.

Read our full ADP TotalSource review

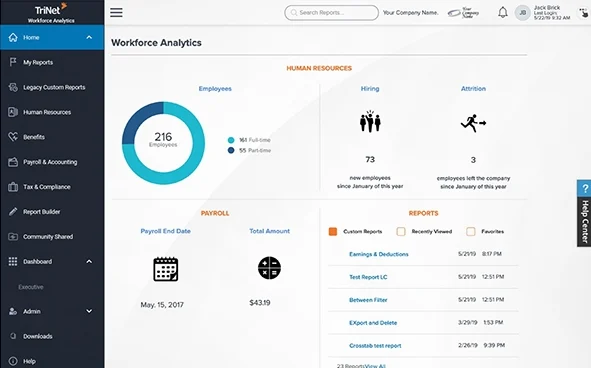

TriNet – Best for Industry-Specific Support

TriNet is a PEO provider that provides tailored HR services for small businesses. It encompasses everything from payroll and tax compliance to staff support, benefits, and risk management. TriNet also offers expert knowledge and services tailored for specialized sectors like healthcare, finance, and technology.

- Tailored support for various industries

- Dedicated HR specialists

- Comprehensive benefits management

- Pricing requires a consultation

- Limited self-service customization

TriNet workforce analytics page.

Book Demo Visit TriNet’s website

TriNet features

- Payroll Management – Handles payroll processing and tax compliance efficiently, ensuring small businesses pay employees accurately and on time while meeting all regulatory requirements.

- Applicant Tracking – Offers applicant tracking capabilities that simplify hiring by helping businesses post jobs, screen candidates, and coordinate interviews within an integrated platform.

- Employee Onboarding – Provides structured onboarding tools that guide new hires through paperwork, policy acknowledgments, and benefits enrollment to help them start smoothly.

- Vacation/Leave Tracking – TriNet’s time-off management system makes tracking employee vacation, sick leave, and other absences easy while ensuring compliance with local and federal leave laws.

- Benefits Administration – Offers access to comprehensive, industry-specific benefits packages, including health insurance and retirement plans, and manages enrollment and compliance for small businesses.

How TriNet pricing works

TriNet doesn’t offer transparent pricing for its PEO services. Instead, pricing is customized based on your business size, industry, and needs. To get a quote, you’ll need to contact TriNet directly for a personalized estimate.

What markets does TriNet serve?

TriNet serves various industries, including healthcare, finance, technology, and retail, making it an ideal PEO for small businesses that need specialized support and compliance expertise across various sectors.

Read our full TriNet review

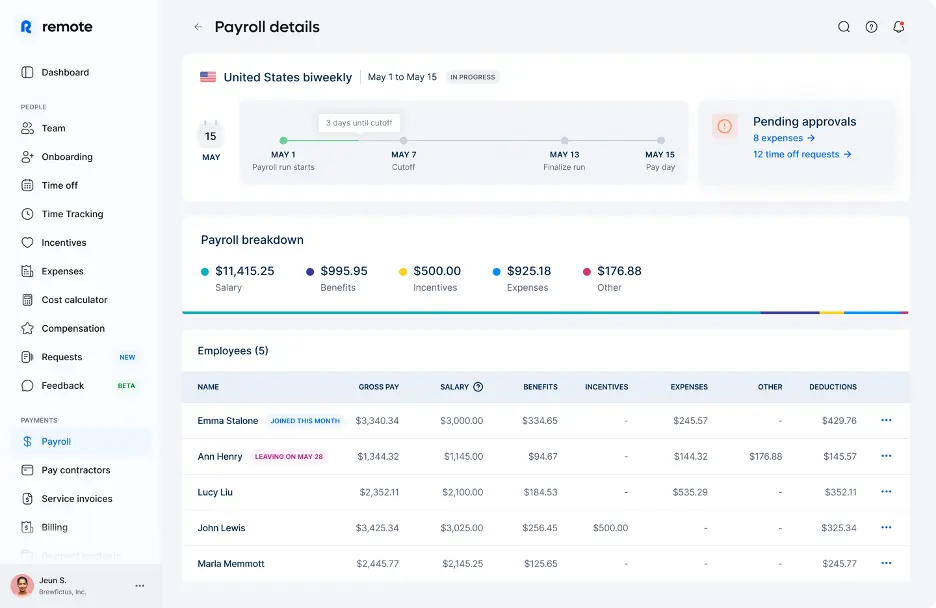

Remote – Best for International EOR Services

Remote is a global HR solution for small businesses and startups looking to hire internationally without establishing legal entities in each country. While it’s not a traditional PEO, Remote acts as an employer of record (EOR), offering many of the same services, such as payroll, benefits administration, taxes, compliance, and stock option support, for international employees. It allows companies to employ talent abroad while simplifying complex cross-border HR processes legally. Although Remote handles key HR functions, it does not engage in the day-to-day management of employees, as it doesn’t operate under a co-employment model like a typical PEO.

