Payroll Services for Small Business Reviews

We started with 23 popular payroll services for small businesses. We carefully narrowed the list to our top six based on features, pricing transparency, customer support, and overall reputation. Each company we review is a trusted name in the industry and focuses on meeting the unique needs of small businesses across various industries. See our methodology section below for a closer look at how we evaluated and selected these services.

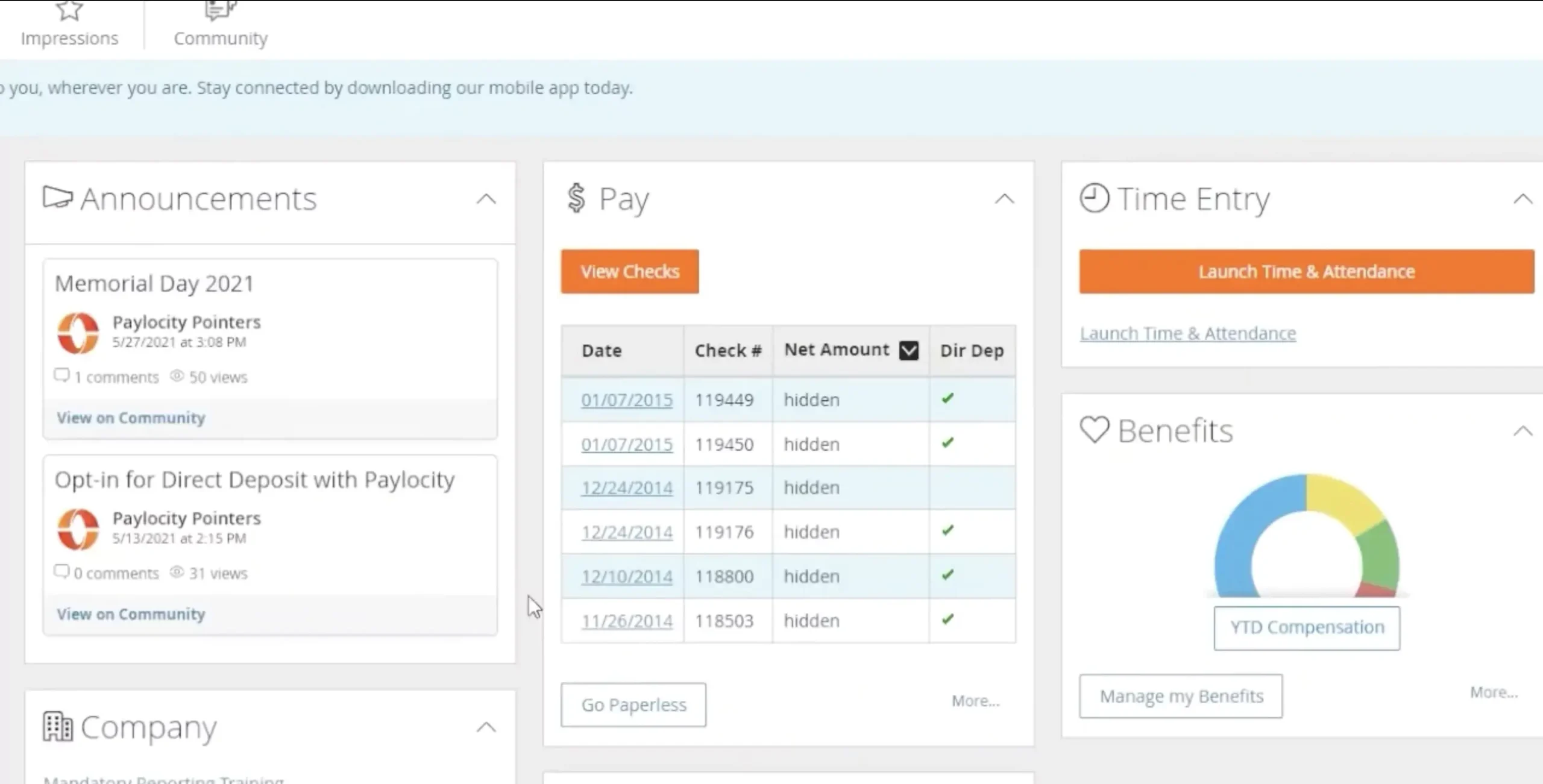

Paylocity – Best for Scalable Payroll Solutions

Paylocity provides an innovative, cloud-based payroll software for small organizations seeking flexibility, automation, and scalability. It offers automated payroll processing runs, direct deposit, automatic tax filing, and a simple-to-use employee self-service portal to streamline the payroll management process in conformity with federal and state regulations. Paylocity includes native, built-in time tracking and extensive HR tools, along with retirement plans, offering a highly integrated platform for serving expanding companies from hire to retire.

- Automated tax filing with built-in compliance monitoring

- Employee self-service portal for accessing pay stubs, tax forms, and benefits

- Seamless integration with native time tracking and HR tools

- Scalable platform ideal for growing businesses

- No upfront pricing; requires a custom quote

- Some features may have a learning curve for new users

Paylocity dashboard.

Request a Demo Visit Paylocity’s website

Paylocity features

- Automated payroll processing – Paylocity automates payroll calculations, direct deposits, and paystub distribution, helping small businesses run payroll efficiently while reducing manual errors and administrative workload.

- Tax filing & compliance – Paylocity handles all federal, state, and local tax filings—including withholdings, payments, and year-end forms—helping your business comply with evolving tax regulations.

- Employee self-service portal – Employees can access pay stubs, tax documents, benefits information, like health benefits, and more through Paylocity’s secure, user-friendly portal, giving them control and transparency over their payroll data.

- Multi-state payroll – Paylocity supports multi-state payroll management, streamlining tax compliance and wage calculations for businesses with employees in multiple locations.

- Custom reporting – With Paylocity’s advanced reporting tools, users can build and schedule customized payroll reports to monitor labor costs, tax liabilities, and workforce trends, helping drive more intelligent business decisions.

How Paylocity pricing works

Paylocity does not provide transparent pricing on its website. Instead, businesses must request a custom quote based on size, payroll needs, and additional payroll features.

What markets does Paylocity serve?

Paylocity is a solid payroll solution for small businesses seeking an integrated product with payroll and HR features. With automated tax filing, compliance tools, built-in time tracking, and benefits administration, it’s ideal for growing businesses that need to simplify operations and develop efficiently.

Read our full Paylocity review

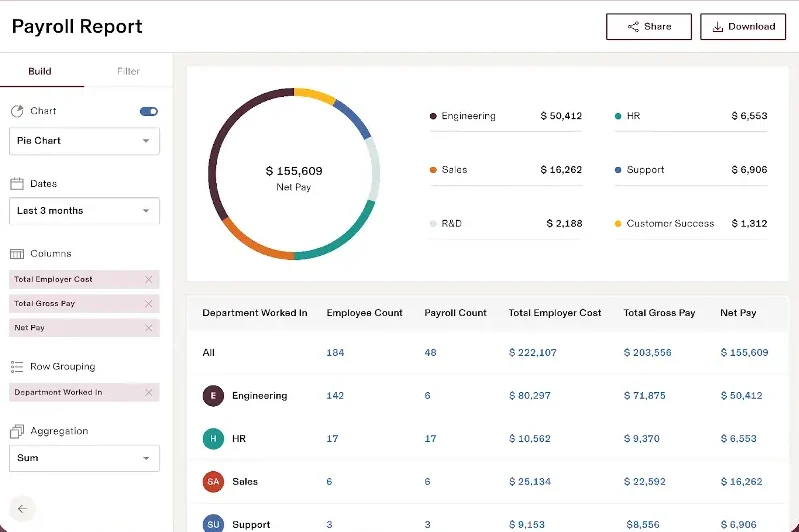

Rippling – Best for Integrated Payroll

Rippling provides a modern, full-service payroll and HR platform designed for small businesses seeking a unified solution to manage employee payments, benefits, and HR tasks. The platform supports multi-state payroll, automates federal, state, and local tax filings, and includes an intuitive employee self-service portal for pay stubs, W-2s, and benefits. Rippling integrates with benefits, PTO tracking, time management, and other HR functions, offering a scalable solution that grows with small teams.

- Unified platform for payroll, HR, and IT

- Employee self-service for pay stubs, W-2s, and benefits

- Scalable for growing businesses with multiple employees or locations

- Custom pricing requires contacting sales; public pricing is not available

- Some advanced features require setup or configuration for optimal use

Rippling payroll report page.

Get Started Visit Rippling’s websiteRippling features

- Automated payroll processing – Handles wage calculations, direct deposits, and check distribution, for fast, accurate, and minimal-error payroll processing.

- Tax filing & compliance – Automates federal, state, and local filing, keeping your compliant with current regulations.

- Employee self-service portal – Employees can access pay stubs, W-2s, benefits, and personal information directly, reducing HR workload and improving transparency.