- Owns local entities to assist in global HR

- Employees can use self-service platform

- No minimum employee counts or contracts

- Not available in some countries

- Customer support receives mixed reviews

Remote payroll page.

Schedule Demo Visit Remote’s website

Remote features

- Payroll Management – Simplifies global payroll by managing payments in local currencies, ensuring tax compliance, and automating payroll processes for international employees.

- Applicant Tracking – While not a complete applicant tracking system, Remote integrates with popular ATS tools and supports global hiring by helping you navigate local employment laws during the recruitment process.

- Employee Onboarding – Provides a streamlined onboarding experience tailored to each country’s legal and HR requirements, helping international hires complete documentation and start work efficiently.

- Vacation/Leave Tracking – Includes tools to manage time-off policies across multiple countries, making it easy to track vacation, sick leave, and regional holidays while maintaining local compliance.

- Benefits Administration – Gives companies access to competitive, country-specific benefits, including health insurance, pensions, and more, while managing enrollment and ensuring local regulatory compliance.

How Remote pricing works

Remote offers three pricing tiers, with one specifically for payroll:

- Employer of Record: Starting at $699/month/employee

- Payroll: Starting at $29/month/employee

What markets does Remote serve?

Nearly any type of company who has a global presence with remote workers will want to consider Remote. Although it can be more expensive to use EOR services, signing up with Remote is one of the most convenient ways to access a compliant global HR system that grows with your company.

Read our full Remote review

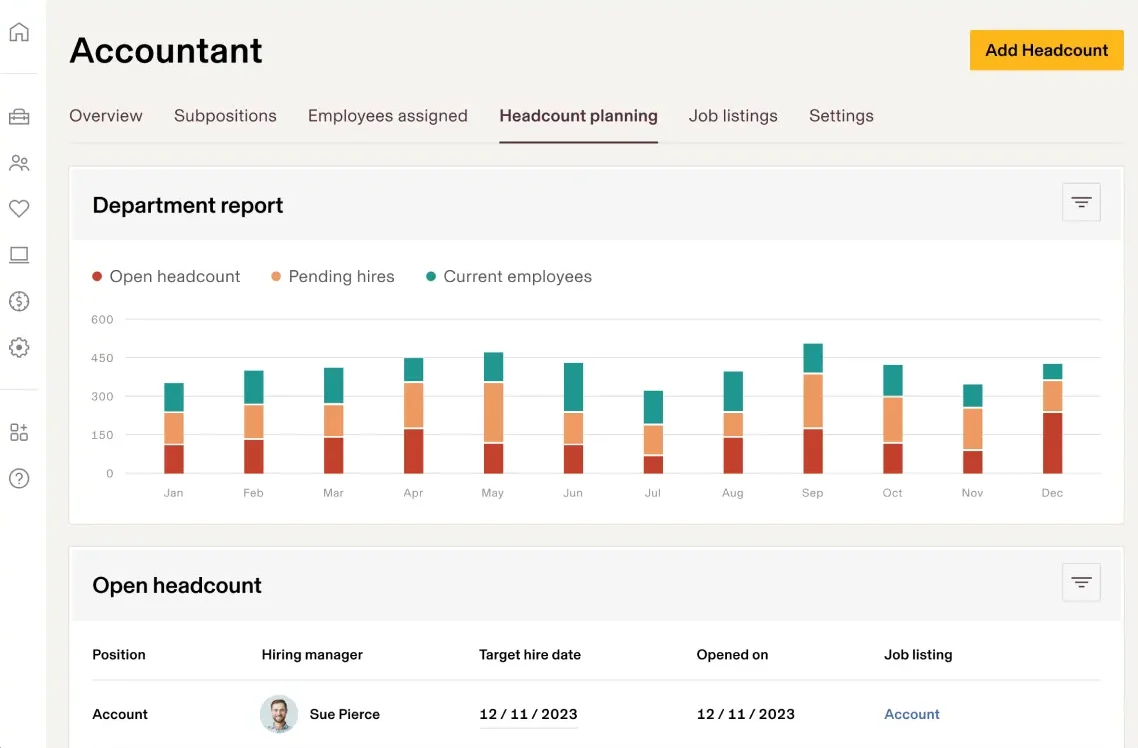

Rippling – Best PEO for Startups

Rippling is an all-in-one HR platform designed to streamline payroll, benefits, compliance, and other key tasks for growing teams. Its core “HR Cloud” can easily expand to include Finance and IT Cloud services, making it a flexible solution for businesses scaling quickly. With its intuitive interface, automation capabilities, and strong customer support, Rippling stands out as a top PEO choice for startups and small businesses aiming to centralize operations and manage rapid growth.

- Automatic employee reports like birthdays

- Streamline onboarding for new hires

- Consolidates disparate HR functions into a unified dashboard

- Can’t add finance or IT could on basic plan

- Less robust applicant tracking features

Rippling accountant page.

Rippling features

- Payroll Management – Automates processing payments to domestic and international employees, ensuring accurate payments, tax withholding, and seamless integration with other HR and finance systems.

- Applicant Tracking – Offers built-in applicant tracking capabilities that help small businesses post openings, screen candidates, manage interviews, and streamline the hiring process—all within one system.

- Employee Onboarding – Offer an effective onboarding process with workflows that can be customized to guide new employees through paperwork, policy acknowledgments, and training, accelerating them to speed.

- Vacation/Leave Tracking – Rippling’s time-off management tools simplify tracking employee vacation, sick time, and holidays with intuitive calendars and automated approval.

- Benefits Administration – Provides access to a wide range of employee benefits and manages eligibility, enrollment, compliance, and HR outsourcing, enabling small businesses to offer competitive packages without added administrative burden.

How Rippling pricing works

Rippling doesn’t offer transparent pricing, but it shows you what plans you can choose from. For PEO Services specifically, you can give employees access to Fortune 500 caliber benefits at scale, automate state and local payroll tax account registration, and access large group health plans.

What markets does Rippling serve?

Rippling isn’t exclusively for startups, but the features neatly line up with a company that’s still got that new-business smell. You can handle all tax compliance requirements and new employee issues like training and PTO.