- Multi-state payroll – Automatically applies the correct taxes and compliance rules for employees in different states, enabling seamless payments.

- Custom reporting – Generate reports on payroll costs, taxation, headcount changes, and other key metrics, all from a centralized dashboard to inform better business decisions.

How Rippling pricing works

Rippling pricing is customized per organization based on the modules selected and team size. Companies must request a quote, and plans can scale as they grow.

What markets does Rippling serve?

Rippling is best suited for small businesses and growing teams that need a unified platform for payroll, HR, and IT. Its automation and integrations simplify operations, from running payroll to managing employee benefits, PTO, apps, and even devices, without requiring multiple separate tools.

Read our full Rippling review

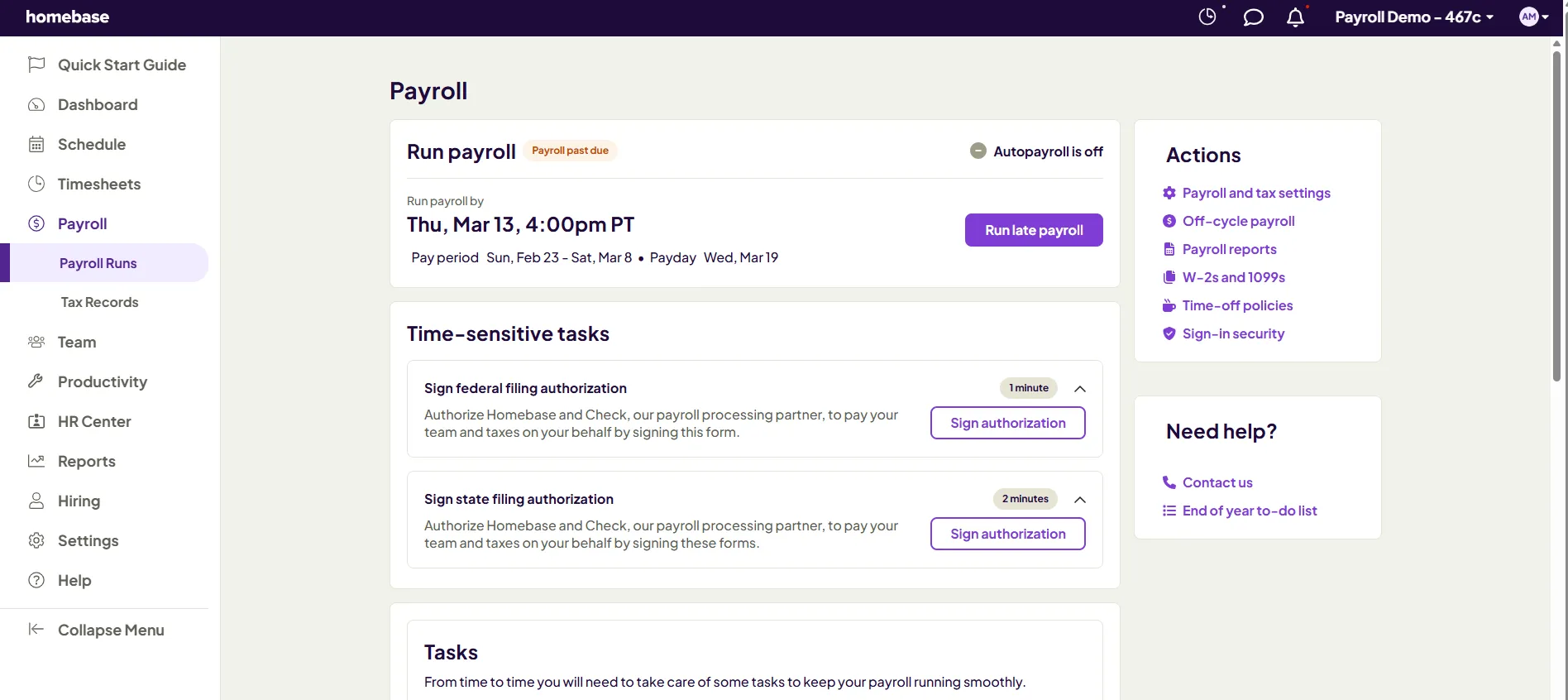

Homebase – Best for Hourly Teams

Homebase offers full-service payroll built for small businesses and hourly teams. It combines payroll, time tracking, and scheduling into a single platform. Through automatic time-to-payroll syncing, your approved timesheets flow directly into payroll, reducing errors, eliminating double entries, and saving money. Additionally, Homebase reduces administrative work by integrating scheduling, time clocks, payroll, and basic HR tools into one, easy-to-use system.

Homebase automatically calculates wages, tips, breaks, overtime, and more to correctly run payroll. The tool helps you stay compliant and up to date with PTO policies, tax requirements, labor laws, and FLSA regulations. Other features include direct deposit & printable checks, wage garnishments, W-2s and 1099s, tip management, next-day payroll, integrated scheduling & timesheets, and more.

Homebase offers guided onboarding, ensuring setup is fast and easy, often taking less than 30 minutes. Support doesn’t end there, however, as Homebase provides ongoing customer support, keeping your small business running smoothly. Overall, the tool streamlines payroll for your hourly employees, keeping it automated, accurate, and all in sync.

- Mobile payroll app

- Unlimited payroll runs

- Allows scheduling past 10 days

- Comprehensive free plan available

- Limited customizations

- Payroll is an add-on

Homebase payroll runs overview.

Get Started Visit Homebase’s websiteHomebase features

- Automated payroll processing – Automatically syncs and handles regular pay, overtime, multiple pay rates, easily calculating final wage, overtime, and tips.

- Tax filing & compliance – Homebase keeps you compliant by calculating, withholding, and filing federal and state payroll taxes automatically, all without added complexity.

- Employee self-service portal – Allows employees to access pay stubs, manage direct deposits, view schedules, and request time off from the same app they already use.

- Multi-state payroll – Homebase offers payroll services to U.S.-based customers in all 50 states and Washington, D.C.

- Custom reporting – Offers reports to help you review, reconcile, and manage payroll, providing visibility into wages, taxes, employee details, and payment activity for your team.

How Homebase pricing works

Homebase has four pricing plans: Basic, Essentials, Plus, and All-in-One. Payroll can be added to any plan easily, no credit card required.

- Basic—$0/location/month for 1 location, up to 10 employees

- Essentials—$30/location/month, unlimited employees

- Plus—$70/location/month, unlimited employees

- All-in-One—$120/location/month, unlimited employees

The payroll add-on costs only $39/month + $6/month per active employee. Additionally, no matter which plan you choose, you get a 14-day free trial of the All-in-One plan. Homebase ensures you can change plans or cancel at any time.

What markets does Homebase serve?

Homebase payroll is ideal for small businesses with hourly employees, like in restaurants, retail, and service-based businesses. However, the tool is highly functional and benefits businesses across industries, including beauty & wellness, medical & veterinary, home & repair, hospitality & leisure, education & caregiving, and more.

Read our full Homebase review

ADP – Best for Payroll with Compliance Support

ADP offers total payroll solutions tailored to small businesses, including employee self-service portals, full compliance support, automatic tax reporting, and direct deposit convenience. Their flexibility allows companies to select the degree of service most responsive to their unique needs, from basic payroll to full-service human resource management. ADP is also straightforward to integrate with many HR, accounting, and time-tracking systems so that your payroll can flow smoothly as your business evolves and grows.

- Scalable payroll and HR solutions that grow with your business

- Employee self-service portal with full mobile access

- Automated tax filing, compliance monitoring, and year-end reporting

- Integrates seamlessly with a wide range of business software

- Pricing details are not disclosed upfront

- Customer support can be inconsistent and sometimes slow to respond

ADP payroll dashboard.

Start Free Trial Visit ADP’s websiteADP features

- Automated payroll processing – Handles your payroll calculations, paycheck generation, and direct deposits automatically, reducing manual work and minimizing errors so your employees get paid accurately and on time every pay period.

- Tax filing & compliance – Takes care of all federal, state, and local tax filings, including withholding, depositing, and reporting, helping ensure your business stays compliant with ever-changing tax laws and deadlines.

- Employee self-service portal – Employees can securely access their pay stubs, tax forms, and benefits information anytime via a user-friendly online portal or mobile app, empowering them to manage their payroll-related details.

- Multi-state payroll – Supports businesses with employees working across multiple states, managing different tax regulations and wage laws, and reporting requirements seamlessly in one system.

- Custom reporting – Generate detailed, customizable reports on payroll, taxes, labor costs, and more, providing valuable insights to help you make informed business decisions and track payroll performance.

How ADP pricing works

ADP does not list pricing transparently on its website. Instead, businesses must contact ADP directly for a custom quote tailored to their company size, industry, and specific payroll requirements. However, ADP does outline its main service tiers, which include: Essential (basic payroll), Enhanced (advanced payroll), Complete (payroll plus HR services), and HR Pro (comprehensive payroll and HR management).