Read our full Rippling review

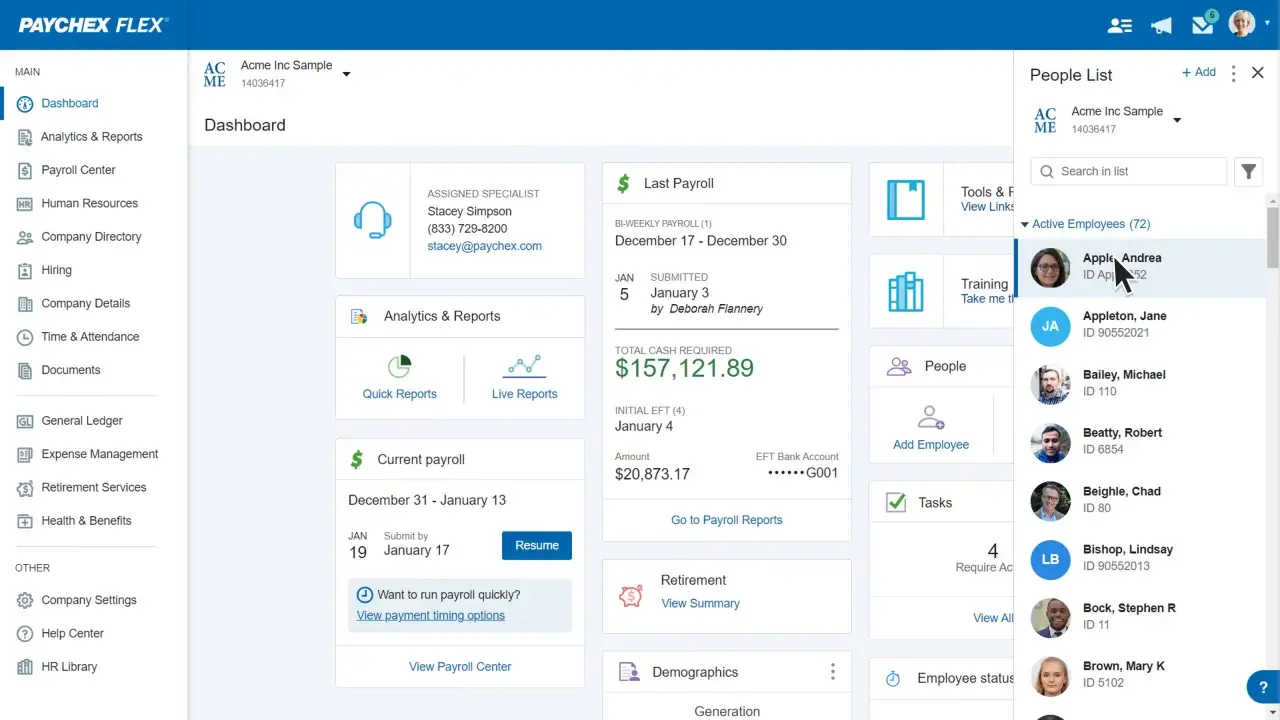

Paychex – Best for Very Small & Growing Businesses

Paychex simplifies HR, payroll, and employee benefits, making it a top choice for self-employed individuals who are adding their first employees. It’s one of the few PEOs that work with fewer than five employees, which is ideal for small businesses and startups. Paychex offers Fortune 500-level benefits like medical, dental, vision, 401(k) plans, and employee discounts.

One Assistant Director of Talent Acquisition said, “I like the convenience of using Paychex. It was very easy to learn how to use it, and it is easy to train new employees on. I also appreciate the customer service. I have a dedicated person I work with at Paychex, and she is always available to answer any questions that I have. Overall, it suits our business needs, is very user-friendly, and provides strong customer support when needed.”

- Options for businesses with 1-19 employees

- Effective tax compliance removes paperwork

- Also offers payment processing services

- Low-transparency pricing

- No free trial

Paychex dashboard.

Paychex features

- Payroll Management – Automates payroll processing with reliable, accurate payment runs and tax filing, which keeps small businesses compliant and reduces administrative work.

- Applicant Tracking – Offers applicant tracking tools that simplify job posting, candidate screening, and interview scheduling, and enable small businesses to manage hiring efficiently.

- Employee Onboarding – Offers customizable onboarding workflows that guide new hires through necessary paperwork, training, and policy reviews to get them off to a smooth start.

- Vacation/Leave Tracking – Paychex time-off management functionality streamlines employee vacation, sick time, and holiday tracking with easy scheduling and approval processes.

- Benefits Administration – Provides access to various employee benefits, including health insurance and retirement plans, while overseeing enrollment, compliance, and employee communications.

How Paychex pricing works

Paychex does not initially provide straightforward price rates for its PEO service, which makes it hard for small businesses to understand the entire cost in advance. Paychex charges various rates based on company size and required services, so prospective companies usually need to contact Paychex for a customized quote.

What markets does Paychex serve?

Paychex offers many small business options, but its 1-19 employee features make the most sense. Everything is simple here for the first-time business owner, so you’ll likely find that if you make Paychex your first PEO solution, it will be a decision that saves you a lot of headaches.

Read our full Paychex review

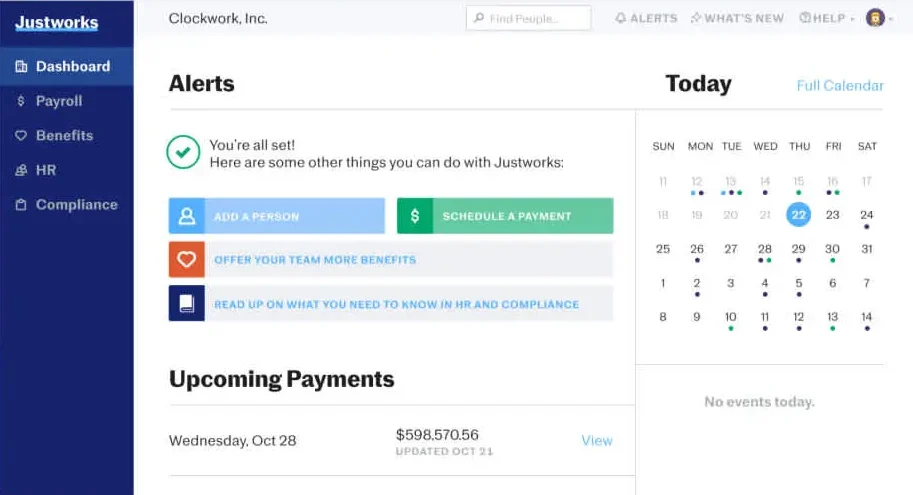

Justworks – Best for Expanding Employee Benefits

Justworks offers simple, straightforward HR and PEO services for small businesses wanting to provide generous benefits like health and dental insurance and retirement plans. It’s especially easy for companies with fewer than 100 employees, thanks to its intuitive tools and seamless integration with employee benefits such as fitness programs and insurance. Justworks is a solid choice for businesses looking to grow while offering competitive benefits.

- Per-employee pricing decreases as you grow

- Syncs with features like health insurance

- Mobile app for employees

- Some user issues with PTO requests

- Fewer HR options for contracted workers

Justworks dashboard.

Justworks features

- Payroll Management – Automates payroll processing and tax filing, paying employees on time and by regulations while keeping small businesses compliant at the federal and state levels.

- Applicant Tracking – Does not possess a full-fledged ATS but connects with popular hiring websites to help small businesses manage applicants and process hiring.

- Employee Onboarding – Provides an easy onboarding process with workflows that allow new hires to fill out required paperwork and easily access benefits.

- Vacation/Leave Tracking – Includes easy-to-use tools to track time-off requests, track vacation and sick leave, and remain compliant with leave laws.

- Benefits Administration – Justworks is known for its seamless benefits integration, offering access to health, dental, retirement plans, and wellness programs through easy enrollment and ongoing administration.

How Justworks pricing works

Justworks offers four plans to choose from:

- Payroll: Starting at $8/month/employee + $50/month base fee

- PEO Basic: Starting at $59/month/employee

- PEO Plus: Starting at $109/month/employee

- EOR: Starting at $599/month/employee

What markets does Justworks serve?

Justworks specializes in agencies, professional services, and tech. And though they serve companies as small as a few employees, they also handle companies with 100 or more. This makes them versatile enough for larger companies but also an ideal fit for companies that are growing and just starting to expand their benefits offerings.