What markets does ADP serve?

ADP addresses a broad market but is best for small to mid-sized companies seeking scalable payroll solutions. Its solutions suit businesses requiring automated payroll processing, comprehensive compliance assistance, and bundled HR and tax services. From startups to expanding companies in many different industries, ADP offers flexible solutions that can grow with you.

Read our full ADP review

G-P – Best Global Payroll Service for Small Businesses Expanding Internationally

G-P (Globalization Partners) is an excellent choice for small businesses looking to manage payroll for remote or international employees without the complexity of setting up entities abroad, and it’s payroll services are offered as part of its Employer of Record (EOR) solution. Its global payroll service automates payments, taxes, and compliance across 180+ countries, ensuring every worker is paid accurately and on time. Small businesses benefit from G-P’s built-in legal and HR infrastructure, which handles international tax regulations, benefits administration, and employment laws. While G-P’s pricing is custom and can be higher than basic domestic payroll providers, the tradeoff is full compliance and a stress-free global payroll experience. Users highlight its responsive support and ease of onboarding as standout advantages.

- Simplifies global payroll for small businesses expanding abroad

- Built-in tax and compliance automation in 180+ countries

- Fast and reliable customer support

- Streamlined onboarding and localized benefits options

- Pricing may be higher for very small teams

- Platform setup may take time for first-time global employers

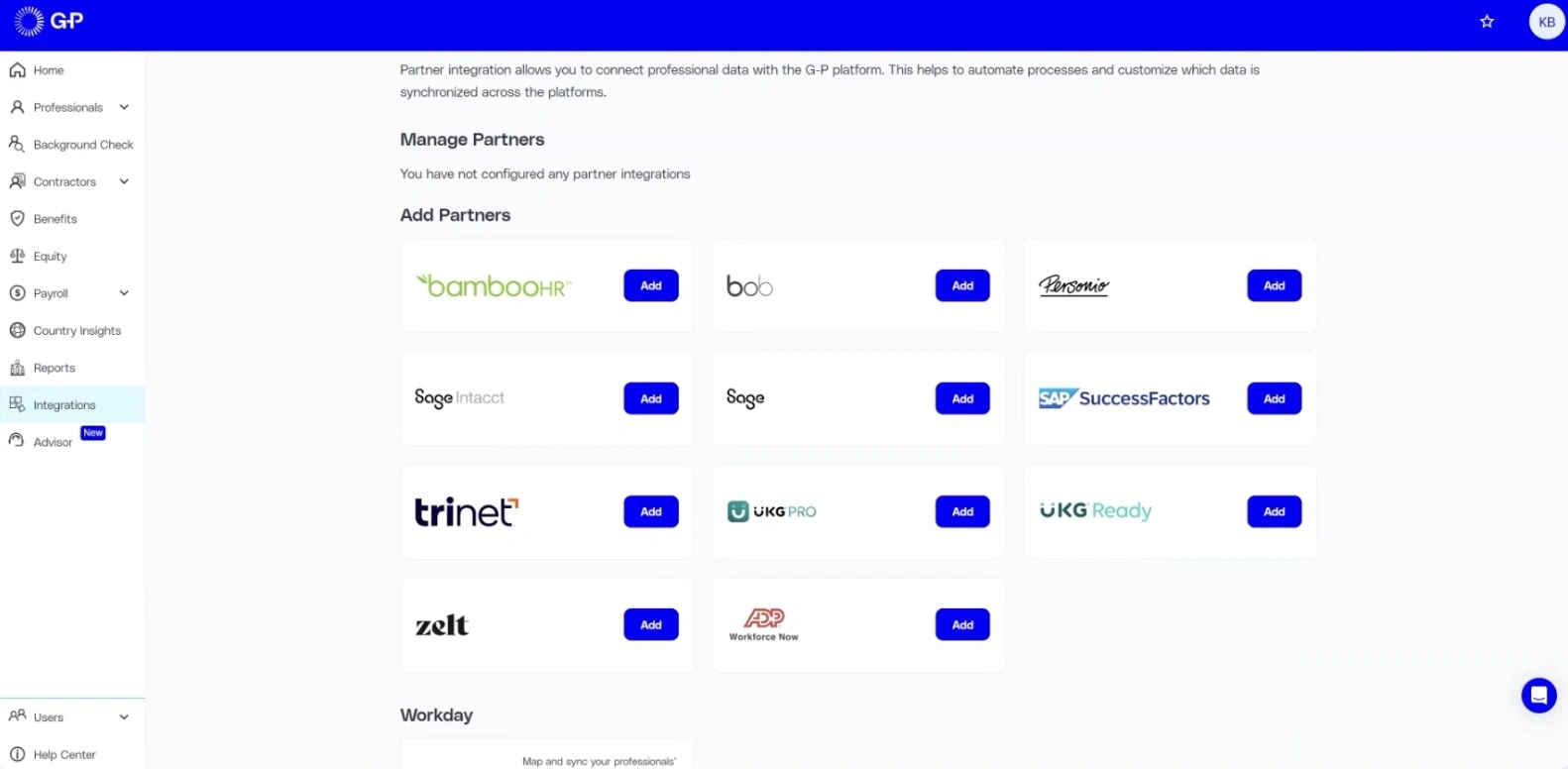

G-P integrations. Source: globalization-partners.com

Book a demo Visit G-P’s website

G-P features

- Automated payroll processing – G-P helps small businesses save time and cut down on payroll errors by automating payroll calculations, direct deposits, and payment disbursements in more than 180 countries.

- Tax filing & compliance – Keeps your company in compliance with local laws by managing your local, regional, and international tax filings, including contributions, withholdings, and year-end forms.

- Employee self-service portal – Through G-P’s user-friendly online portal, accessible anywhere in the world, employees can securely access their pay stubs, tax documents, and benefits information.

- Multi-state payroll – Small businesses can pay employees in multiple locations without incurring additional setup fees thanks to G-P’s full compliance multi-country payroll support.

- Custom reporting – To assist small businesses in making well-informed financial decisions, generate comprehensive payroll and tax reports that monitor expenditures, compliance, and labor expenses.

How G-P pricing works

G-P provides custom pricing based on your company size, the number of employees, and the countries where you operate. Pricing typically includes payroll processing, tax compliance, benefits administration, and dedicated HR support.

What markets does G-P serve?

G-P serves small to mid-sized businesses looking to hire or manage employees internationally. It’s ideal for startups and growing companies that need reliable, compliant global payroll solutions without the overhead of creating local entities.

Read our full G-P review

Deel – Best for Hiring Globally

Deel enables small businesses to hire globally in over 150 countries and run payroll in 90+ currencies, making international workforce management simple. Focusing on local tax and compliance removes the complexities of global payroll. Deel offers plans for contractor-only teams and those hiring full-time employees abroad, letting you avoid costly entity setups or tax penalties by using Deel’s worldwide entities to take on legal liability. The service is free for businesses with fewer than 200 employees. Highly rated by users, Deel is praised for its excellent customer support, affordability, and seamless onboarding across locations.