Read our full Justworks review

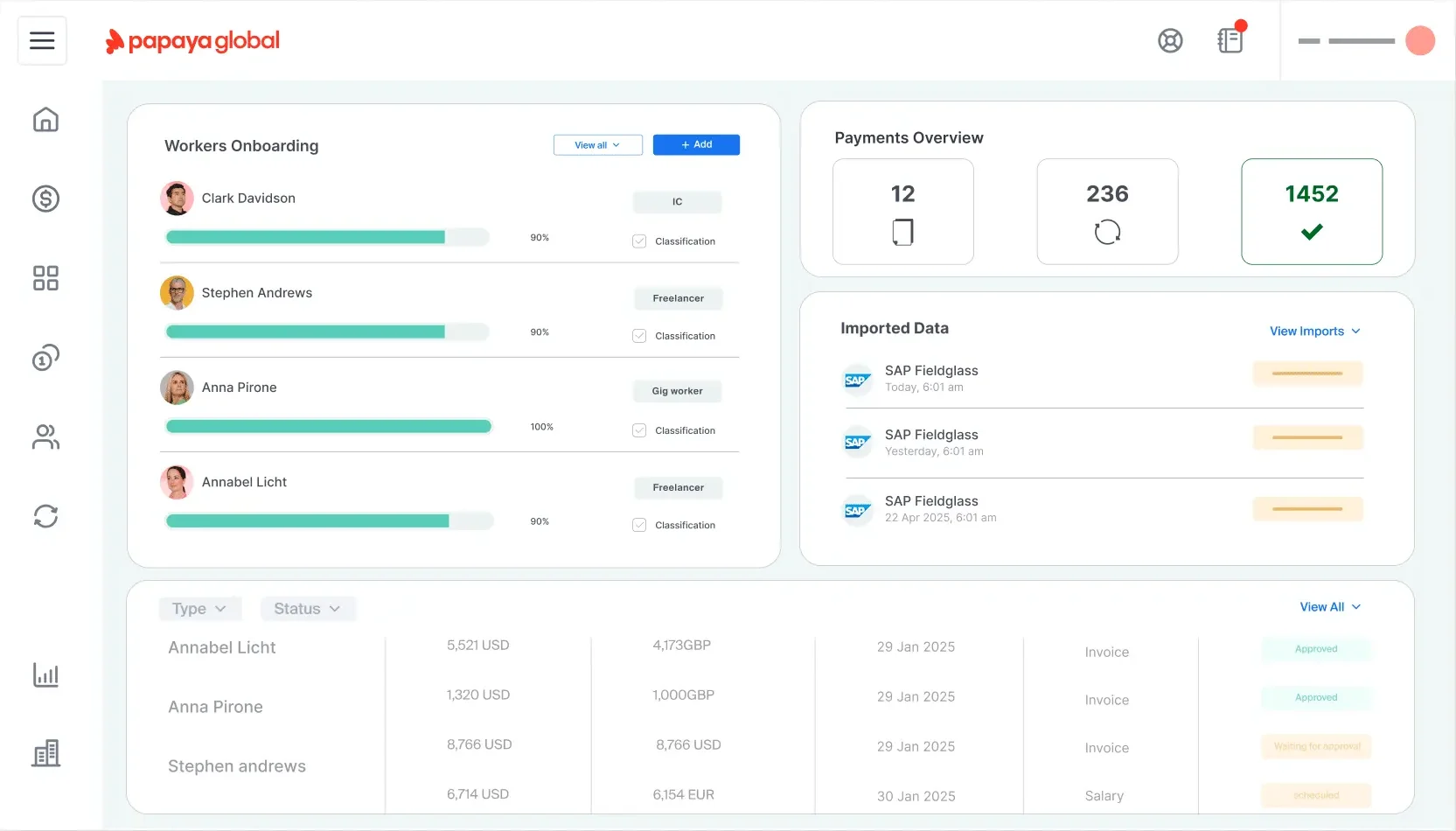

Papaya Global – Best for Global Employees

Papaya Global is cost-effective and great for large global teams who already have HR systems in place but want to get organized. Papaya offers an “operating system” that’s great for CFOs of large companies who need to take control of their workforce spending and see what’s coming out of their payroll. For example, Papaya compares HR benefits with competitors, giving you a bird’s-eye view of whether your HR systems are up to par with your industry.

- Easy interface for enacting payroll changes

- Fast-responding customer support

- Less manual input for multiple currencies

- Lack of self-service features for employees

- No free trial

Papaya Global dashboard.

Papaya Global features

- Payroll Management – Automates global payroll processing, handling multi-currency payments, and ensuring compliance with local tax laws for international employees.

- Applicant Tracking – While Papaya Global doesn’t offer a complete applicant tracking system, it integrates with popular recruitment tools to help manage hiring across multiple countries.

- Employee Onboarding – Streamlines onboarding by managing country-specific compliance and documentation, making it easy for international hires to start quickly.

- Vacation/Leave Tracking – Provides tools to track time off, sick leave, and local holidays, ensuring leave policies are managed in line with regional regulations.

- Benefits Administration – Offers access to competitive, localized employee benefits and handles enrollment and compliance to support a global workforce.

How Papaya Global pricing works

Papaya Global provides six pricing plans tailored to different business needs. For its Employer of Record (EOR) services, pricing begins at $599 per employee per month, which includes payroll management. For payroll-only services, pricing tiers are based on employee count: Grow Global starts at $25 per employee per month for 101–500 employees, Scale Global at $20 for 501–1,000 employees, and Enterprise Global at $15 for companies with over 1,000 employees.

What markets does Papaya Global serve?

As its name suggests, Papaya Global is primarily a service for growing companies who might be crossing that “small business” barrier into greater things. That’s why it’s a great option for small businesses that want more flexibility with scaling across the globe, particularly with full-time global employees.

Read our full Papaya Global review

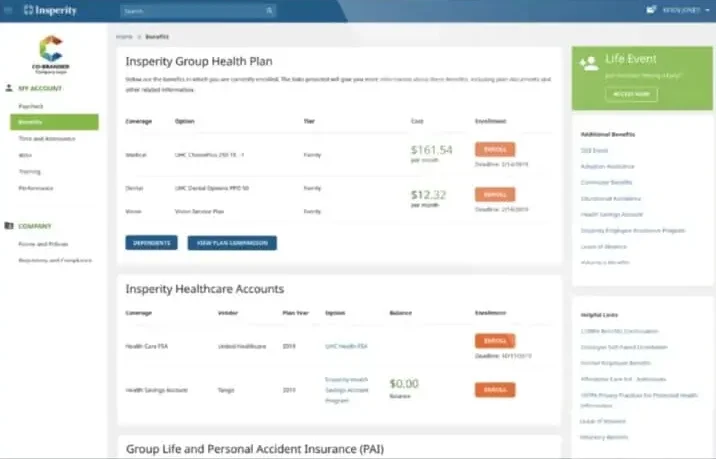

Insperity – Best for Small Business PEO

Insperity is a full-service PEO that delivers comprehensive HR support tailored specifically for small businesses looking to grow while staying compliant with ever-changing regulations. As an extension of your internal HR team, Insperity helps streamline everyday HR processes, from payroll and benefits administration to employee training and risk management. This reduces administrative burdens and enhances overall operational efficiency, allowing business owners to focus more on growth and less on paperwork. Additionally, Insperity offers access to competitive employee benefits that help attract and retain top talent.

- HR features with dedicated HR experts

- Offers top-tier employee benefits

- Scalable solutions for businesses of various sizes

- Strong risk management support

- Pricing can be high for small businesses

- Some features may be overkill for businesses with fewer employees

Insperity employee benefits.

Insperity features

- Payroll Management – Automates payroll processing with timely, accurate payments and tax filing, keeping small businesses compliant and reducing administrative hassle.

- Applicant Tracking – Includes applicant tracking software that simplifies hiring by managing job postings, candidate screening, and interview scheduling in one place.

- Employee Onboarding – Provides onboarding workflows that walk employees through needed paperwork, training, and benefits enrollment to smooth the transition.

- Vacation/Leave Tracking – Insperity’s absence management program simplifies vacation, sick time, and other absenteeism for companies while providing compliance at the local and federal levels.

- Benefits Administration – Offers access to a range of competitive employee benefits, including health coverage and retirement programs, handling enrollment and ongoing compliance on behalf of small businesses.

How Insperity pricing works

Insperity doesn’t provide transparent pricing for its PEO services. Instead, pricing is customized based on your business size and needs, so you must contact them directly for a quote.

What markets does Insperity serve?

Insperity is excellent for small businesses looking to outsource their HR tasks while providing top-tier employee benefits.

Read our full Insperity review

Compare the Best PEO for Small Businesses Side-By-Side

| Software Name | Why we picked it | Starting price for cheapest plan | Highlights |

|---|---|---|---|

| ADP TotalSource | Best for Comprehensive HR Software | Available by quote | Full-service PEO solution for small businesses needing extensive HR, payroll, and compliance assistance |

| TriNet | Best for Industry-Specific Support | Available by quote | Covers everything from payroll and tax compliance to benefits, risk management, and employee support |

| Remote | Best for International EOR Services | $699/month/employee | Handles payroll and benefits for remote workers in 170+ countries |

| Rippling | Best PEO for Startups | Available by quote | Full-service HR solution |

| Paychex | Best for Very Small & Growing Businesses | Available by quote | Simplifies payroll and paperwork |

| Justworks | Best for Companies Expanding Benefits | $8/month/employee + $50/month base fee | Ability to grow via employee benefits |

| Papaya Global | Best for Global Employees | $25/month/employee | Offers expertise in global payroll compliance |

| Insperity | Best for Small Businesses | Available by quote | Acts as an extension of your HR department |

What is a PEO service?

A professional employer organization (PEO) is a co-employer of a person and becomes liable for tax implications, HR, payroll, and benefits. In contrast, the original company/employer is liable for the day-to-day responsibility of the employee. Such firms typically offer full-service HR solutions for small firms that do not have the budget to create a full-scale HR department. A PEO will act as an HR department on your behalf, but is not technically employed by your firm.

What Size Company is Best for a PEO?

PEOs are best suited for small- to medium-sized businesses, typically ranging from 10 to 200 employees, who want to outsource HR, payroll, and compliance tasks. These companies often benefit most because they gain access to expert HR support, employee benefits, and risk management services that might be difficult or costly to handle in-house. However, PEOs can also serve larger companies looking to streamline their HR operations or expand into new regions.

How Can a PEO Benefit My Small Business?

A PEO can help your small business by taking over essential but time-consuming HR tasks such as payroll processing, benefits administration, compliance management, and risk mitigation. By outsourcing these responsibilities, you can focus more intensely on growing and managing your core business operations without getting bogged down in administrative details. Additionally, PEOs provide access to competitive employee benefits and expert HR support, which can improve employee satisfaction and retention. They also help reduce legal liability by ensuring your business stays compliant with constantly changing labor laws and regulations, maximizing efficiency, and minimizing costly risks.

What are the Three Types of PEO?

The three main types of PEO arrangements are full-service PEOs, ASOs (Administrative Services Organizations), and EORs (Employers of Record). A full-service PEO enters a co-employment relationship, handling payroll, benefits plans, compliance, and HR functions while sharing specific legal responsibilities with your business. ASOs provide many of the same administrative services but without co-employment, meaning your business retains all legal employer responsibilities. EORs are typically used for international hiring—they become the legal employer on paper in a foreign country, allowing companies to hire globally without setting up local entities. Each model serves different business needs depending on size, structure, and hiring goals.