- Supports global payroll in 150+ countries

- Pays employees in over 90 currencies

- Assumes full legal liability for international workers

- Strong focus on local tax compliance

- Free global payroll for businesses under 200 employees

- No phone support available

- Onboarding is mostly self-service and can be complex for beginners

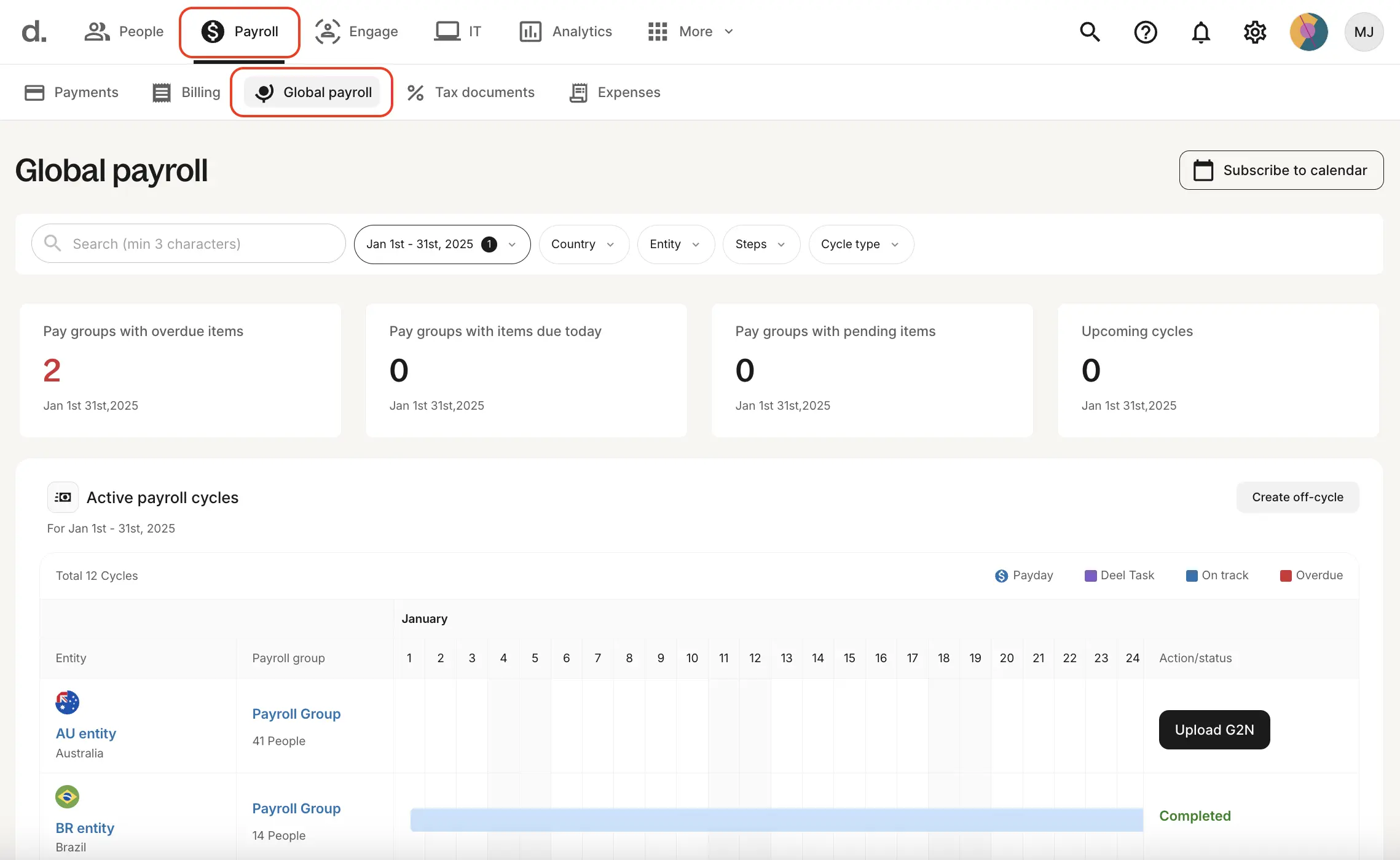

Deel global payroll page.

Get Started Visit Deel’s website

Deel features

- Automated payroll processing – Handles global payroll end-to-end, from precise wage calculations to direct deposits and payments in multiple currencies, ensuring timely and accurate employee compensation with minimal manual effort.

- Tax filing & compliance – Manages local tax filings and payments worldwide (depending on plan), keeping your business compliant with diverse international tax laws and reducing administrative workload.

- Employee self-service portal – Offers employees a straightforward online portal to access pay stubs, tax documents, benefits info, and personal data, empowering them to manage their payroll details independently, regardless of location.

- Multi-state payroll – Supports employee payroll in multiple countries and states, automatically applying the correct local tax rules and compliance standards based on each employee’s jurisdiction.

- Custom reporting – Provides versatile reporting tools that give insights into payroll costs, tax obligations, and workforce trends across regions, all accessible through a centralized dashboard to help you make smart global business decisions.

How Deel pricing works

Deel offers six pricing plans to choose from under their Payroll services:

- Deel EOR (Employer of Record): Starting at $599/month/employee

- Deel Contractor Management: Starting at $49/month/contractor

- Deel Contractor of Record: Starting at $325/month/contractor

- Deel PEO: Starting at $95/month/employee

- Deel Global Payroll: Starting at $29/month/employee

- Deel US Payroll: Available by quote

What markets does Deel serve?

Deel is ideal for small businesses that hire and pay employees or contractors worldwide. By using Deel’s global entities, companies can avoid the cost and complexity of setting up their international entities, making it a cost-effective solution, especially since payroll services are free for businesses with fewer than 200 employees.

Read our full Deel review

OnPay – Best for Affordable Full-Service Payroll

OnPay is a top full-service payroll and tax solution for small businesses, offering excellent value with a single flat monthly fee. It includes multi-state payroll, unlimited payroll runs, multiple pay schedules, direct deposit, automated tax filing, employee self-service, and custom reporting. Unlike many competitors, OnPay includes HR tools like PTO and benefits management at no extra cost. While it lacks built-in time tracking, it integrates smoothly with popular HR platforms that offer it. Users praise OnPay’s responsive, helpful customer support, which is available with extended hours, including weekends.

- Responsive customer support with extended weekend hours

- Easy-to-use employee self-service portal

- Supports multi-state payroll at no extra cost

- Unlimited payroll runs are included in the flat monthly fee

- No dedicated mobile app for payroll management

- Lacks built-in time tracking functionality

OnPay payroll page.

Get Started Visit OnPay’s website

OnPay features

- Automated payroll processing – Automatically runs payroll computations, direct deposits, and paystub generation, making it easy for small businesses to accurately and efficiently run payroll with minimal effort.

- Tax filing & compliance – Handles all local, state, and federal tax filings for you, including withholdings, payments, and year-end forms, keeping your business compliant and pain-free.

- Employee self-service portal – Gives employees secure web access to pay stubs, tax forms, and benefits information, like health insurance, through a simple-to-use portal, enabling them to keep their payroll organized on their own with ease.

- Multi-state payroll – It is included with multi-state payroll at no additional cost, which is ideal for businesses with employees spread across several states and must follow various taxation regulations.

- Custom reporting – Allows users to create customized payroll reports to track key elements such as labor costs, tax payments, and the like, and furnish small businesses with the data they need to make wise financial choices.

How OnPay pricing works

OnPay offers a 30-day free trial on top of one pricing plan starting at $49/month as a base fee plus $6/month per person.

What markets does OnPay serve?

OnPay is a top payroll solution for small businesses, especially those looking for a straightforward, all-inclusive service with no hidden fees. It goes beyond basic payroll by including tax filing and essential HR tools, helping small businesses save time, reduce costs, and ensure employees are paid accurately and on schedule.

Read our full OnPay review

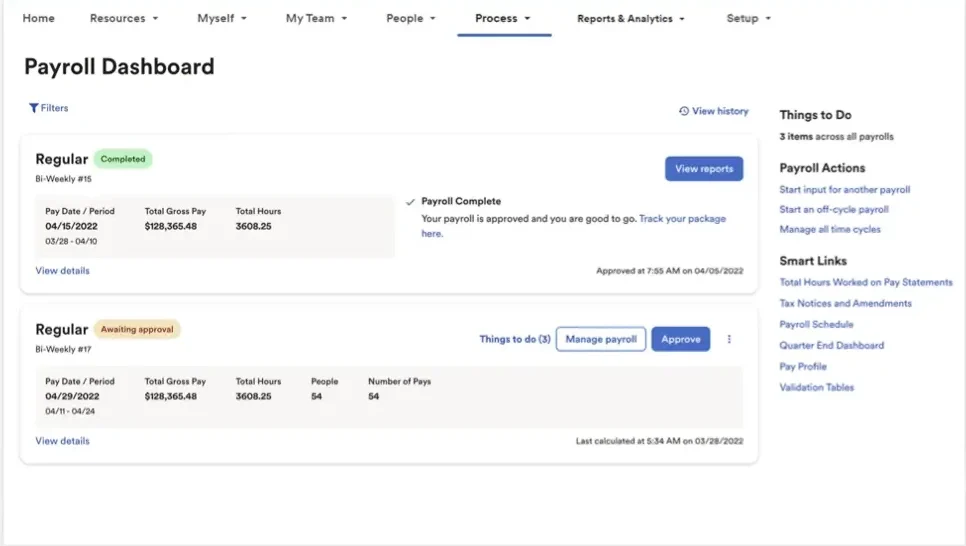

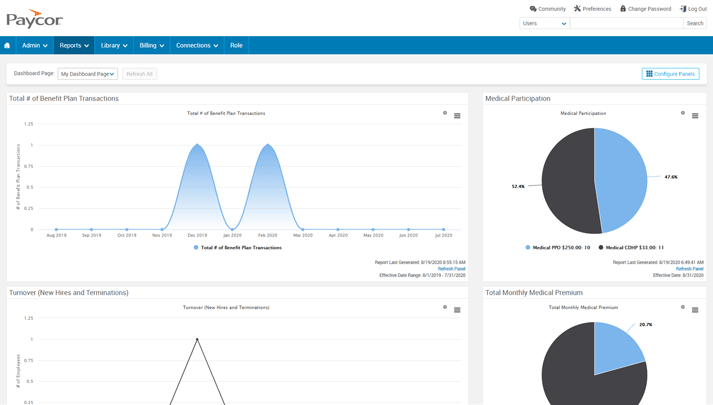

Paycor – Best Payroll to Grow and Scale

Paycor offers payroll software as part of its broader HCM platform, making it a strong choice for small businesses needing payroll and HR support. Its AutoRun feature lets users schedule payroll in advance and flags errors before processing. Paycor includes unlimited payroll runs, tax compliance tools, automation options, a mobile app, and core HR features like document management. Add-ons cover benefits, recruiting, talent management, and more. Users find the interface intuitive, though customer service reviews are mixed.