How Much Does a PEO for a Small Business Cost?

The price of a PEO for a small business differs greatly based on the provider, what’s covered, and how large your staff is. Most PEOs assess either a per-employee flat fee, usually $100 to $200 monthly, or a percentage of your overall payroll, generally 2% to 12%. Additional factors like the intricacy of your HR needs, industry, and level of customization can also affect pricing. Since most PEOs don’t publish their rates, it’s appropriate to request a customized quote to get a more accurate estimate for your specific business.

| Vendor | Monthly Fee | Free Trial |

|---|---|---|

| Remote | $699 | 7 days |

| Justworks | $8 + $50 base fee | No |

| Papaya Global | $25 | No |

PEO for Small Businesses FAQ

Is PEO good for small businesses?

Yes, but with some caveats. You may not need a full PEO in certain cases, such as if you’re hiring an employee who lives in the same location as your business entity and you don’t plan on offering benefits or 401(k) plans. If you run a global team in a complicated industry, you may find that a PEO is ultimately the best way to simplifiy your HR solutions.

How do I choose the right PEO for my small business?

To choose the right PEO for your SMBs, assess your specific needs, such as payroll, benefits, compliance, or hiring support. Look for a PEO with experience in your industry and a solid reputation for customer service and compliance expertise. Compare the services offered, contract terms, and whether they provide scalable solutions as your business grows. Transparent pricing and user-friendly technology are also key factors. Finally, ask for client references and ensure the PEO is certified by organizations like the IRS or ESAC for added credibility and financial reliability.

What are the best full-service PEO firms for startups?

The best full-service PEO vendors for startups include Rippling, Justworks, TriNet, and ADP TotalSource. These vendors offer a full suite of HR services like payroll, benefits administration, compliance support, and onboarding that startups need to scale quickly without developing an in-house human resources team. They will help small business owners get the support they need. Rippling stands out because it is technology-focused and scalable, and Justworks is renowned for ease of use and simplicity. TriNet and ADP TotalSource offer full benefits and compliance support, making them a good fit for startups facing growth and regulatory challenges. It entirely depends on your firm’s growth potential, size, and budget.

What are the negatives of PEO?

While PEOs have many benefits, there are some possible downsides to consider. One of the potential problems is the loss of control of certain HR functions, like the PEO becoming a co-employer and, theoretically, having benefits providers or policies determined by it. The fees can quickly add up, especially for small businesses, and pricing is often unclear. Some companies become trapped in lengthy contracts or struggle with switching providers. Additionally, not all PEOs are created equal—using one that doesn’t fit your type of business or corporate culture can lead to inefficiencies or gaps in service.

How We Chose the Best PEO Companies for Small Businesses

Comparing PEO options for your small business can get tricky, especially since not all vendors offer the same PEO services. For example, Remote’s “employer of record” offerings stand out, so their pricing is unique on our list. In other cases, options like Papaya Global can offer plenty of HR features, but you will have to get a special quote for its PEO services, which aren’t necessarily included.

With that in mind, we took as many PEO-capable and all-in-one HR solutions as possible. We whittled it down to a list of about a dozen options. We then explored what we had available to us using a variety of methods:

- Online research, including software review websites, and the direct websites and information listed by each company

- Phone call research, particularly when it came to capturing pricing information or feeling out the customer support teams

- Head-to-head comparisons of similar features across different platforms

From there, we were able to gather enough information about each service to place it in its proper context. And that’s where more direct comparisons came in. Using a score of 1 to 5 (poor to excellent) across the following criteria, we built a system where each factor included 25% of the overall score:

- Feature variety: We looked for companies that offer extensive HR services, like onboarding and applicant tracking, with platforms that are easy for employees to use. Greater feature variety means higher scores in this area.

- Pricing and transparency: We found prices listed all over, but transparency was key. We also weighed the fact that some services (like employer of record services for international teams) are naturally going to be more expensive. For example, Remote’s pricing for EOR services was not necessarily a detriment in its overall score.

- Onboarding and support: These can be tricky for business owners new to HR and PEO software, so we took into account how easy it is to start with the platform and user reviews that mentioned onboarding specifically.

- Brand reputation: A brand’s reputation within the marketplace speaks to its performance with thousands of customers. We considered that, noting that our impression of a platform wasn’t the only one that mattered.