- AutoRun features let you schedule payroll in advance and catch errors

- Includes essential HR tools like document management

- Wide range of HR add-ons, including benefits and talent management

- 14-day free trial to test the platform

- No transparent pricing; custom quotes required

- Customer support received mixed reviews from users

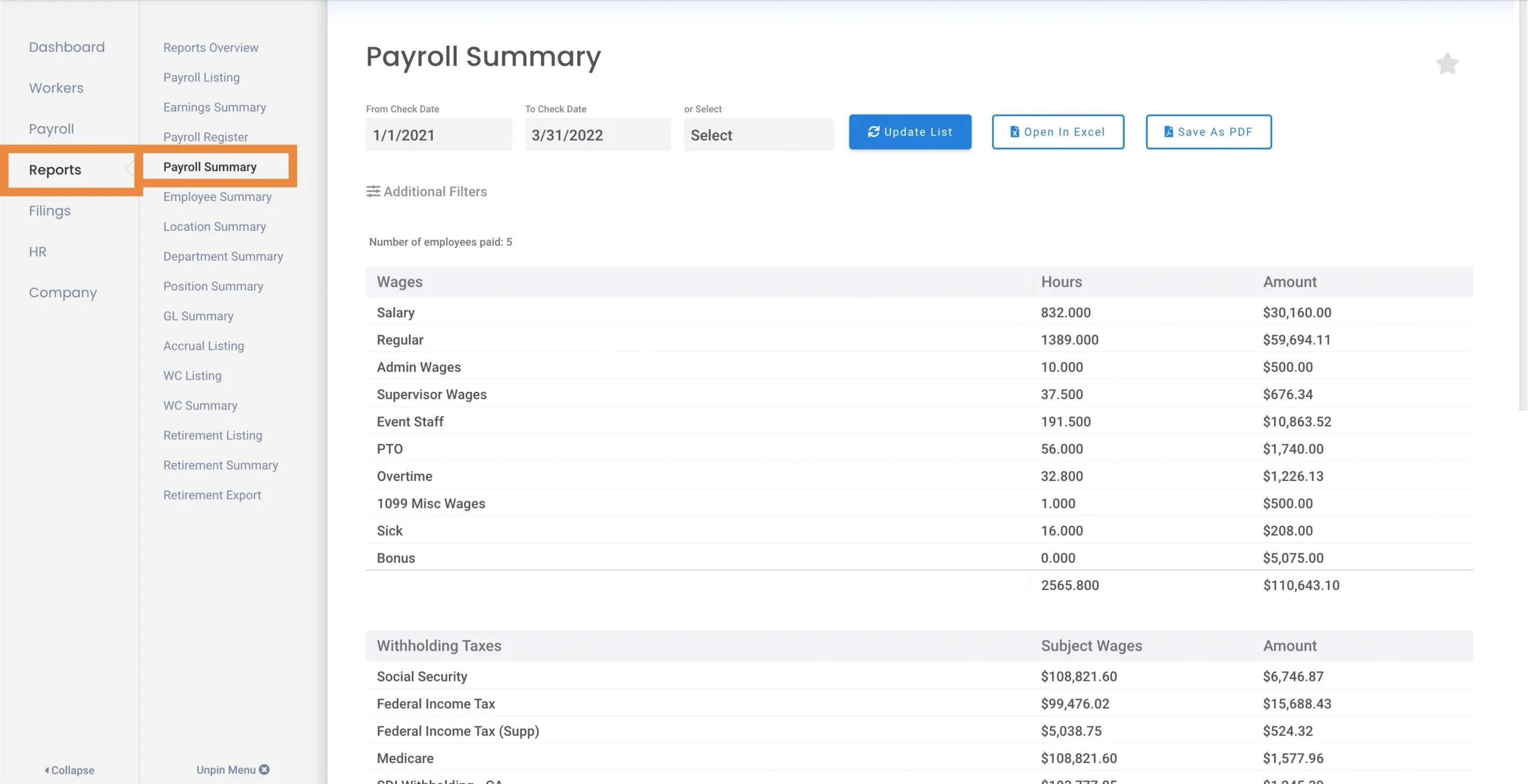

Paycor reports page.

Get Started Visit Paycor’s website

Paycor features

- Automated payroll processing – Automates payroll calculations, direct deposits, and payment disbursement, reducing manual work and helping ensure accuracy with every pay cycle.

- Tax filing & compliance – Manages federal, state, and local tax filings and payments, helping your business stay compliant with current tax laws and reducing the risk of costly errors.

- Employee self-service portal – Employees can securely access pay stubs, tax forms, and benefits details through Paycor’s intuitive self-service platform, improving transparency and reducing administrative requests.

- Multi-state payroll – Designed to handle payroll across multiple states, Paycor streamlines compliance with varying tax laws and reporting requirements in one unified system.

- Custom reporting – Offers flexible reporting tools that let you track payroll expenses, taxes, and labor data, helping your business make more competent workforce and budgeting decisions.

How Paycor pricing works

Paycor does not list pricing on its website, opting for custom quotes based on your business’s size, industry, and specific needs. You can compare costs upfront or budget by speaking to a sales representative.

What markets does Paycor serve?

Paycor is designed for small to mid-sized businesses that need nimble, cloud-based payroll and HR solutions. Its scalable design is especially well-suited for companies that plan to grow, offering tools that enable everything from basic payroll to complex HR features as needs evolve.

Read our full Paycor review

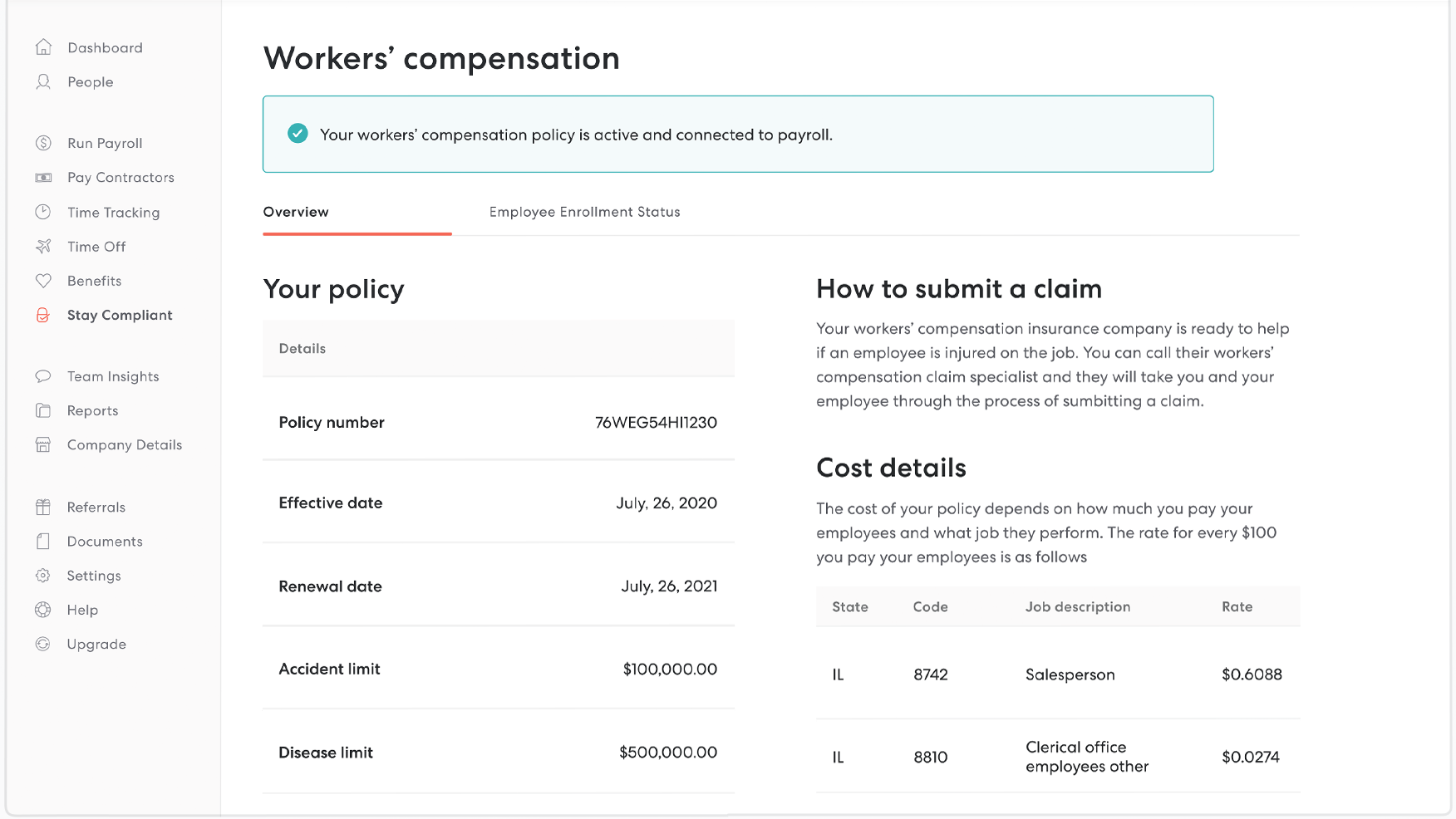

Gusto – Best for Startups

Gusto offers a versatile payroll solution tailored for small businesses, featuring four plans—including a contract worker plan with no monthly fee. Each plan includes full-service, single-state payroll, employee self-service via a mobile app, and streamlined hiring and onboarding tools. Additional HR features and varying levels of customer support are available depending on the chosen plan. Users consistently praise Gusto’s intuitive, user-friendly interface, which makes setup and payroll management simple enough to eliminate the need for support often, helpful since some users report mixed experiences with customer service responsiveness.

- Affordable contractor-only plan with no monthly fee

- Employee self-service is available via a mobile app

- Fast, reliable direct deposit

- Automated tax filing and compliance are handled seamlessly

- Supports U.S.-based payments only

- LLimited customer support on entry-level plans

Gusto workers’ comp page.

Get Started Visit Gusto’s website

Gusto features

- Automated payroll processing – Handles the payroll from start to finish, from precise calculations of wages and direct deposits to check delivery to guarantee timely payment to employees with minimal manual intervention.

- Tax filing & compliance – Automatically handles all federal, state, and local payroll tax returns and payments, keeping your company in compliance with current legislation and reducing administrative hassles.

- Employee self-service portal – Employees can easily access their pay stubs, tax statements, benefits, and personal data on Gusto’s easy-to-use user portal and mobile app, allowing them to take control of their payroll data quickly.

- Multi-state payroll – Simplifies payroll for businesses with employees in many states by automatically applying correct tax and regulatory compliance based on where each employee works.

- Custom reporting – Offers dynamic reporting functionality that provides payroll expense, tax expense, and labor trend intelligence, all from a single, unified dashboard to help make better business decisions.

How Gusto pricing works

Gusto offers four pricing plans:

- Simple: Starting at $49/month plus $6/month per person

- Plus: Starting at $80/month plus $12/month per person

- Premium: Starting at $180/month plus $22/month per person

- Contractor Only: Starting at $35/month plus $6/month per person

What markets does Gusto serve?

Gusto is ideal for small businesses that frequently onboard new hire contractors or independent workers. Its contractor-only plan waives the monthly base fee. It charges a low per-contractor fee instead, making it a cost-effective choice for companies relying heavily on freelancers or gig workers. This flexible pricing model helps small businesses control costs compared to traditional monthly plus per-employee fees on other plans.

Read our full Gusto review

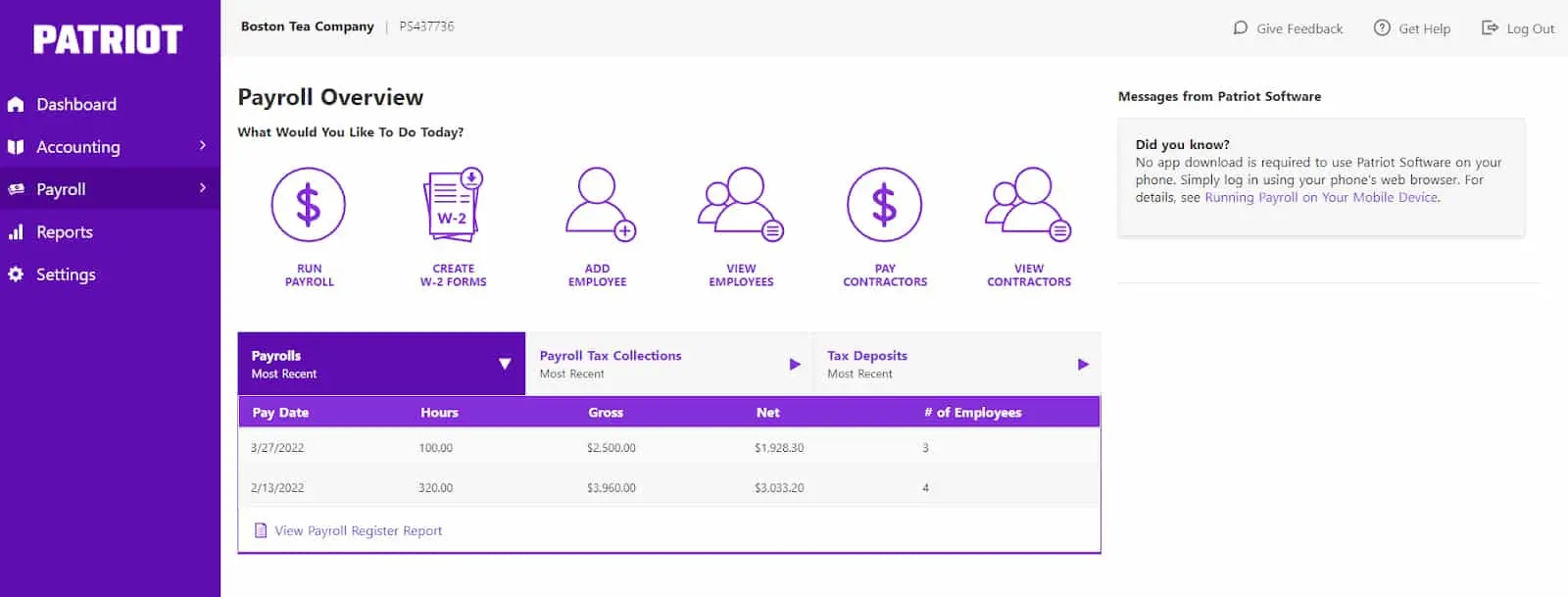

Patriot – Cheapest Payroll Service for Small Business

Patriot has basic payroll and accounting software for small businesses with 500 or fewer workers. It has two main plans: a basic payroll plan in which you prepare payroll taxes yourself and a full-service plan that prepares tax filings and makes payments on your behalf. Main features are free setup and onboarding, direct deposit, unlimited payroll runs, and an employee self-service portal. Other features, such as time and attendance monitoring and HR support, are also included. Customer feedback highlights Patriot’s ease of use, dependability, and highly regarded customer support, which makes it a first choice for small business payroll software needs.

- Budget-friendly option

- Complimentary setup and onboarding support

- User-friendly interface with an easy learning curve

- Tax filing services are included only in the full-service plan

- Time and attendance tracking requires an additional purchase

Patriot payroll page.

Get Started Visit Patriot’s website

Patriot features

- Automated payroll processing – Manages the entire payroll process, from accurate wage and tax calculations and direct deposits to check distribution, ensuring employees are paid on time with minimal manual effort.

- Tax filing & compliance – Takes care of all federal, state, and local payroll tax filings and payments (available with the full-service plan), helping your business stay compliant and reducing administrative burdens.

- Employee self-service portal – Provides employees with easy access to pay stubs, tax forms, benefits information, and personal data through a simple, user-friendly online portal, empowering them to manage their payroll details independently.

- Multi-state payroll – Supports payroll processing for employees across multiple states, automatically applying the appropriate tax laws and compliance requirements based on each employee’s location.

- Custom reporting – Delivers flexible reporting tools that offer insights into payroll expenses, tax liabilities, and labor trends, all accessible from one centralized dashboard to support informed decision-making.

How Patriot pricing works

Patriot offers two options under their Payroll Software pricing plan:

- Basic Payroll: Starting at $17/month plus $4 per worker, or a 30-day free trial and 50% off for 3 months to be $8.50/month plus $2 per worker

- Full Service Payroll: Starting at $37/month plus $5 per worker, or a 30-day free trial and 50% off for 3 months to be $18.50/month plus $2.50 per worker

What markets does Patriot serve?

Patriot is designed for small businesses and firms with up to 500 employees. Due to its free onboarding and setup, intuitive interface, and good customer support, Patriot is an excellent choice for small businesses that need good payroll software but with fewer staff or budget flexibility.

Read our full Patriot review

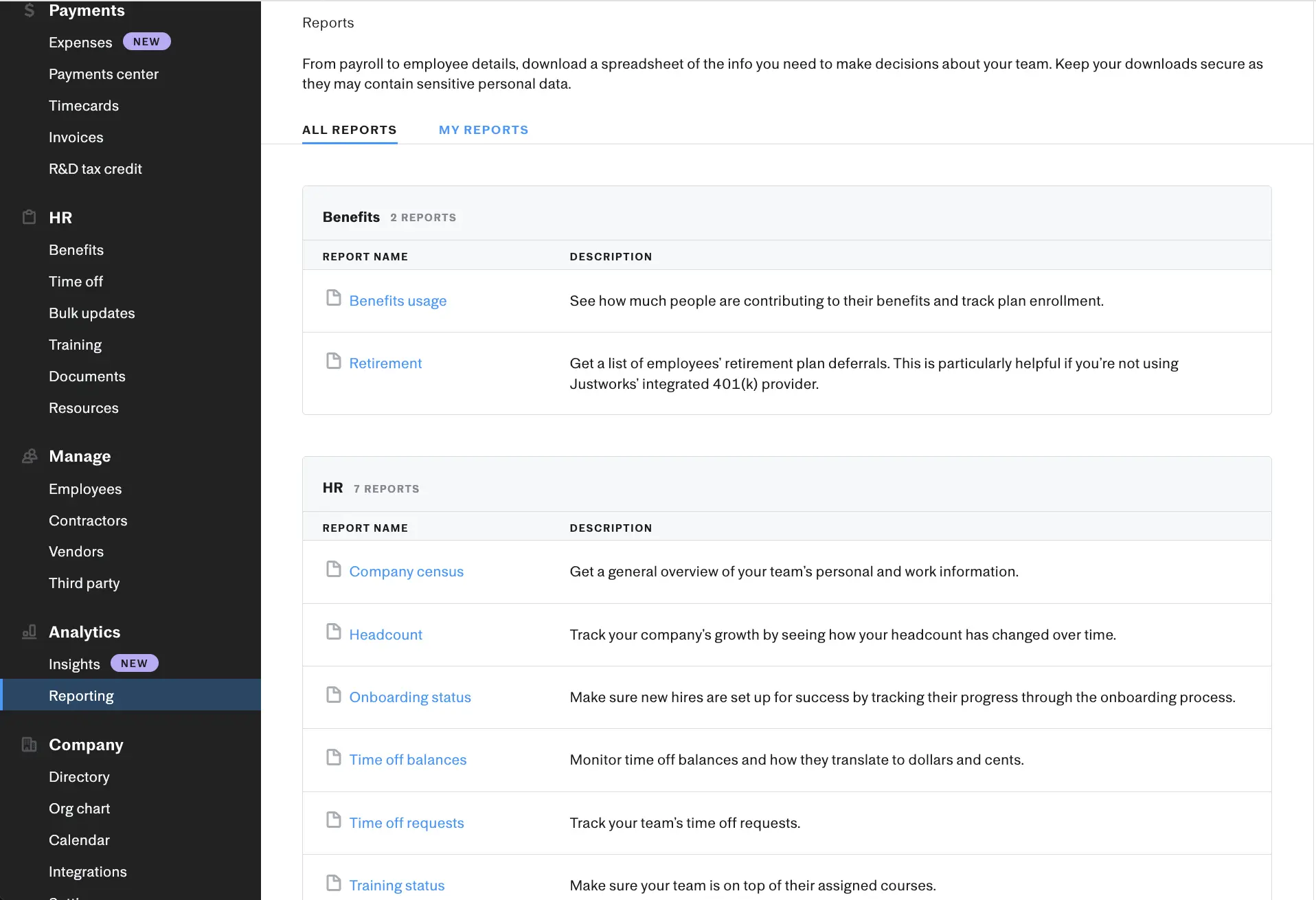

Justworks – Best for Outsourcing Payroll

Justworks stands out from other payroll services as a Professional Employer Organization (PEO), meaning it becomes the employer of record and fully manages your payroll and HR responsibilities. This setup reduces your legal liability while offering a hands-off, all-in-one solution. Ideal for growing small businesses, Justworks combines payroll, tax filing, direct deposit, and synced timesheets with core HR tools like onboarding, document management, and compliance support. It also enables access to competitive employee benefits. Users praise its easy-to-use interface and 24/7 customer support, though some note limited customization in reporting and features.

- Shifts legal and payroll liability to the PEO

- Fully managed payroll runs–takes the workload off your hands

- Great for businesses with complex hiring needs or high employee turnover

- Higher cost compared to traditional payroll services

- Does not include built-in time tracking (requires integration)

Justworks reporting page.

Justworks features

- Automated payroll processing – Gathers all payroll figures and direct deposits and checks disbursements for you, removing your business from the drudgery of manual payroll labor and reducing mistakes.

- Tax filing & compliance – As your employer of record, Justworks makes all federal, state, and local tax filings and payments, keeping your business compliant with complex and continually changing regulations.

- Employee self-service portal – Provides employees with a secure gateway to view pay stubs, tax statements, benefits, and other HR information, giving them visibility and easy access to their data.

- Multi-state payroll – Simplifies payroll for businesses with employees in multiple states by integrating disparate tax laws and regulations into one system.

- Custom reporting – Offers reporting capabilities that provide data on payroll costs, taxes, and workforce metrics to help you make informed business decisions.

How Justworks pricing works

Justworks offers four pricing plans:

- Payroll: Starting at $8/month/employee plus a $50/month base fee

- PEO Basic: Starting at $59/month/employee

- PEO Plus: Starting at $109/month/employee

- EOR: Starting at $599/month/employee

What markets does Justworks serve?

Justworks is ideal for small to mid-sized businesses that lack dedicated HR and payroll staff, offering a fully managed solution that handles these tasks for you. It’s especially well-suited for companies with high employee turnover or complex hiring needs, including international employees, helping save time, reduce administrative burden, and control costs by outsourcing payroll and HR responsibilities to a trusted PEO.

Read our full Justworks review

Insperity – Best for Comprehensive Payroll

Insperity provides a comprehensive full-service payroll solution for small businesses looking to simplify and streamline payroll management. Its platform includes essential features like direct deposit, automated federal and state tax filing, multi-state payroll capabilities, and an intuitive employee self-service portal. Beyond payroll, Insperity integrates closely with its broader HR and workforce management services, offering added value with tools for benefits administration, compliance support, and employee onboarding. This makes it a strong choice for small businesses that want a scalable payroll solution backed by robust HR expertise.

- Combines payroll with integrated HR and compliance support

- Employee self-service portal with PTO and benefits management

- Strong compliance assistance to help navigate complex regulations

- Pricing isn’t transparent and requires contacting sales for a quote

- No dedicated mobile app

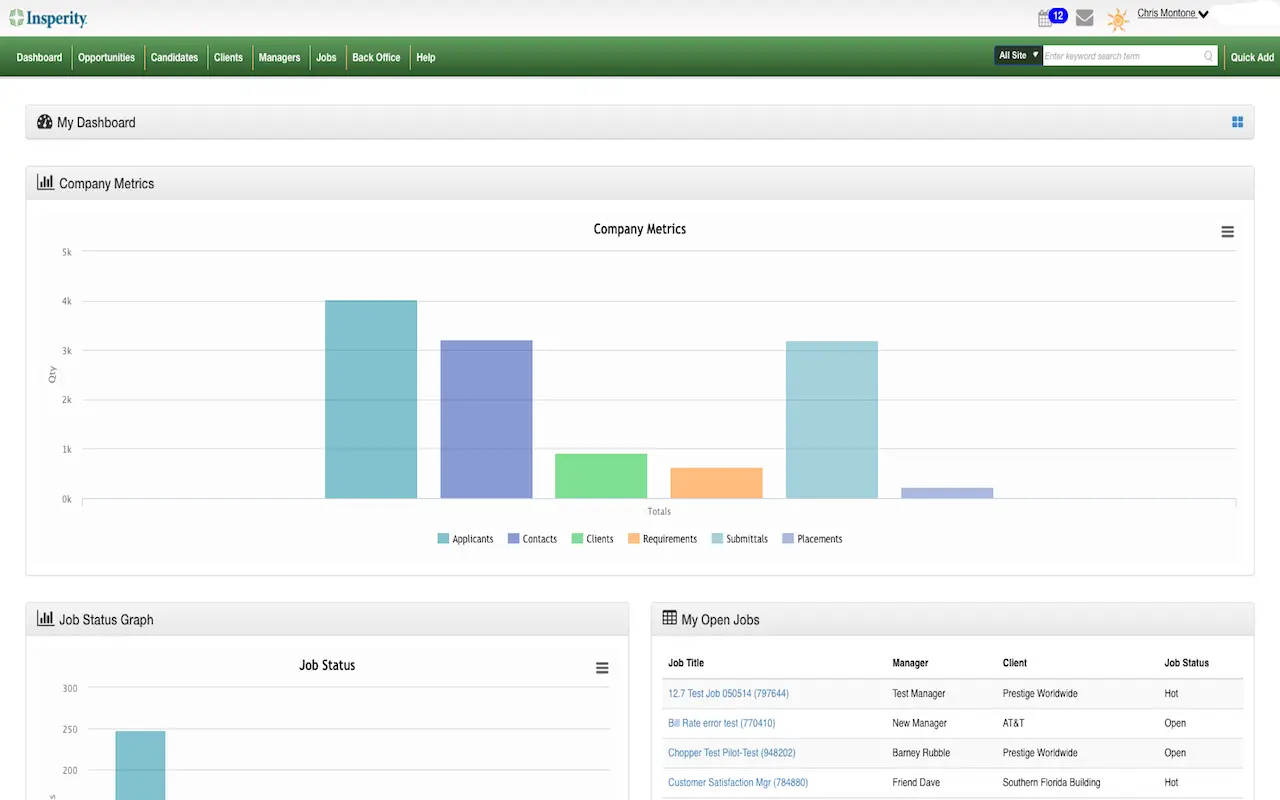

Insperity dashboard.

Insperity features

- Automated payroll processing – Processes payroll from start to finish, from accurate wage computation to direct deposits and check delivery, delivering timely and accurate payroll with little manual intervention.

- Tax filing & compliance – Automatically handles all federal, state, and local payroll tax payments and filings, keeping your firm current with the latest regulations and reducing administrative tasks.

- Employee self-service portal – Employees can securely view their pay stubs, tax forms, benefit information, and employee information through Insperity’s simple-to-use portal, helping reduce HR requests and enabling employees.

- Multi-state payroll – Processes payroll assistance for employees in various states by applying the right compliance laws and regulations automatically based on the location of each employee.

- Custom reporting – Provides flexible reporting functionality that provides details on payroll expense, tax compliance, workforce activity, among other data points, all downloadable through a standard dashboard to assist with making informed decisions.

How Insperity pricing works

Insperity does not provide pricing details upfront on its website. Instead, businesses must contact Insperity directly for a customized quote based on their size, industry, and specific payroll and HR needs.

What markets does Insperity serve?

Insperity serves small to mid-sized businesses seeking an all-in-one payroll, HR, and compliance management platform. It’s especially well-suited for companies focused on long-term growth that need scalable solutions to support workforce management and regulatory requirements.

Read our full Insperity review

Need help choosing the right HR software? Book a free expert call today

–>Compare Payroll Quotes and Save

Compare the Best Payroll Services for Small Businesses Side-by-Side

| Software Name | Why we picked It | Starting price for cheapest plan | Highlights |

|---|---|---|---|

| Paylocity | Best for Scalable Payroll Solutions | Available by quote | Easy access to pay stubs, direct deposit, and tax documents |

| Rippling | Best for Integrated Payroll | Available by quote | Offers an affordable full-service payroll solution for small businesses |

| Homebase | Best for Hourly Teams | $39/month + $6/month/employee | Combines payroll, time tracking, and scheduling in one platform |

| ADP | Best for Payroll with Compliance Support | Available by quote | Reliable, compliant, and scalable payroll solutions |

| G-P | Best Global Payroll Service for Small Businesses Expanding Internationally | Available by quote | Simple, scalable payroll for small teams |

| Deel | Best for Hiring Globally | $29/month/employee | Run payroll in over 150 countries in 90 currencies |

| OnPay | Best for Affordable Full-Service Payroll | $49/month as a base fee plus $6/month per person | Unlimited and multi-state payroll runs with no hidden fees |

| Paycor | Best to Grow and Scale | Available by quote | Features AutoRun payroll and many HR features not included with competitors |

| Gusto | Best for Startups | $49/month plus $6/month per person | No monthly fee when only paying independent contractors |

| Patriot | Cheapest Payroll Service for Small Businesses | $17/month plus $4 per worker | Low cost, free setup and onboarding, easy to use, and excellent user reviews |

| Justworks | Best for Outsourcing Payroll | $8/month/employee plus $50/month base fee | Reduced liability, they take and run payroll for you |

| Insperity | Best for Comprehensive Payroll | Available by quote | Solution for small businesses seeking full-service payroll |

What is Payroll?

Payroll is paying your staff for work done—computing pay, deducting the right amount for taxes and benefits, making payments, and keeping records. It also remains in compliance with federal, local, and state laws. Whether one or numerous workers, payroll must be on time, accurate, and consistent. Small business payroll services nowadays simplify the process by doing the calculations, submitting taxes, and making direct deposits for you, freeing your time, avoiding errors, and keeping you in compliance.

Why Do You Need Payroll Services for a Small Business?

Payroll services are a time-saver for small businesses, reduce errors, and ensure compliance with tax and labor laws. Instead of manually calculating wages, processing tax filings, and storing employee records, payroll services automatically do all of this, paying employees accurately and on time. They also provide direct deposit, year-end tax forms, and employee self-service features, making payroll more straightforward and efficient, especially for businesses without an HR or accounting department.

Can a Small Business Do Their Own Payroll?

Yes, a small business can do payroll internally, especially with the help of payroll software that computes, files taxes, and makes payments. However, doing payroll manually requires careful attention to tax laws, filing deadlines, and accurate recordkeeping. In tiny businesses, it can be done internally, but with growing business size, payroll services can save time, reduce errors, and provide compliance with state and federal regulations.

What Features Should I Look For in a Payroll Software for a Small Business?

When choosing payroll software for a small business, look for prominent features like automated payroll processing, tax preparation and compliance support, direct deposit, and an employee self-service tool. Having multi-state payroll, integration with time off tracking, customizable reports, simplified bookkeeping, and scalability is also helpful as the business grows. An easy-to-use interface and excellent customer support can also save a lot of time and money.

How Much Does Payroll Software Cost for a Small Business?

Payroll software for small businesses generally charges a monthly base fee plus a per-employee or contractor fee. Prices vary depending on the level of service and features. For example, Patriot offers one of the most affordable options, with basic plans starting at a low monthly rate plus a small fee per worker. Gusto stands out by waiving its monthly fee for businesses that only hire contractors, charging a per-contractor rate instead.

On the higher end, Justworks—an outsourced payroll and HR solution—charges a premium per employee but includes full-service payroll and workers’ compensation for compliance and liability coverage, which can be more cost-effective than hiring in-house payroll staff. Pricing transparency also varies, with some providers like Paycor offering custom quotes based on business size and needs.

| Vendor | Monthly Fee | Free Trial |

|---|---|---|

| Gusto | $49 plus $6 per person | No |

| Patriot | $17 plus $4 per worker | 30 days |

| OnPay | $49 as a base fee plus $6 per person | 30 days |

Payroll Services for Small Business FAQs

What is the best way to do payroll for a small business?

The simplest way to do payroll for a small business is to use a payroll software or service that fits your business size, budget, and compliance needs. Payroll automation with good software reduces manual errors, ensures timely tax filing, and keeps your business compliant with labor laws. Choose a solution that offers features like automated pay runs, tax filing, direct deposit, and employee self-service. For tiny HR operations, full-service payroll firms or PEOs can manage much of the payroll weight on your behalf, allowing you to focus on growing your business.

Why are online payroll services good?

Online payroll services are a great option because they simplify and automate the complex process of the payroll system and paying employees. These services handle tasks like calculating wages, deducting taxes, filing tax forms, and issuing direct deposits—all through an easy-to-use platform. They help reduce human error, save time, ensure compliance with changing regulations, and give employees access to their pay information through self-service portals. For small business owners, this means less administrative burden and more confidence that payroll is done correctly and on time, to give them peace of mind. Setting up a dedicated bank account for payroll can also help small businesses manage employee payments smoothly and securely.

What are payroll taxes?

Payroll taxes are taxes that employers have to deduct from their employees’ wages and pay to the government on behalf of their employees. Payroll taxes include federal income tax, Social Security, and Medicare tax. Employers must also pay other payroll taxes, i.e., federal and state unemployment taxes. These amounts withheld are remitted to the respective government agencies and are utilized to fund programs like Social Security, Medicare, and unemployment compensation. Proper calculation and payment of payroll taxes are required to be tax compliant.

How We Chose the Best Payroll Services for Small Businesses

To find the best payroll services for small businesses, we began with a list of 23 vendors and narrowed the list to 10 based on popularity and online search volume. We selected the top six payroll vendors based on features, customer experience, pricing transparency, and brand reputation.

We gathered and verified information from the following sources:

- Official vendor and parent company websites

- Verified user reviews and expert evaluation from trusted third-party websites

We evaluated each payroll service and graded it on a 1 (poor) to 5 (excellent) scale in four weighted categories, each accounting for 25% of the total grade:

- Variety of features: We preferred platforms that offer basics like direct deposit (same-day or next-day), automated tax filing, employee self-service apps or portals, time tracking, and HR integrations. Providers with more robust, easy-to-use features scored higher.

- Pricing transparency:We looked at how openly vendors present their pricing online, including base costs, per-employee fees, and whether they offer a free trial. Overt and upfront pricing ranked the highest.

- Customer support: We looked at the availability and ease of access to support channels, including live chat, email, phone support, help centers, and onboarding support. Vendors with numerous support channels ranked best.

- Brand reputation: We looked at recent ratings and reviews from real users on third-party websites to establish overall customer satisfaction, reliability, and trustworthiness.